Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

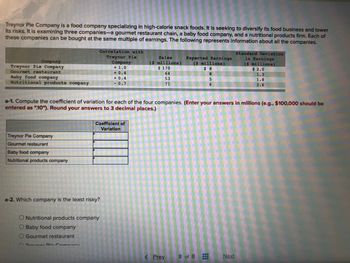

Transcribed Image Text:Treynor Pie Company is a food company specializing in high-calorie snack foods. It is seeking to diversify its food business and lower

its risks. It is examining three companies-a gourmet restaurant chain, a baby food company, and a nutritional products firm. Each of

these companies can be bought at the same multiple of earnings. The following represents information about all the companies.

Company

Treynor Pie Company

Gourmet restaurant

Baby food company

Nutritional products company

Treynor Pie Company

Gourmet restaurant

Baby food company

Nutritional products company

Correlation with

Treynor Pie

Company

+ 1.0

a-2. Which company is the least risky?

Traunar Din Company

+0.4

+0.4

-0.7

Coefficient of

Variation

O Nutritional products company

O Baby food company

O Gourmet restaurant

a-1. Compute the coefficient of variation for each of the four companies. (Enter your answers in millions (e.g., $100,000 should be

entered as "10"). Round your answers to 3 decimal places.)

Sales

$ millions

$ 170

64

53

71

Expected Earnings

($ millions)

< Prev.

$8

8

5

6

8 of 8

Standard Deviation

in Earnings

($ millions)

$ 2.0

1.3

1.8

3.6

Next

14

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

it say all answers above are incorrect, please enter answers in millions

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

it say all answers above are incorrect, please enter answers in millions

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Lygon Food Distributors (LFD) hired a consultant to update its system for reporting the cost of customers. The consultant showed Anjana Malik, the owner of LFD, an analysis that indicates that customer support costs are significantly higher for customers who order on weekends than for those who order during the week. Required a. What pricing decisions might LFD make based on the consultant's information? b. Would these be ethical? Why or why not? c. The consultant comes back to Anjana's office and explains that he made a mistake in the analysis. The relation is actually between the cost of customer support and the customer's gender. Does this affect your answers to requirements (a.) and (b.)?arrow_forwardDurham Parts (DP) makes a variety of products. It is organized in two divisions, Eastern and Western. The managers for each division are paid, in part, based on the financial performance of their divisions. The Western Division normally sells to outside customers but. on occasion, also sells to the Eastern Division. When it does, corporate policy states that the price must be cost plus 25 percent to ensure a "fair" return to the selling division. Western received an order from Eastern for 1,200 units. Western's planned output for the year had been 4,800 units before Eastern's order. Western's capacity is 6,000 units per year. The costs for producing those 4,800 units follow Materials Direct labor Other costs varying with output Fixed costs (do not vary with output) Totals Total $ 240,000 115,200 76,800 288,000 $ 720,000 Per Unit $ 50 24 16 60 $ 150 Required: a. If you are the manager of the Western Division, what unit cost would you ask the Eastern Division to pay? b. If you are the…arrow_forwardUsing This Information, Prepare a Contribution Income Statement For Fashionisto.arrow_forward

- Google Inc. is a technology company specializing in Internet-related products and services, including its famous web search engine. Whirlpool Corp. manufactures home appliances including laundry appliances, refrigerators, and dishwashers. Google has a market - to - book ratio of 3.8. Based on your knowledge of the industries in which these two companies compete, and the determinants of the M/B ratio, would you estimate that Whirlpool's market-to - book ratio is O A. less than Google's M/B ratio of 3.8 O B. approximately equal to Google's M/B ratio of 3.8 O C. greater than Google's M/B ratio of 3.8arrow_forwardHazlett & Family is organized into two geographic markets Northern and Southern. The company makes an off-road vehicle for recreation and agricultural use. The vehicle is sold in three models, depending on the power and options. The three models, from least expensive to most expensive, are the H-L, H-LX, and H-LXS. The company's financial staff has prepared the following forecasted income statement for the upcoming fiscal year (in thousands of dollars): Sales revenue Cost of goods sold Gross margin Marketing costs Administrative costs Total marketing and administrative Operating profits Management has expressed special concern with the Southern market because of the extremely poor return on sales. This market was entered a year ago because it seemed like the best opportunity for growth. Hazlett & Family knew that it would take some time to build profitability in the market, but there has been no noticeable change in the low returns over time. H-L H-LX H-LXS The financial staff has also…arrow_forwardDarden Restaurants, Inc. (DRI) is the largest full-service restaurant company in the world. It operates over 2,200 restaurants under a variety of brand names, including Olive Garden, Bahama Breeze, and LongHom Steakhouse. Panera Bread Company (PNRA) operates over 1,800 bakery-cafe locations across North America. It is one of the Largest fcxxl service companies in the United States. The cost of food, beverage, and packaging and the beginning and ending inventory balances from recent annual reports for Darden and Panera are as follows (in millions): a. Compute the inventory turnover for both companies. Round calculations to one decimal place.b. Compute the number of days' sales in inventory for Ixith companies. Round calculations to one decimal place.C. Which company is more efficient in managing inventory?d. What might explain the difference in the inventory management efficiency of the two companies?arrow_forward

- Allocate the corporate costs to each region and calculate the income of each region after assigning corporate costs.arrow_forwardWonkies, Inc. is a large company that owns fast-food restaurants, has a soft drink division, and a snack division. Wonkies, Inc. corporate management gives its division managers considerable operating and investment autonomy in running their divisions. Wonkies, Inc. is considering how it should compensate Mark Hamm, the general manager of the snack division. ■ Proposal 1 calls for paying Hamm a fixed salary. ■ Proposal 2 calls for paying Hamm no salary and compensating him only on the basis of the division’s RI, calculated based on operating income before any bonus payments. ■ Proposal 3 calls for paying Hamm some salary and some bonus based on RI. Q. Wonkies, Inc. competes against Galaxy Industries in the snack business. Galaxy is approximately the same size as the Wonkies snack division and operates in a business environment that is similar to Wonkies. The top management of Wonkies, Inc. is considering evaluating Hamm on the basis of his snack division’s RI minus Galaxy’s RI. Hamm…arrow_forwardEllis Island Tropical Tea, launched by entrepreneur Nailah Ellis-Brown as described in this chapter’s opener, makes Jamaican sweet tea from all-natural ingredients. Required 1. Identify at least two fixed costs that do not change regardless of how much tea Nailah’s company sells. 2. Ellis Island Tropical Tea is growing. How could overly optimistic sales estimates hurt Nailah’s business? 3. Explain how cost-volume-profit analysis can help Nailah manage her company.arrow_forward

- visnoarrow_forwardAnalyze El Pollo Loco Holdings, Inc. El Pollo Loco Holdings, Inc. (LOCO), Spanish for “The Crazy Chicken,” operates almost 500 restaurants, approximately 40% of which are company-owned and the rest are franchises. El Pollo Loco combines the culinary traditions of Mexico and California, creating unique menu items such as their signature Chicken Avocado Burrito. The company aims to improve profitability, in part, by simplifying operations to make it easier for employees and franchisees to run the restaurants. Recent data (in millions) for company-operated and franchised restaurants are as follows: Line Item Description Company-Operated Franchised Revenues $374 $29 Operating income 62 1 Invested assets 79 2 a. Determine the profit margin for each segment. Round to one decimal place. Line Item Description Profit margin Company-Operated fill in the blank 1% Franchised fill in the blank 2% b. Determine the investment turnover for each segment. Round to two decimal…arrow_forwardPlease help mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education