FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

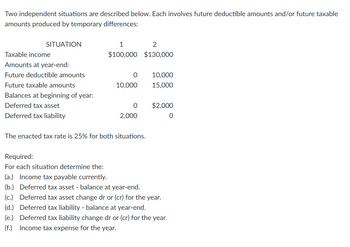

Transcribed Image Text:Two independent situations are described below. Each involves future deductible amounts and/or future taxable

amounts produced by temporary differences:

SITUATION

Taxable income

Amounts at year-end:

Future deductible amounts

Future taxable amounts

Balances at beginning of year:

Deferred tax asset

Deferred tax liability

1

2

$100,000 $130,000

0

10,000

0

2,000

The enacted tax rate is 25% for both situations.

10,000

15,000

$2,000

0

Required:

For each situation determine the:

(a.) Income tax payable currently.

(b.) Deferred tax asset - balance at year-end.

(c.) Deferred tax asset change dr or (cr) for the year.

(d.) Deferred tax liability - balance at year-end.

(e.) Deferred tax liability change dr or (cr) for the year.

(f.) Income tax expense for the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I need part d, e, f answered

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I need part d, e, f answered

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In picture below:arrow_forwardEight Independent situations are described below. Each involves future deductible amounts and/or future taxable amounts: 1. 2. 3. 5. 6. 7. 2 The Income Statement Revenue 3 4 5 6 7 8 ($ in millions) Temporary Differences Reported First on: The Tax Return $24 19 19 19 Expense $24 Situations Taxable Income 1 24 24 24 24 Revenue $24 19 9 Expense Required: For each situation, determine taxable income, assuming pretax accounting income is $140 million. (Enter your answers in millions (I.e., 10,000,000 should be entered as 10).) $24 14 14arrow_forwardSubject: acountingarrow_forward

- 10030.arrow_forwardA taxpayer receives $5,000 on their federal return in taxable unemployment income. What is the amount that must be subtracted from the state return to calculate the portion taxable to the State? A. Potentially a $5,000 subtraction. The amounts need to have been taxable on the federal return and administered by California's EDD to be excludable. Unemployment received from other states is still fully taxable in most cases. B. $5,000 subtraction - California does not include amounts received from any unemployment source in State income. C. $0 subtraction - The taxpayer may, however, claim a credit for the job search costs to reduce their taxable exposure to unemployment income. D. $0 subtraction - This is taxable income to the State.arrow_forwardHi there, Need help with question, thanks!arrow_forward

- Save & Exit Subm Two independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences: SITUATION Taxable income Amounts at year-end: Future deductible amounts 2. $46,000 $86,000 5,600 10,600 0 5,600 Future taxable amounts Balances at beginning of year, dr (cr): Deferred tax asset, Deferred tax liability $ 1,000 $ 3,180 0 1,000 The enacted tax rate is 30% for both situations. Required: For each situation determine the: SITUATION 2. (a.) Income tax payable currently. (b.) Deferred tax asset - balance at year-end. (c.) Deferred tax asset change dr or (cr) for the year. (d.) Deferred tax liability - balance at year-end. (e.) Deferred tax liability change dr or (cr) for the year. (f.) Income tax expense for the year. Next > 31 of 39arrow_forwardFederal income taxes are allowed as an itemized deduction but are limited to $10,000? Ture or falsearrow_forwardShwonson Industries reported a deferred tax asset of $9.75 million for the year ended December 31, 2020, related to a temporary difference of $39 million. The tax rate was 25%. The temporary difference is expected to reverse in 2022, at which time the deferred tax asset will reduce taxable income. There are no other temporary differences in 2020–2022. Assume a new tax law is enacted in 2021 that causes the tax rate to change from 25% to 15% beginning in 2022. (The rate remains 25% for 2021 taxes.) Taxable income in 2021 is $49 million. Required:1. Prepare the appropriate journal entry to record Shwonson’s income tax expense in 2021.2. What effect, will enacting the change in the 2022 tax rate, have on Shwonson’s 2021 net income?arrow_forward

- Sherrod, Inc., reported pretax accounting income of $70 million for 2021. The following information relates to differences between pretax accounting income and taxable income: Income from installment sales of properties included in pretax accounting income in 2021 exceeded that reported for tax purposes by $4 million. The installment receivable account at year-end 2021 had a balance of $6 million (representing portions of 2020 and 2021 installment sales), expected to be collected equally in 2022 and 2023. Sherrod was assessed a penalty of $1 million by the Environmental Protection Agency for violation of a federal law in 2021. The fine is to be paid in equal amounts in 2021 and 2022. Sherrod rents its operating facilities but owns one asset acquired in 2020 at a cost of $60 million. Depreciation is reported by the straight-line method, assuming a four-year useful life. On the tax return, deductions for depreciation will be more than straight-line depreciation the first two years but…arrow_forwardA taxpayer is itemizing their return and they're trying to calculate the deductible amount of state income taxes paid. They have $4,000 from their Form(s) W-2 and they paid an outstanding balance in the current year for the prior year's balance of $2,500. What is the total amount of Line 5 income taxes that they can itemize? (Do not consider SALT limitations for this question) 2500 4000 6500arrow_forwardIn 2020, Bartley Corporation's federal income tax due was $147,000. Compute the required installment payments of 2021 tax in each of the following cases: Required: a. Bartley's 2021 taxable income is $440,000. b. Bartley's 2021 taxable income is $975,000. c. Bartley's 2021 taxable income is $2,100,000. X Answer is complete but not entirely correct. a. Total installment payments b. Total installment payments c. Total installment payments Amount $ 92,400 $ 204,750 X $ 441,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education