FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

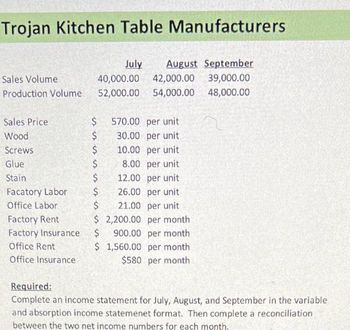

Transcribed Image Text:Trojan Kitchen Table Manufacturers

July August September

40,000.00 42,000.00 39,000.00

52,000.00 54,000.00 48,000.00

Sales Volume

Production Volume

Sales Price

Wood

Screws

Glue

Stain

Facatory Labor

Office Labor

Factory Rent

Factory Insurance

Office Rent

Office Insurance

SsSs is

$

570.00 per unit

30.00 per unit

10.00 per unit

8.00 per unit

12.00 per unit

26.00 per unit

21.00 per unit

$

2,200.00 per month

$ 900.00 per month

1,560.00 per month

$580 per month

$

$

$

$

$

$

$

Required:

Complete an income statement for July, August, and September in the variable

and absorption income statemenet format. Then complete a reconciliation

between the two net income numbers for each month.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fantastic29 Cleapers owns and operates a large automatic laundry facility in Winchester. The company expects to process 8,100 loads of laundry in June and to collect an average of $6.20 per load processed. The following table provides data concerning the company's costs: Cost per Load of Laundry $ 0.60 $ 0.15 $ 0.40 $0.08 Detergents and Softeners. Equipment Maintenance Staff Compensation $ 4,300 $ 1,200 $ 8,100 $ 2,000 Administrative Expenses $1,500 $ 0.04 For example, utilities costs are $1,200 per month plus $0.08 per load of laundry. Utilities Equipment Depreciation Facility Lease The actual operating results for June are as follows: Fantastic29 Cleaners Income Statement For the Month Ended June 30 Actual loads processed Revenue Expenses: Fixed Cost per Month Detergents and Softeners Equipment Maintenance Staff Compensation Utilities Equipment Depreciation ( Facility Lease Administrative Expenses Total expense Net operating income 8,200 $ 52,320 5,360 1,455 7,900 1,018 8,100 2,200…arrow_forwardItem 3 Dawson Toys, Ltd., produces a toy called the Maze. The company has recently created a standard cost system to help control costs and has established the following standards for the Maze toy: Direct materials: 6 microns per toy at $0.32 per micron Direct labor: 1.3 hours per toy at $6.70 per hour During July, the company produced 5,400 Maze toys. The toy's production data for the month are as follows: Direct materials: 73,000 microns were purchased at a cost of $0.30 per micron. 32,500 of these microns were still in inventory at the end of the month. Direct labor: 7,420 direct labor-hours were worked at a cost of $52,682. Required: 1. Compute the following variances for July: (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations. Round final answer to the nearest whole dollar amount.) a. The materials price…arrow_forward1 part 1arrow_forward

- Help needed please! Please helparrow_forward32arrow_forwardPrime Cost and Conversion Cost Grin Company manufactures digital cameras. In January, Grin produced 3,750 cameras with the following costs: Direct materials $1,000,000 Direct labor 104,000 Manufacturing overhead 768,000 There were no beginning or ending inventories of WIP. Required: If required, round your answers to the nearest cent. 1. What was the total prime cost in January?$fill in the blank 1 2. What was the prime cost per unit in January?$fill in the blank 2per unit 3. What was the total conversion cost in January?$fill in the blank 3 4. What was the conversion cost per unit in January? $fill in the blank 4per unitarrow_forward

- Question 9.3 Burnaby traders makes four products in a single facility. Following information regarding products is given: Product A B C D Selling Price per Unit $35.30 $30.20 $20.80 $26.00 Variable Manufacturing Cost per Unit $16.50 $15.80 $7.90 $8.50 Variable Selling Cost per Unit $3.80 $1.60 $1.90 $3.30 Milling Machine Minutes per Unit 3.20 1.80 2.20 2.50 Monthly Deman in Units 4,000 1,000 3,000 1,000 Maximum minutes on all machines (22,600) Required: 1) How many minutes of milling machine time would be required to satisfy demand for all four products? 2) Which product makes the LEAST profitable use of the milling machines? 3) Which product makes the MOST profitable use of the milling machines?arrow_forwardanswer in 20 minutes Imperial Jewelers manufactures and sells a gold bracelet for $407.00. The company’s accounting system says that the unit product cost for this bracelet is $274.00 as shown below: Direct materials $ 148Direct labor 90Manufacturing overhead 36Unit product cost $ 274 The members of a wedding party have approached Imperial Jewelers about buying 26 of these gold bracelets for the discounted price of $367.00 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $13. Imperial Jewelers would also have to buy a special tool for $456 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education