FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

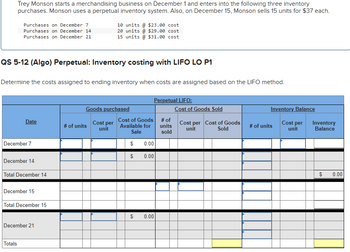

Transcribed Image Text:Trey Monson starts a merchandising business on December 1 and enters into the following three inventory

purchases. Monson uses a perpetual inventory system. Also, on December 15, Monson sells 15 units for $37 each.

Purchases on December 7

Purchases on December 14

Purchases on December 21

QS 5-12 (Algo) Perpetual: Inventory costing with LIFO LO P1

Determine the costs assigned to ending inventory when costs are assigned based on the LIFO method.

Date

December 7

December 14

Total December 14

December 15

Totals

Total December 15

December 21

10 units @ $23.00 cost

20 units @ $29.00 cost

15 units @ $31.00 cost

Goods purchased

# of units

Cost per

unit

Cost of Goods

Available for

Sale

69

$

69

$

Perpetual LIFO:

0.00

0.00

0.00

# of

units

sold

Cost of Goods Sold

Cost per Cost of Goods

unit

Sold

Inventory Balance

Cost per

unit

# of units

Inventory

Balance

$

0.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Monson uses a perpetual inventory system. Also, on December 15, Monson sells 15 units for $34 each. Purchases on December 7 Purchases on December 14 10 units @ $20.00 cost 20 units @ $26.00 cost Purchases on December 21 15 units @ $28.00 cost Determine the costs assigned to ending inventory when costs are assigned based on the LIFO method.arrow_forwardplease answer 4 and 5? answer are at the bottom what is the process to get these answersarrow_forwardDate Nov. 1 Nov. 10 Nov. 15 Nov. 20 November 1 Nov. 24 Nov. 30 10 15 20 24 30 15 X Inventory 27 units at $88 The business maintains a perpetual inventory system, costing by the first-in, first-out method. Sale a. Determine the cost of the goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 3. Under FIFO, if units are in inventory at two different costs, enter the units with the LOWER unit cost first in the Cost of Goods Sold Unit Cost column and in the Inventory Unit Cost column. Purchase Sale Sale Purchase 59 units at $81 48 units. 33 units at $84 17 units 18 units. Quantity Purchases Purchases Purchased Unit Cost Total Cost Cost of the Goods Sold Schedule First-in, First-out Method DVD Players Cost of Cost of Quantity Goods Sold Goods Sold Inventory Inventory Inventory Sold Unit Cost Total Cost Quantity Unit Cost Total Cost O UD 000 8 00 00arrow_forward

- Crane Company uses a perpetual inventory system and reports the following for the month of June. Date June 1 (a1) 12 23 30 June 1 June 12 June 15 June 23 Explanation Units Unit Cost Inventory Purchase June 27 Purchase Inventory $ $ $ eTextbook and Media 120 Save for Later 360 Calculate the weighted-average cost per unit, using a perpetual inventory system. Assume a sale of 400 units occurred on June 15 for a selling price of $9 and a sale of 50 units on June 27 for $10. (Round intermediate calculations to O decimal places, e.g. 152 and final answers to 3 decimal places, e.g. 5.125.) 170 200 $5 6 7 Total Cost $600 2,160 1,190 Attempts: 0 of 6 used Submit Answerarrow_forwardShow Me How Beginning inventory, purchases, and sales data for prepaid cell phones for December are as follows: Inventory Dec. 1 1,600 units at $33 Purchases Dec. 10 800 units at $35 20 720 units at $37 Sales Dec. 12 1,120 units 14 960 units 31 480 units a. Assuming that the perpetual inventory system is used, costing by the LIFO method, determine the cost of goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. Schedule of Cost of Goods Sold LIFO Method Prepaid Cell Phones Quantity Purchases Purchases Purchased Unit Cost Total Cost Cost of Quantity Goods Sold Goods Sold Sold Unit Cost Total Cost Cost of Inventory Quantity Inventory Unit Cost Inventory Total Cost Date Dec. 1 1,600 33 52,800 Dec. 10 800 35…arrow_forwardCarla Vista Lighting had a beginning inventory of 29 units at a cost of $7 per unit on August 1. During the month, the following purchases and sales were made. August 5 34 units at $8 August 11 44 units at $9 August 23 39 units at $10 Purchases 1. 2. Ending inventory Cost of goods sold $ Sales Carla Vista uses a periodic inventory system. Determine ending inventory and cost of goods sold under: 1. FIFO and 2. LIFO. $ August 2 August 10 August 19 August 21 24 units FIFO 29 units 59 units 29 units $ LIFOarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education