Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

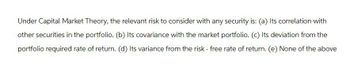

Transcribed Image Text:Under Capital Market Theory, the relevant risk to consider with any security is: (a) Its correlation with

other securities in the portfolio. (b) Its covariance with the market portfolio. (c) Its deviation from the

portfolio required rate of return. (d) Its variance from the risk - free rate of return. (e) None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The systematic risk principle states that the expected return on a risky asset depends only on which one of the following? Unsystematic risk Market risk Diversifiable riskarrow_forwardWhat does Jensen's alpha measure? a. An investor's reward in proportion to their assumption of systematic risk b. The abnormal return of an asset, defined as the degree to which its actual return exceeds that predicted by the capital asset pricing model c. The degree to which diversifiable risk is eliminated d. How much reward an investor is getting for each unit of risk assumedarrow_forwardich of the following will not reduce risk in a portfolio? Select one: a. Selecting two securities that are perfectly positively correlated. b. Selecting two securities that are positively correlated. c. Selecting two securities that are perfectly negatively correlated. d. Selecting two securities that are negatively correlated.arrow_forward

- According to modern portfolio theory, pair-wise covariance is more important to total portfolio risk than individual security variance. True or Falsearrow_forwardWhich one of the following is a property of a pure arbitrage portfolio?a. Negative investment.b. Zero return.c. Positive systematic risk.d. Zero total risk.arrow_forwardWhat type of risk is the risk that belongs to the market as a whole? Systematic risk Unsystematic risk (or nonsystematic risk) Total riskarrow_forward

- Which one of the following statements is correct concerning unsystematic risk? An investor is rewarded for assuming unsystematic risk. Beta measures the level of unsystematic risk inherent in an individual security. Eliminating unsystematic risk is the responsibility of the individual investor. Standard deviation is a measure of unsystematic risk. Unsystematic risk is rewarded when it exceeds the market level of unsystematic risk. оо O Oarrow_forward8. Fluctuations of a security's return that are due to market-wide news representing common risk is the ________. A. Idiosyncratic risk B. Systematic risk C. Unique risk D. Unsystematic riskarrow_forwardWhich one of the following expressions about risk and returns is wrong? A. In general, one reason why a stock is riskier than a bond is that because cash flows from a bond are known and promised, whereas cash flows from a stock are neither known nor promised. B. According to CAPM model, a well-diversified portfolio will have a beta which equals to 0. C. Risk premium is the extra return provided on risky assets to compensate for risk. The difference between risky return and the risk-free return. D. Unexpected return happened because new information came to light which caused our expectations about prices and returns to change.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education