FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Using the the following trial balance , with a closing stock of $1,000, prepare a Balance Sheet as at the month end date.

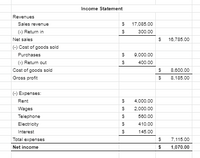

Transcribed Image Text:Income Statement

Revenues

Sales revenue

17,085.00

(-) Return in

300.00

Net sales

16,785.00

(-) Cost of goods sold

Purchases

9,000.00

(-) Return out

400.00

Cost of goods sold

8,600.00

Gross profit

8,185.00

(-) Expenses:

Rent

4,000.00

Wages

2,000.00

Telephone

580.00

Electricity

410.00

Interest

145.00

Total expenses

7,115.00

Net income

1,070.00

%24

%24

%24

%24

%24

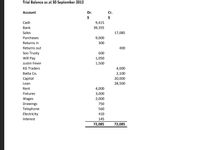

Transcribed Image Text:Trial Balance as at 30 September 2012

Account

Dr.

Cr.

$

$

Cash

9,415

Bank

39,355

Sales

17,085

Purchases

9,000

Returns in

300

Returns out

400

Soo Trusty

600

Will Pay

1,050

Justin Fever

1,500

KG Traders

4,000

2,100

20,000

Batta Co.

Capital

Loan

28,500

Rent

4,000

Fixtures

3,000

2,000

Wages

Drawings

Telephone

750

560

Electricity

410

Interest

145

72,085

72,085

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The first two closing entries to the Income Summary account indicate a debit of $53,000 and a credit of $64,000. The third closing entry would be: Multiple Choice debit Capital $11,000; credit Income Summary $11,000 debit Income Summary $11,000; credit Capital $11,000 debit Drawing $11,000; credit Income Summary $11,000 debit Income Summary $11,000; credit Drawing $11,000arrow_forwardsarrow_forwardSubsequent events are reviewed through which date under IFRS?(a) Statement of financial position date.(b) Sixty days after the year-end date.(c) Date of independent auditor’s opinion.(d) Authorization date of the financial statements.arrow_forward

- Interim financial reports should be published a. Within a month of the half year-end b. Once a year at any time in that year c. Whenever the entity wishes d. On a quarterly basisarrow_forwardA fiscal period is any period of time covering a complete accounting cycle. A fiscal year consists of 12 consecutive months. The accounting cycle represents the sequence of steps in the accounting process completed during the fiscal period. Which of the following would be considered a fiscal year? (Select "Yes" for the items that are applicable and "No" for the items that do not apply) August 1, 20-- to November 30, 20-- January 1, 20-- to December 31, 20-- May 1, 20-- to April 30, 20-- July 1, 20-- to June 30, 20--arrow_forwardPrepare an Income Statement for year ended 30 June.arrow_forward

- Selected accounts and related amounts for Druid Hills Co. for the fiscal year ended May 31, 20Y8, are presented in Problem 6-5A. Adjunt problem 6-5A Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 12. 2. Prepare closing entries as of May 31, 20Y8.arrow_forwardcompany received a deposit for $19600 last month for services to be provided in the current month, October. By the end of October the services have been provided. What does the appropriate journal entry include at the end of October?arrow_forwardThe following items appear on the balance sheet of a company with a one-year operating cycle. Identify the proper classification of each item as follows: C if it is a current liability, L if it is a long-term liability, or N if it is not a liability. 1. Interest payable (due in 90 days) Item 2. Unearned revenues (to be earned over next 3 months) 3. Employee Union Dues Payable 4. Pension liability (to be paid to employees retiring in 2 to 5 years) 5. Warranty liability (6 months of coverage) 6. FICA-Social Security Taxes Payable 7. FICA Medicare Taxes Payable 8. Prepaid Insurance (6 months of coverage) 9. Sales taxes payable. 10. Pension liability (to be fully paid to retired employees in next 11 months) Classificationarrow_forward

- Question: Use the following information: Month Revenue Billed in the Month Revenue From the Month that is Outstanding at End of Quarter (i.e., on March 31) January $200,000 February $250,000 March $300,000 $50,000 $100,000 $200,000 On the Uncollected Balances Schedule, what percent of the uncollected accounts are from January?arrow_forwardOn 15 July, an analyst is examining a company with a fi scal year ending on 31 December. Use the following data to calculate the company’s trailing 12 month earnings (forthe period ended 30 June 2010):• Earnings for the year ended 31 December, 2009: $1,200;• Earnings for the six months ended 30 June 2009: $550; and• Earnings for the six months ended 30 June 2010: $750.arrow_forwardAssume a company receives a bill for $10,000 for advertising done during the current year. If this bill is not yetrecorded at the end of the year, what will the adjustingjournal entry include?a. Debit to Advertising Expense of $10,000.b. Credit to Advertising Expense of $10,000.c. Debit to Accrued Liabilities of $10,000.d. Need more information to determinearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education