Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

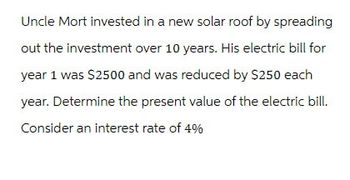

Transcribed Image Text:Uncle Mort invested in a new solar roof by spreading

out the investment over 10 years. His electric bill for

year 1 was $2500 and was reduced by $250 each

year. Determine the present value of the electric bill.

Consider an interest rate of 4%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Amr Al Kaitoob wants to buy the house in 3 years (at end of Year 3) and he is currently saving for down payment. He plans to save $5,000 at the end of the first year (at end of Year 1). Amr anticipates his annual savings will increase by 10% annually thereafter. His expected annual return is 7%. Calculate the amount of money that Amr will have for the down payment at the end of Year 3.arrow_forwardThe Johnson family bought a quad and were able to finance it with a simple interest loan for 36 months at 11% interest. They are going to pay the loan off 3 months early. The balance after 33 months is $1,400. Find the amount of the final payment.arrow_forwardPLEASE SHOW ALL WORK Richard deposits $ 5400 and got back an amount of $ 6000 after a year. Find the simple interest he got.arrow_forward

- The Simpsons are moving into their new home. They purchased it for $250,000 by putting a down payment of $120,000 towards the purchase and paying the balance with a $130,000 mortgage amortized over 20 years at 6.75% per annum ( for a 3-year term). At the end of the 3-year term, the interest rate increased by 0.5%. What is the approximate increase in their monthly payment?arrow_forwardTomas purchased a new heating and air-conditioning system for his home and financed $9,100 at an annual interest rate of 2.2% compounded monthly for 3 years. How much interest (in dollars) will Tomasz pay over the term of the loan? (Round your answer to the nearest cent.)arrow_forwardTomas purchased a new heating and air-conditioning system for his home and financed $6,700 at an annual interest rate of 4.2% compounded monthly for 3 years. What are Tomas's monthly payments (in dollars)? Round your answer to the nearest cent.arrow_forward

- Peter and Amy Chambers have saved $4,500. They are accumulating funds for a down payment on a house. If they can invest these funds at 3% annual interest for 5 years, how much money will they have accumulated at the end of this five-year time-frame?arrow_forwardTomasz purchased a new heating and air-conditioning system for his home and financed $9,100 at an annual interest rate of 2.2% compounded monthly for 3 years. How much interest (in dollars) will Tomasz pay over the term of the loan? (Round your answer to the nearest cent.)arrow_forwardMr. Deneau accumulated $98000 in an RRSP. He converted the RRSP into a RRIF and started to withdraw $5400 at the end of every three months from the fund. If interest is 4.1% compounded annually, for how long can Mr. Deneau make withdrawals? State your answer in years and months (from 0 to 11 months).arrow_forward

- Calculate the Present Value given the following: Jack invests $5,000 at the end of year 1, and every year increases his investment amount by $1000 for 5 years. Interest = 4%. N = 5arrow_forwardA new home was purchased in Niagara Fall’s Butler Heights subdivision for $375,000 by Karen. The house is going to be financed by making a down payment of 15% and financing the balance with a conventional mortgage. The mortgage is to be amortized over 20 years with weekly payments. The rate chosen for the first four years of the mortgage is 2.79% compounded semi-annually. Show all work with formulas a) Determine the size of the weekly payments? b) What will the outstanding balance be after the first four years? c) Determine the size of the new weekly payment if after the first four year term she renews the mortgage using a fixed rate of 2.04% compounded semi-annually.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education