Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

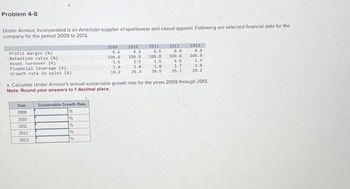

Transcribed Image Text:Problem 4-8

Under Armour, Incorporated is an American supplier of sportswear and casual apparel. Following are selected financial data for the

company for the period 2009 to 2013.

Profit margin (%)

Retention ratio (%)

Asset turnover (X)

Financial leverage (X)

Growth rate in sales (%)

Year

2009

2010

2011

2012

2013

Sustainable Growth Rate

%

%

%

%

2009

%

5.4

100.0

1.5

1.6

19.2

a. Calculate Under Armour's annual sustainable growth rate for the years 2009 through 2013.

Note: Round your answers to 1 decimal place.

2010

6.3

100.0

1.5

1.6

25.3

2013

2011

2012

6.5 6.9

100.0 100.0

1.5

1.5

1.4

1.8

1.7

1.8

39.5 25.7 28.2

6.9

100.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- The accompanying data represent the annual rates of return of two companies' stock for the past 12 years. Complete parts (a) through (k). O A. OB. 0.50- 0.50- 0.00- 0.00- -0.50- -0.50- -0.3 RR of Company 2 0.0 0.3 -0.3 0.0 0.3 RR of Company 1 OC. 0.30- 0.50- 0.00- 0.00- -0.30- -0.50- o.0 0'5 0.0 0.3 -0.5 RR of Company 2 0.5 -0.3 RR of Company 1 (b) Determine the correlation coefficient between rate of return of Company 1 and Company 2. The correlation coefficient is 0.966. (Round to three decimal places as needed.) (c) Based on the scatter diagram and correlation coefficient, is there a linear relation between rate of return of Company 1 and Company 2? Yes No (d) Find the least-squares regression line treating the rate of return of Company 1 as the explanatory variable. y=x+O (Round to four decimal places as needed.) RR of Company 1 RR of Company 1 RR of Company 2 RR of Company 2arrow_forwardPlease Answer 3 Sub Parts the question and no Reject.... Thank uarrow_forwardMonthly Sales 6267.19 7058.06 7119.5 7147.18 7198.52 7298.09 7325.7 7335.68 7355.97 7481.05 7490.23 7530.08 7616.09 7682.69 7684.14 7704.12 7704.98 7779.28 7798.23 7815.15 7844.16 7890.21 7977.6 7993.16 8021.03 8028.37 8068.86 8082.42 8096.17 8119.25 8129.21 8190.68 8255.28 8282.44 8376.31 8392.4 8400.95 8451.16 8456.66 8505.35 8539.25 8543.65 8573.05 8641.78 8667.48 8751.08 8777.97 8800.08 8888.65 8907.03 9096.87 9241.74 9411.68 9450.73 9484.62 9514.57 9521.4 9524.91 9733.44 10123.24 Given the company’s performance record and based on the empirical rule of normal distribution (also known as the 68%-95%-99.7% rule), what would be the lower bound of the range of sales values that contains 68% of the monthly sales? What would be the upper bound of the range of sales values that contains 68% of the monthly sales?arrow_forward

- Multiple Choice Assume that a company is considering purchasing a machine for $45,000 that will have a five-year useful life and no salvage value. The machine will lower operating costs by $17,000 per year. The company's required rate of return is 18%. The profitability index for this investment is closest to: Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. 0.85. ○ 1.14. ○ 1.18. о 1.24.arrow_forwardAlertbdont submit AI generated answer.arrow_forwardFind the effective yield of an investment that earns 2.5% compounded semiannually. round to the nearest hundredth of a percentarrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardSuppose that a firm's sales were $3,750,000 five years ago and are $5,250,000 today. What was the geometric mean growth rate in sales over the past five years?arrow_forwardYear Quarter Revenue 2005 Qtr1 5,206 Qtr2 6,310 Qtr3 6,037 Qtr4 5,551 2006 Qtr1 5,226 Qtr2 6,476 Qtr3 6,454 Qtr4 5,932 2007 Qtr1 6,103 Qtr2 7,733 Qtr3 7,690 Qtr4 7,331 2008 Qtr1 7,379 Qtr2 9,046 Qtr3 8,393 Qtr4 7,126 2009 Qtr1 7,169 Qtr2 8,267 Qtr3 8,044 Qtr4 7,510 2010 Qtr1 7,525 Qtr2 8,674 Qtr3 8,426 Qtr4 10,494 State the model found when performing a regression using seasonal binaries. (A negative value should be indicated by a minus sign. Round your answers to 4 decimal places.) yt = + t + Q1 + Q2 + Q3 Use the regression equation to make a prediction for each quarter in 2011. (Enter your answers in millions rounded to 3 decimal places.) Quarter Predicted Q1 Q2 Q3 Q4arrow_forward

- Given that y, (x) = x is a solution of the differential equation x?y" – xy' + y = 0. If we use the reduction of order method, the general solution of the given equation Y2(x) = -Vx y2 (x) = x In|x| This option This option Y2(x) = xVx Y2(x) = e2x %3| This option This optionarrow_forward3. You are an excellent investor and have averaged a 12% rate of return over the last 20 years. Over the same time period, inflation has averaged 3.2%. What is the real rate of return you have earned on your investments?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,