FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

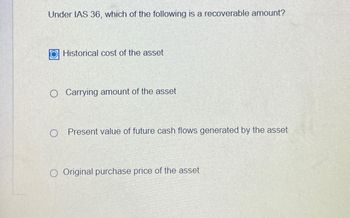

Transcribed Image Text:Under IAS 36, which of the following is a recoverable amount?

Historical cost of the asset

Carrying amount of the asset

Present value of future cash flows generated by the asset

O Original purchase price of the asset

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- When using IFRS, an asset's recoverable value isarrow_forwardWhat is an intangible asset? Should all intangible assets be subject to amortization? Explain why or why not. Why are some intangible assets not amortized? What is the implication to the financial statements?arrow_forwardGains and losses arising from the retirement or disposal of an item of property, plant and equipment shall be determined as the difference between * Gross disposal proceeds and the cost of the asset Gross disposal proceeds and the carrying amount of the asset Net disposal proceeds and the cost of the asset Net disposal proceeds and the carrying amount of the assetarrow_forward

- QUESTION 17 Match the term on the left to the appropriate description on the right. v Historical cost A. The amount of a PP&E asset's acquisition cost that will be depreciated over the asset's useful life v Depreciable cost B. An asset whose value derives from rights and privileges rather than physical existence v Salvage value v Accumulated depreciation C. The capitalized acquisition cost of an asset v Intangible asset v Amortization D. The process of allocating an intangible asset's acquisition cost to expense over its useful life E. The book value of a fully-depreciated PP&E asset F. The total amount of depreciation expense that has been recorded to-date for a PP&E assetarrow_forwardWhich of the following intangible assets should not be amortized? a. Copyrights b. Customer lists c. Perpetual franchises d. All of these intangible assets should be amortized.arrow_forward97. The portion of the acquisition cost of an asset yet to be allocated is known as A. Written down value B. Accumulated value C. O Realizable value D. O Salvage valuearrow_forward

- A loss on impairment on a limited life intangible asset is the difference between the asset’s Select one: carrying value and its undiscounted expected future net cash flows. fair value and its net realizable value. fair value and its discounted expected future net cash flows. carrying value and its fair value.arrow_forwardThe difference between book value of the asset with the proceeds received from its sale, will result in:arrow_forwardThe allocation of the cost of a tangible asset to expense in the periods in which the asset is used is termed as: Select one: a. Depreciation b. None of the given options c. Appreciation d. Fluctuationarrow_forward

- What is the 'carrying amount of a depreciating non-current asset? O A. The cost (or fair value) of the asset less the accumulated depreciation on that asset O B. The current market value of the asset C. The cost (or fair value) of the asset less the current year's depreciation O D. The cost (or fair value) of the assetarrow_forwardThe asset's recoverable value is calculated in accordance with IFRS asarrow_forwardUnder the impairment of assets, value-in-use is * a. The undiscounted present value of future cash flows arising from the continuing use of the asset and from its disposal. b. The discounted present value of future cash flows arising from the continuing use of the asset and from its disposal. c. The higher of an asset's fair value less cost to sell and its market value d. The amount at which the asset is recognized in the statement of financial positionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education