FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

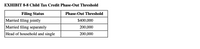

Transcribed Image Text:EXHIBIT 8-8 Child Tax Credit Phase-Out Threshold

Filing Status

Phase-Out Threshold

Married filing jointly

$400,000

Married filing separately

200,000

Head of household and single

200,000

Transcribed Image Text:Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his wife.

What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2021 for his

daughters under each of the following alternative situations? Use Exhibit 8-8.

a. His AGI is $103,100.

Amount of child tax credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Paola and Isidora are married; file a joint tax return; report modified AGI of $136,025; and have one dependent child, Dante. The couple paid $8,070 of tuition and $16,035 for room and board for Dante (a freshman). Dante is a full-time student and claimed as a dependent by Paola and Isidora. Determine the amount of the American Opportunity credit for 2023.arrow_forwardShonda and Andre adopted a child with special needs in a domestic adoption. They had $10,000 in adoption expenses in 2021, and the adoption was finalized on December 15, 2021. How much can they claim in 2021arrow_forwardAriana and John, who file a joint return, have two dependent children, Kai and Angel. Kai is a freshman at State University and Angel is working on her graduate degree. The couple paid qualified expenses of $4,010 for Kai (who is a half-time student) and $8,020 for Angel. Required: a. What education tax credits are available if Ariana and John report modified AGI of $173,920? b. What education tax credits are available if Ariana and John report modified AGI of $173,920 and Angel is taking one class a semester (is less than a half-time student) and not taking classes in a degree program? Complete this question by entering your answer in the tabs below. Required a Required b What education tax credits are available if Ariana and John report modified AGI of $173,920? (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) Type of Credit Dependent Kai Angel Total Amount of Credit $ 0arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his spouse. What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2023 for his daughters under each of the following alternative situations? Use Exhibit 8-8. c. His AGI is $420,500, and his daughters are ages 10 and 12. Amount of child tax creditarrow_forwardBenjamin is a taxpayer who qualifies because he has the following dependents: 17-year-old child 15-year-old child 67-year-old mother What is the max number of the child tax credit that Benjamin will receive in 2021?arrow_forwardJillian and Greg are married and file a joint return. They expect to have $420,000 of taxable income in the next year and are considering whether to purchase a personal residence that would provide additional tax deductions of $126,000 for mortgage interest and real estate taxes. View the 2022 tax rate schedule for the Married Filing Joint filing status. Read the requirements. the divi: (Lintas as pervomayed in the tuitial plaut.) What is the marginal tax rate if the personal residence is not purchased? What is the marginal tax rate if the personal residence is purchased? Tax without purchase of personal residence Tax with purchase of personal residence Tax savings 32 % Requirement b. What is the tax savings if the residence is acquired? (Do not round intermediary calculations. Only round the amounts you input in the cells to the nearest cent.) 83,283.50 54,832 28,451.50 24 % eens 10...3 eensh 10...0 eensh 10...1 Parrow_forward

- Required information [The following information applies to the questions displayed below.] Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his spouse. What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2023 for his daughters under each of the following alternative situations? Use Exhibit 8-8. c. His AGI is $420,600, and his daughters are ages 10 and 12. Amount of child tax creditarrow_forward2arrow_forwardTrey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his wife. What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2021 for his daughters under each of the following alternative situations? Use Exhibit 8-8. b. His AGI is $421,200.arrow_forward

- Brian and Kim have a 12-year-old child, Stan. For 2018, Brian and Kim have taxable income of $52,000, and Stan has interest income of $4,500. Click here to access the income tax rate schedules. If Stan’s parents elected to report Stan’s income on his parents’ return, what would the tax on Stan’s income be?$arrow_forward5 people are possible dependents for Gerald’s tax return, but only 3 qualify. Who are those 3?arrow_forwardIn 2021, Lisa and Fred, a married couple, had taxable income of $305,200. If they were to file separate tax returns, Lisa would have reported taxable income of $126,700 and Fred would have reported taxable income of $178,500. Use Tax Rate Schedule for reference. What is the couple’s marriage penalty or benefit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education