FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

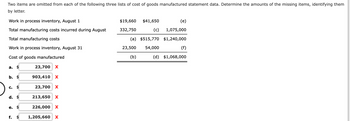

Transcribed Image Text:Two items are omitted from each of the following three lists of cost of goods manufactured statement data. Determine the amounts of the missing items, identifying them

by letter.

Work in process inventory, August 1

Total manufacturing costs incurred during August

Total manufacturing costs

Work in process inventory, August 31

Cost of goods manufactured

a. $

b. $

C. $

d. $

e.

f.

$

$

23,700 X

903,410 X

23,700 X

213,650 X

226,000 X

1,205,660 X

$19,660

332,750

$41,650

(c)

(a) $515,770

54,000

23,500

(b)

(e)

1,075,000

$1,240,000

(f)

(d) $1,068,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Manufacturing Income Statement, Statement of Cost of Goods Manufactured Several items are omitted from the income statement and cost of goods manufactured statement data for two different companies for the month of December. OnCompany OffCompany Materials inventory, December 1 $88,830 $121,700 Materials inventory, December 31 (a) 137,520 Materials purchased 225,630 (a) Cost of direct materials used in production 238,060 (b) Direct labor 334,890 273,830 Factory overhead 103,930 136,300 Total manufacturing costs incurred in December (b) 787,400 Total manufacturing costs 847,430 1,080,700 Work in process inventory, December 1 170,550 293,300 Work in process inventory, December 31 143,900 (c) Cost of goods manufactured (c) 780,100 Finished goods inventory, December 1 150,120 136,300 Finished goods inventory, December 31 157,230 (d) Sales 1,309,350 1,217,000 Cost of goods sold (d) 787,400 Gross…arrow_forwardPls asaparrow_forwardCost of Goods Manufactured for a Manufacturing Company Two items are omitted from each of the following three lists of cost of goods manufactured statement data. Determine the amounts of the missing items, identi Work in process inventory, August 1 $19,660 $41,650 (e) Total manufacturing costs incurred during August 332,750 (c) 1,075,000 Total manufacturing costs (a) $515,770 $1,240,000 Work in process inventory, August 31 23,500 54,000 (f) Cost of goods manufactured (b) (d) $1,068,000 a. $ EA b. $ C. d. $ e. f. $ $ 69arrow_forward

- Cost of Goods Manufactured for a Manufacturing Company Two items are omitted from each of the following three lists of cost of goods manufactured statement data. Determine the amounts of the missing items, identifying them by letter. Work in process inventory, August 1 Total manufacturing costs incurred during August Total manufacturing costs Work in process inventory, August 31 Cost of goods manufactured a. $ b. $ C. $ d. $ e. $ tA f. $ X X X X X X $1,900 13,100 (a) 2,900 (b) $15,600 (c) $182,500 38,300 (d) (e) 91,300 $99,100 (f) $83,200arrow_forwardSelected accounts with some amounts omitted are as follows: Work in Process Date Transaction Debit amount Date Transaction Credit amount Aug. 1 Balance 279, 100 Aug. 31 Goods finished 190, 700 31 Direct materials X 31 Direct labor 47, 400 31 Factory overhead X Factory Overhead Date Transaction Debit amount Date Transaction Credit amount Aug. 1-31 Costs incurred 113,000 Aug. 1 Balance 12, 100 31 Applied X If the balance of Work in Process on August 31 is $196, 400, what was the amount debited to Work in Process for factory overhead in August, assuming a factory overhead rate of 30% of direct labor costs? a. $190, 700 b. $12, 100 c. $113, 000 d. $14, 220arrow_forwardManufacturing Income Statement, Statement of Cost of Goods Manufactured Several items are omitted from the income statement and cost of goods manufactured statement data for two different companies for the month of December: OnCompany OffCompany Materials inventory, December 1 $87,370 $114,450 Materials inventory, December 31 (a) 129,330 Materials purchased 221,920 (a) Cost of direct materials used in production 234,150 (b) Direct labor 329,380 257,510 Factory overhead 102,220 128,180 Total manufacturing costs incurred in December (b) 740,490 Total manufacturing costs 833,500 833,500 Work in process inventory, December 1 167,750 275,820 Work in process inventory, December 31 141,540 (c) Cost of goods manufactured (c) 733,620 Finished goods inventory, December 1 147,660 128,180 Finished goods inventory, December 31 154,640 (d) Sales 1,287,830 1,144,500 Cost of goods sold (d) 740,490 Gross…arrow_forward

- Cost of Goods Manufactured for a Manufacturing Company Two items are omitted from each of the following three lists of cost of goods manufactured statement data. Determine the amounts of the missing items, identifying them by letter. Work in process inventory, August 1 $2,200 $18,900 (e) Total manufacturing costs incurred during August 15,200 (c) 111,200 Total manufacturing costs (a) $221,100 $120,700 Work in process inventory, August 31 3,300 46,400 (f) Cost of goods manufactured (b) (d) $101,400 a. b. c. d. e. f.arrow_forwardCost of Goods Manufactured for a Manufacturing Company Two items are omitted from each of the following three lists of cost of goods manufactured statement data. Determine the amounts of the missing items, identifying them by letter. Work in process inventory, August 1 $3,100 $25,700 (e) Total manufacturing costs incurred during August 21,400 (c) 150,900 Total manufacturing costs (a) $300,700 $163,800 Work in process inventory, August 31 4,700 63,100 (f) Cost of goods manufactured (b) (d) $137,600 a. b. C. d. e. f.arrow_forwarddsl.3arrow_forward

- Need answerarrow_forwardSelected accounts with amounts omitted are as follows Work in Process Aug. 1 Balance 279,350 Aug. 31 Goods finished 171,180 31 Direct materials X 31 Direct labor 33,600 31 Factory overhead X Factory Overhead Aug. 1 – 31 Costs incurred 115,090 Aug. 1 Balance 15,610 31 Applied (30% of direct labor cost) X If the balance of Work in Process on August 31 is $206,820, what was the amount debited to Work in Process for direct materials in August? a. $54,970 b. $106,130 c. $519,770 d. $348,590arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education