FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

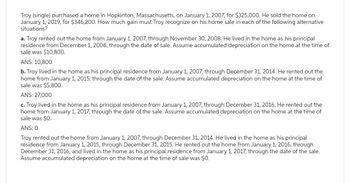

Transcribed Image Text:Troy (single) purchased a home in Hopkinton, Massachusetts, on January 1, 2007, for $325,000. He sold the home on

January 1, 2019, for $346,200. How much gain must Troy recognize on his home sale in each of the following alternative

situations?

a. Troy rented out the home from January 1, 2007, through November 30, 2008. He lived in the home as his principal

residence from December 1, 2008, through the date of sale. Assume accumulated depreciation on the home at the time of

sale was $10,800.

ANS: 10,800

b. Troy lived in the home as his principal residence from January 1, 2007, through December 31, 2014. He rented out the

home from January 1, 2015, through the date of the sale. Assume accumulated depreciation on the home at the time of

sale was $5,800.

ANS: 27,000

c. Troy lived in the home as his principal residence from January 1, 2007, through December 31, 2016. He rented out the

home from January 1, 2017, through the date of the sale. Assume accumulated depreciation on the home at the time of

sale was $0.

ANS: 0

Troy rented out the home from January 1, 2007, through December 31, 2014. He lived in the home as his principal

residence from January 1, 2015, through December 31, 2015. He rented out the home from January 1, 2016, through

December 31, 2016, and lived in the home as his principal residence from January 1, 2017, through the date of the sale.

Assume accumulated depreciation on the home at the time of sale was $0.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Larry is the sole proprietor of a trampoline shop. During 2020, the following transactions occurred. For each transaction, what are the amount and nature of recognized gain or loss? Larry sold an apartment building for $300,000 on September 1. The rental property was purchased on September 1, 2017, for $150,000 and was being depreciated over a 27.5-year life using the straight-line method. At the date of sale, the adjusted basis was $124,783. There is an overall § 1231 gain of $__________ How much § 1250 recapture is recognized? $__________ What is the amount of unrecaptured § 1250? $__________ Larry's personal yacht was stolen on September 5. The yacht had been purchased in August at a cost of $25,000. The fair market value immediately preceding the theft was $19,600. Larry was insured for 50% of the original cost, and he received $12,500 on December 1. There is a tax loss (before AGI limitations) of $__________ that is treated as nondeductable personal casualty loss. Larry sold a…arrow_forwardThomas and Courtney are married, and they will file a joint return. In 2023, they sold an undeveloped plot of land. They had purchased the land in 2018 as an investment. Unfortunately, the value of the land decreased, and they incurred a $5,000 loss at the time of sale. They had no other capital gains or losses during the year, and they had no prior-year carryover losses. How much of the loss from the sale of the land may the couple use to offset their 2023 ordinary income? $0 $1,500 $3,000 $5,000arrow_forwardErin is the landlord of a single-family home, which she leased to Carlos in February 2022. Prior to moving in, Carlos paid $1,000 for the first month's rent and an additional $1,000 for the last month's rent (for a total of $2,000 advance rent). He then paid $10,000 in rent during the remainder of the tax year. What amount does Erin include in gross rental income for this property in 2022?arrow_forward

- Vijayarrow_forwardDineshbhaiarrow_forwardTed and Alice were divorced in January 2018. The provisions of the divorce decree and Alices's obligations follow: 1. Transfer the title in their resort condo to Ted. At the time of the transfer, the condo had a basis to Alice of $95,000, a fair market value of $115,000; it was subject to a mortgage of $85,000. 2. Alice is to make the mortgage paynents for 17 years regardless of how long Ted lives. Alice paid $12,000 in 2020. 3. Alice is to pay Ted $1,000 per month, beginning in 2018, for 10 years or until Ted dies. Of this amount, $500 is designated as child support. Alice made five payments of $900 each in 2021 (January - May). What is the amount of alimony from his settlement that is includible in Ted's gross income for 2021?arrow_forward

- Joyce is a widowed taxpayer whose husband Willard passed away on March 31, 2020. Joyce and Willard had purchased a home for $215,000 on September 12, 2004, lived in the home as their main home until Willard's death. Joyce moved in with her daughter after Willard's death, and sold the home on November 30, 2020 , for $595,000. How much of the gain on the sale can Joyce exclude from taxable income? Select one: O a. $500,000, the maximum exclusion for an unmarried surviving spouse O b. $380,000, the amount of gain on the sale of the home O C. $250,000, the maximum exclusion amount for a single taxpayer O d. $0, because she moved out before she sold the homearrow_forwardTroy (single) purchased a home in Hopkinton, Massachusetts, on January 1, 2007, for $305,000. He sold the home on January 1, 2020, for $326,400. How much gain must Troy recognize on his home sale in each of the following alternative situations? d. Troy rented out the home from January 1, 2007, through December 31, 2015. He lived in the home as his principal residence from January 1, 2016, through December 31, 2016. He rented out the home from January 1, 2017, through December 31, 2017, and lived in the home as his principal residence from January 1, 2018, through the date of the sale. Assume accumulated depreciation on the home at the time of sale was $0.arrow_forwardSharon Sutherland owned a home in Toronto, Ontario, a ski chalet in Whistler, British Columbia, and a condominium in Florida, U.S., until June 15, 2022, when she sold all three properties and moved into a seniors’ residence. She provides the following information with respect to the properties:arrow_forward

- Jeff is a single taxpayer who sold his home when he was transferred from NY to Denver by hisemployer. He purchased the home on January 10, 2013. He was sent by his company for temporaryassignment to Detroit on February 1, 2016, that lasted for longer and was gone for 16 months in2016 and 2017, during which time he rented out his home. He moved back into the home on June 3,2017. He sold the home on March 15, 2020. Jeff can claim an exclusion of gain on the sale up to:Select one:a. $500,000b. $300,000c. $250,000d. $0arrow_forwardSarah (single) purchased a home on January 1, 2008, for $600,000. She eventually sold the home for $800,000. What amount of the $200,000 gain on the sale does Sarah recognize in each of the following alternative situations? (Assume accumulated depreciation on the home is $0 at the time of the sale.) Note: Leave no answer blank. Enter zero if applicable. a. Sarah used the home as her principal residence through December 31, 2019. She used the home as a vacation home from January 1, 2020, until she sold it on January 1, 2023. Answer is complete but not entirely correct. Gain recognized $ 50,000arrow_forwardMark (age 55 in 2020) and his late wife, Mary, were married in 1990. Mark and Mary have a son, Matt, who was born in 2009. Mary passed away on October 4, 2020. Mark has not remarried. Mark maintained a household for Matt, his dependent child (qualifying child), for all of 2020 & 2021. What allowable filing status would be most beneficial for Mark to use in 2020?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education