ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

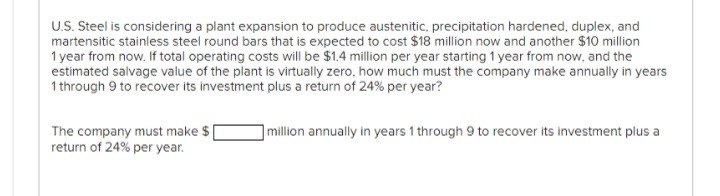

Transcribed Image Text:U.S. Steel is considering a plant expansion to produce austenitic, precipitation hardened, duplex, and

martensitic stainless steel round bars that is expected to cost $18 million now and another $10 million

1 year from now. If total operating costs will be $1.4 million per year starting 1 year from now, and the

estimated salvage value of the plant is virtually zero, how much must the company make annually in years

1 through 9 to recover its investment plus a return of 24% per year?

The company must make $

return of 24% per year.

million annually in years 1 through 9 to recover its investment plus a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Problem 02.038 - Calculation of unknown base cash flow The future worth in year 10 of an arithmetic gradient cash flow series for years 1 through 10 is $600,000. If the gradient increase each year, G, is $1500, determine the cash flow in year 1 at an interest rate of 11% per year. The cash flow in year 1 is $arrow_forwardNadine Chelesvig has patented her invention. She is offering a potential manufacturer two contracts for the exclusive right to manufacture and market her product. Plan A calls for an immediate single lump sum payment to her of $175,000. Plan B calls for an annual payment of $14,000 plus a royalty of $3.90 per unit sold. The remaining life of the patent is 10 years. Nadine uses a MARR of 10%/year. What must be the uniform annual sales volume of the product for Nadine to be indifferent between the contracts, based on an units annual worth analysis? Carry all interim calculations to 5 decimal places and then round your final answer to the nearest unit. The tolerance is ±10.arrow_forwardWaller County is planning to construct a Dam some tens of miles away from the Hempstead Recreation center to facilitate fishing in the El Manny River Basin and Power Generation. The first cost for the Dam will amount to $6,500,000. Annual maintenance and repairs will amount to $24,000 for the first four years, to $28,000 for each year in the next eight years, and to $32,000 per year for the next four years. At the end of the 16th year, $25,000 is estimated to be deposited into Waller county account as tax credits earned for its environmental compliance in the construction and operation of the Dam. In addition a major overhaul costing $650,000 will be required at the end of the seventh year. Use an interest rate of 10% and : a) Determine the engineering economy symbols and their value for each option. b) Construct the cash flow diagram c) Calculate the Capital Recovery for the projectarrow_forward

- An outboard motor has an initial price of $1,080. A service contract costs $350 for the first year and increases $130 per year thereafter. The total cost of the outboard motor (in dollars) after n years is given by C(n) = 1,080 + 150n + 30n“, where n21. Complete parts (A) through (C). (A) Write an expression for the average cost per year, C(n), for n years. C(n) =O %Darrow_forwardAvian Air Cargo is considering an investment of $10,000,000 with life expectancy of 10 years and annual operating cost of $400,000 in Year 1 with an $50,000 per year starting in Year 2 through the life of the project. Avian Air Cargo anticipates a revenue stream of $2,500,000 per year for 20 years I 12%, what is the rate of return for this project and is it economically justified? It is NOT economically justified because the rate of return is between 14% and 15%. It IS economically justified because the rate of return is between 10% and 11%. It is NOT economically justified because the rate of return is between 10% and 11%. It IS economically justified because the rate of return is between 14% and 15% of MARRarrow_forwardYour firm is thinking about investing $300,000 in the overhaul of a manufacturing cell in a lean environment. Revenues are expected to be $39,000 in year one and then increasing by $13,000 more each year thereafter, Relevant expenses will be $20,000 in year one and will increase by $10,000 per year until the end of the cell's nine-year life. Salvage recovery at the end of year nine is estimated to be $10,000. What is the annual equivalent worth of the manufacturing cell if the MARR is 10% per year? How sensitive is the annual worth to ± 10% changes in the MARR? Are changes in the MARR really a significant consideration in this problem? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 9% per year. E Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 11% per year. Find Annual Equivalent…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education