FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Problems 15 through 18 are based on the following information:

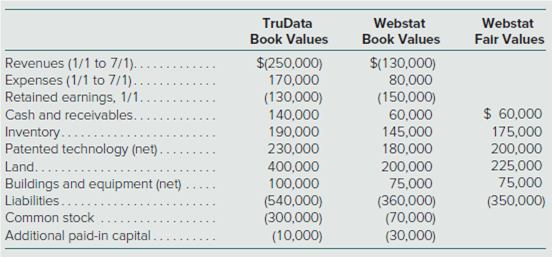

On July 1, TruData Company issues 10,000 shares of its common stock with a $5 par value and a $40 fair value in exchange for all of Webstat Company’s outstanding voting shares. Webstat’s precombination book and fair values are shown below along with book values for TruData’s accounts.

On its acquisition-date consolidated

a. $130,000

b. $210,000

c. $260,000

d. $510,000

Transcribed Image Text:TruData

Webstat

Webstat

Book Values

Book Values

Falr Values

Revenues (1/1 to 7/1). .

Expenses (1/1 to 7/1).

Retained earnings, 1/1.

Cash and receivables.

$(250,000)

170,000

(130,000)

140,000

190,000

230,000

400,000

100,000

(540,000)

(300,000)

(10,000)

$(130,000)

80,000

(150,000)

60,000

$ 60,000

Inventory...

Patented technology (net).

Land.......

Buildings and equipment (net)

145,000

180,000

175,000

200,000

225,000

200,000

75,000

(360,000)

(70,000)

(30,000)

75,000

Liabilities....

(350,000)

Common stock

Additional paid-in capital....

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Palm Corporation and Staple Company have announced terms of an exchange agreement under which Palm will issue 8,500 shares of its $15 par value common stock to acquire all of Staple Company’s assets. Palm shares currently are trading at $59, and Staple $10 par value shares are trading at $23 each. Historical cost and fair value balance sheet data on January 1, 20X2, are as follows: Palm Corporation Staple Company Balance Sheet Item Book Value Fair Value Book Value Fair Value Assets Cash & Receivables $ 151,000 $ 151,000 $ 46,000 $ 46,000 Land 110,000 190,000 57,000 83,000 Buildings & Equipment (net) 313,000 411,000 176,000 230,000 Total Assets $ 574,000 $ 752,000 $ 279,000 $ 359,000 Equities Common Stock $ 200,000 $ 81,000 Additional Paid-In Capital 18,000 9,900 Retained Earnings…arrow_forwardG Company is considering the takeover of K Company whereby it will issue 8,000 common shares for all of the outstanding shares of K Company. K Company will become a wholly owned subsidiary of G Company. Prior to the acquisition, G Company had 15,000 shares outstanding, which were trading at $9.70 per share. The following information has been assembled: Current assets Plant assets (net) Current liabilities Long-term debt Common shares Retained earnings Current assets Plant assets (net) Goodwill Investment in K Company Acquisition differential Current liabilities Long-term debt Common shares Retained earnings Carrying Amount $67,500 79,000 $146,500 $ 21,900 24,500 67,000 33,100 $146,500 G Company $ $ Fair Value $57,000 89,000 $ (b) Prepare G Company's consolidated balance sheet immediately after the combination using the worksheet approach and the acquisition method. (Leave no cells blank - be certain to enter "0" wherever required. Values in the first two columns and last column (the…arrow_forwardOn 1 May 2019, PR Corp purchased 75 per cent of the equity of SS Corp for $2.6 million. The consideration was 35,000 equity shares in PR Corp with a fair value of $2.6 million. The followings are extracts from the draft (not finalised) statements of profit or loss for PR Corp and its subsidiary SS Corp for the year ending 30 June 2019 together with the draft statements of financial position as at 30 June 2019. The profits of SS Corp have been earned evenly throughout the year 2019. Statements of profit or loss for the year ending 30 June 2019 PR Corp ($000) SS Corp ($000) Gross profit 1,456 960 Profit for the year 920 384 Statements of financial position as at 30 June 2019 PR Corp ($000) SS Corp ($000) Share capital 2,800 740 Retained earnings 11,600 1,324 Revaluation surplus 120 - 14,520 2,064 PR Corp has not yet accounted for the issue of its own…arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education