Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

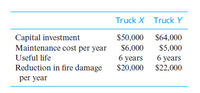

The city council of Morristown is considering the purchase of one new fire truck. The options are Truck X and Truck Y. The appropriate financial data are as follows (shown): The purchase is to be financed by money borrowed at 12% per year. Use this information to answer, What is the conventional B–C ratio for Truck X? (a) 1.41 (b) 0.87 (c) 1.64 (d) 1.10 (e) 1.15.

Transcribed Image Text:Truck X Truck Y

Capital investment

Maintenance cost per year

$50,000 $64,000

$6,000

$5,000

Useful life

6 years

6 years

Reduction in fire damage

$20,000 $22,000

per year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Robert Trails Senior Living Community is considering investing in solar panels to save on utility costs. The initial cost of the panels, including installation, is $241,000. The expected reduction in utility costs are noted below. Utility costs savings for the next five years are: (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Click here to view factor tables Year 1: Year 2: Year 3: Year 4: Year 5: $66,000 $68,100 $72,900 $76,200 $78,700 The current interest rate used to evaluate investment decisions is 6%. The inflation rate is expected to remain constant at 3% for the entire period. (a) * Your answer is incorrect. Compute the present value of the expected cash flows (savings). Present Value of Expected Cash Flows $ 303248arrow_forwardKamil Koç Transportation is considering two models of buses for newly opened routes. Bus Model 1 will have a first cost of $160912, an operating cost of $21338 per year, and a resale value of $86231 after 6 years. Bus Model 2 will have a first cost of $108347, an operating cost of $15486 per year, and also have a $75850 resale value, but after 4 years. At an interest rate of 7% per year, which model should the Kamil Koç buy based on an annual worth analysis? What is the annual worth and the present worth of the selected alternative? Select one: a. Bus Model 1 is selected, AW is $-25017 and PW is $-102936 b. Bus Model 2 is selected, AW is $-30390 and PW is $– 30390 c. Bus Model 1 is selected, AW is $-25017 and PW is $-205161 d. Bus Model 2 is selected, AW is $-33123 and PW is $ – 102936 e. Bus Model 2 is selected, AW is $-33123 and PW is $-205161 f. Bus Model 1 is selected, AW is $-30390 and PW is $-102936arrow_forwardA local municipality is considering investing $220,000 to upgrade a park. Based on similar investments made by similar cities, it is anticipated the investment will result in annual costs and annual benefits over a 7-year period as shownin the cash flow profhle given below in thousands of dollars. Notice, an intermediate investment of $140,000 is anticipated in the 6th year of the investment. Based on a MARR of 5%, calculate the benefit-cost ratio of the investment. Round answer to two decimal places. (All values in thousand dollars) End-of Year Costs Benefits Net Cash Flow $220 -$220 $70 $120 $50 $70 $130 $60 $70 $140 $70 4 $70 $150 $80 $70 $160 $90 $210 $170 -$40 7. $70 $160 $90 1.45 2. inarrow_forward

- Dave Krug finances a new automobile by paying $6,800 cash and agreeing to make 40 monthly payments of $580 each, the first payment to be made one month after the purchase. The loan bears interest at an annual rate of 12%. What is the cost of the automobile? (PV of $1. EV of $1. PVA of $1. and EVA of $1) Note: Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places. Monthly Payment 580 Table Values are based on: Present Value of Loan n = Table Factor $ 40 12% Cash Down Payment 6,800 - Present Value of Loan Cost of the Automobilearrow_forwardHi sir please find the answer of the questionarrow_forward7. What is the payback period? ?arrow_forward

- In a highway construction the drivers save annually around $20,000 and the road cost construction was $100,000 and the annual maintenance is $10,000. The interest rate is 5% and this alternative is evaluated in a 20 year time span. The B/C ratio is nearly: a. 2.49 b. 1.25 c.1.11 d. 0.24arrow_forwardVancouver Shakespearean Theater's board of directors is considering the replacement of the theater's lighting system. The old system requires two people to operate it, but the new system would require only a single operator. The new lighting system will cost $115,700 and save the theater $24,000 annually for the next eight years. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Exercise 16-28 New Present Value with Different Discount Rates (Section 1) (LO 16-1) Required: 1-a. Prepare a table showing the proposed lighting system's net present value for each of the following discount rates: 8 percent, 10 percent, 12 percent, 14 percent, and 16 percent. 1-b. Based on your findings in requirement 1-a., Which statement is true? Complete this question by entering your answers in the tabs below. Req 1A Prepare a table showing the proposed lighting system's net present value for each of the following discount rates: 8 percent, 10 percent, 12 percent, 14…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education