ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

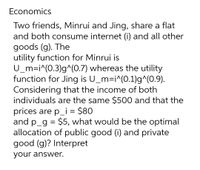

Transcribed Image Text:Economics

Two friends, Minrui and Jing, share a flat

and both consume internet (i) and all other

goods (g). The

utility function for Minrui is

U_m=i^(0.3)g^(0.7) whereas the utility

function for Jing is U_m=i^(0.1)g^(0.9).

Considering that the income of both

individuals are the same $500 and that the

prices are p_i = $80

and p_g = $5, what would be the optimal

allocation of public good (i) and private

good (g)? Interpret

your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 42 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Maya is doing her undergrad at Queen's University. She loves donuts and chocolate chip cookies (CCC). Her utility function is given by u(x, y) = √8x +5 + 2y, where x denotes her consumption of donuts and y denotes her consumption of CCC. Her budget is $10/day. The price of a donut is $1. (a) When the price of CCC is $1, what is Maya's optimal choice of donuts and CCC? (b) When the price of CCC is $8, what is Maya's optimal choice of donuts and CCC? (c) When the price of CCC increases from $1 to $8, calculate Maya's substitution effect and income effect. (d) According to your calculation in part (c), is CCC a normal good or an inferior good? Explain. Is CCC an ordinary good or a Giffen good? Explain.arrow_forwardPlease get correct, I keep getting wrong. Thank you so much.arrow_forwardKatie Kwasi's utility function is U(x₁, x₂)=5(In x₁)+x₂. Given her current income and the current relative prices, she consumes 10 units of x₁ and 15 units of x₂. If her income doubles, while prices stay constant, how many units of x₁ will she consume after the change in income? a)10 b)20 c)15 d)5arrow_forward

- Suppose a consumer’s utility function is u = x_1^(3/2) x_2^(3/2) . She spends her budget of £27 for two goods. The prices of both goods are p1 = 6 and p2 = 6 Now suppose that instead both goods are priced as follows: There is a discount of 50% on the price of good 1 on each additional unit in excess of 3 units, and there is a discount of 50% on the price of good 2 on each additional unit in excess of 3 units. Draw the new budget constraint and derive it analytically.arrow_forwardAisha is considering how to allocate the next 6 hours of her free time. She could choose between leisure (L) and helping her neighbour with the house chores. If she decides to help her neighbour, she is going to get paid at £25 per hour, which she can then spend on her favourite pizza (P). Suppose the price of pizza is £12.50. Aisha’s preferences for leisure and pizza are given by the following utility function: . U(L,P)= 3L + P MU(L)= 3 MU(P)=1 Write down Aisha’s budget equation and draw the corresponding budget line. Clearly label the axes and calculate the coordinates of the points of intersection of the budget line with each axis. Calculate Aisha’s marginal rate of substitution between leisure and pizza. Explain the concept of MRS and interpret the figure obtained. Find Aisha’s optimal consumption bundle, both algebraically and graphically. Explain your reasoning. Would Aisha’s optimal choice change if she could get a discount on her pizza purchases so that each pizza would cost…arrow_forwardSuppose that there are two goods (X and Y ). The price of X is $2 per unit, and the price of Y is $1 per unit. There are two consumers (A and B). The utility functions for the consumers are UA (X, Y): = X0.5y-0.5 UB (X,Y)= X0.8y-0.2 Consumer A has an income of $100, and Consumer B has an income of $300. PAGE 2 (a) Use Lagrangians to solve the constrained utility-maximization problems for Consumer A and Consumer B. (b) Calculate the marginal rate of substitution for each consumer at his or her optimal consumption bundles. (c) Suppose that there is another consumer (let's call her C). You don't know anything about her utility function or her income. All you know is that she consumes both goods. What do you know about C's marginal rate of substitution at her optimal consumption bundle? Why?arrow_forward

- PROBLEM (4) You have the Cobb-Douglas utility function u(x, y) = xy over apples (x) and plums (y) and you have $120 budget to spend and can carry at most 480 ounces in weight in your backpack going back to the dorm. Each apple costs $1 and weighs 8 ounces, and each plum costs $3 and weighs 4 ounces. You can only leave the store with a bundle of fruits you can afford and carry. (a) Drawing the relevant lines, intercepts, marking the points and hence identifying the feasible set of bundles, calculate the optimal bundle. (b) Forget about (a). If you were to choose a backpack before going on this shopping trip, for the weight constraint not to be an issue for you, how many ounces of weight capacity would you need for your backpack? HINT: That is, for this weight capacity of the backpack, you'd be able to carry the best bundle you can afford, i.e, the weight constraint is not binding for your decision. (c) Forget about (b). In (a), just before going out for shopping with your backpack to…arrow_forwardRhea is determining how many gallons of milk (M) and loaves of bread (B) to purchase. Use the information in italics to answer the bolded question below: Rhea's marginal utility function for milk: MUN • Rhea's marginal utility function for bread: M = 0.5M-2 MUB = 0.5MB-1/2 • Rhea has $60 to spend on bread and milk. • The price of milk (Pm) is $3/gallon of milk. • The price of bread (Pb) is $1/loaf of bread. • For the sake of computation, assume that bread is the horizontal axis good (i.e., good X) and milk is the vertical axis good (i.e., good Y). When you set up the optimal budget decision rule for Rhea's consumer problem, which of the following statements best describes how much she will buy of both goods at her consumer equilibrium? O For each gallon of milk, Rhea will buy 1/3 loaf of bread. O For each gallon of milk, Rhea will buy 3 loaves of bread. For each gallon of milk, Rhea will buy 1 loaf of bread. O For each gallon of milk, Rhea will buy 6 loaves of bread.arrow_forwardTwo grad students go out to lunch and decide to split the bill evenly between them. Each student has a quasi-linear utility function given by ui(fi, xi) = φi(fi)+xi, where φi(·) is strictly concave, fi is the amount of food consumed by student i, and xi is a composite numeraire good. Each student has a fixed budget of mi. EVALUATE THIS CLAIM: Both students eat too much!arrow_forward

- For the utility function U = Qx0.28Q (1-0.28) and the budget 137 = 11Qx+6Qy find the CHANGE in optimal consumption of X if the price of X increases by a factor of 1.6. Please enter your response as a positive number with 1 decimal and 5/4 rounding (e.g. 1.15 = 1.2, 1.14 = 1.1).arrow_forwardAdam's Utility at Optimal Consumption Bundle Given Adam's utility function U = 4x0.8y 0.2 And the optimal consumption bundle found previously (X= 40, Y = 30), substitute these values into the utility function. U = 4 \times 400.8 \times 300.2 U = 4 \times 19.127 \times 300.2 U = 76.5 \times 1.97 U = 151 Adam's utility at his optimal consumption bundle is 151. C. The Lagrange multiplier at the optimal consumption bundle can be interpreted as the marginal utility of income, or how much additional utility Adam would gain from an additional unit of currency. From the Lagrange multiplier method, dL = 3.2X-0.20.2 - 451 = 0 dt = 0.8x087-08-151 = 0 Using equation 1, 3.2 \times 40-0.2 \times 300.2= 452 45= 3.2.40-0.2 300.2 452 = 32 = 0.067 d. Budget Constraint Line PX. X + PY. Y = B With PX = £45, PY = £15, and B = £2,250, this becomes 45X + 15Y= 2,250. Set Y to 0 in the budget equation, 45X = 2250, X = 50. The X-intercept is at (50, 0). Set X to 0, 15Y = 2250, Y = 150. The Y-intercept is at (0,…arrow_forwardFor the utility function U = Qx0.46Qy(1-0.46) and the budget 100 = 11Qx + 11Qy find the CHANGE in optimal consumption of X if the price of X increases by a factor of 1.5. Please enter your response as a positive number with 1 decimal and 5/4 rounding (e.g. 1.15 = 1.2, 1.14 = 1.1).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education