FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Required

Using the information contained in the original financial statements, prepare corrected

statements, including a statement of changes in equity, for the month of May

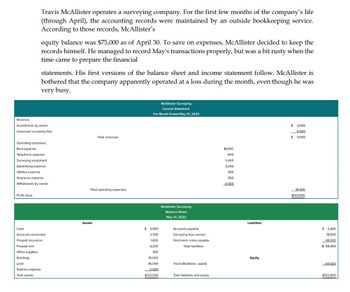

Transcribed Image Text:Travis McAllister operates a surveying company. For the first few months of the company's life

(through April), the accounting records were maintained by an outside bookkeeping service.

According to those records, McAllister's

equity balance was $75,000 as of April 30. To save on expenses, McAllister decided to keep the

records himself. He managed to record May's transactions properly, but was a bit rusty when the

time came to prepare the financial

statements. His first versions of the balance sheet and income statement follow. McAllister is

bothered that the company apparently operated at a loss during the month, even though he was

very busy.

Revenue:

Investments by owner

Unearned surveying fees

Profit (loss)

Operating expenses:

Rent expense

Telephone expense

Surveying equipment

Advertising expense

Utilities expense

Insurance expense

Withdrawals by owner

Cash

Accounts receivable

Prepaid insurance

Prepaid rent

Office supplies

Buildings

Land

Salaries expense

Total assets

Total revenues

Total operating expenses

Assets

McAllister Surveying

Income Statement

For Month Ended May 31, 2023

$3,900

2,700

1,800

4,200

300

81,000

36,000

3,000

$132,900

McAllister Surveying

Balance Sheet

May 31, 2023

Accounts payable

Surveying fees earned

Short-term notes payable

Total liabilities

Travis McAllister, capital

Total liabilities and equity

$3,100

600

5,400

3,200

300

900

6.000

Liabilities

Equity

$3,000

6,000

$ 9,000

19,500

$(10,500)

$ 2,400

18,000

48,000

$68,400

64,500

$132,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please check my work For journal entries 1 through 12, indicate the explanation that most closely describes it. You can use explanations more than once. To record receipt of unearned revenue. To record this period's earning of prior unearned revenue. To record payment of an accrued expense. To record receipt of an accrued revenue. To record an accrued expense. To record an accrued revenue. To record this period's use of a prepaid expense. To record payment of a prepaid expense. To record this period's depreciation expense.arrow_forwardWhy are transactions recorded in the journal? Group of answer choices To ensure that total debit equal total credits To help prepare the financial statements To ensure that all transactions are posted to the ledger To have a chronological record of all transactionsarrow_forwardWrite a journal entry for the following beginning balance: “accounts receivable (net of allowance of 5200) 235,884"arrow_forward

- Please analyze, assess, and synthesize the Annual Report or Form 10-K or Form 20 - F (whatever they call it in that jurisdiction) of the company you choose. You can usually find it on the Company's website in Investor R. Introduction 2. Industry situation and company plans A. Management Letter B. B. Review Company's Products and Services 3. Financial Statements A. Income Statement B. Cash Flow Statement C. Balance Sheet D. Accounting Policies 4. Financial Analysis & Ratio A. Financial Analysis B. Ratio C. Market Indicator Financial Ratios 5. References 6. Complete Calcuation of Part 4 in excelLimiarrow_forwardFor the purpose of process analysis, which of the following measures would be considered an appropriate flow unit for analyzing the main operation of a local accountingfirm? Instructions: You may select more than one answer.a. Number of accountants working each weekb. Number of tax returns completed each weekc. Number of customers with past-due invoicesd. Number of reams of paper received from suppliersarrow_forwardEvaluate the company’s latest annual financial statements (balance sheet, income statement, and cash flow statement) and comment on the company's financial performance and position. In your response, use the requirements of IAS 1 as a guide.b) Identify and discuss key accounting principles and standards applied in the company’s financial reporting process indicating their reasons for choosing these and how they were applied. Comment briefly on the appropriateness of the choices made given the company’s industry, location and type (e.g. MNC, regional conglomerate, etc.)c) Critically analyze any significant accounting policies and estimates disclosed in the notes to the financial statements. In your answer, indicate whether the company complied with the accounting standards and conventions.arrow_forward

- QUESTION 2 Study the following transactions that occurred during August 2022 for Renwick & Co. Aug 2 - Renwick & Co. sold 40 office desks costing $2,000 each, at a unit price of $4,500 to Shams Ltd. Terms: 2/10, n/30. Aug 7- Shams Ltd. Returned for full credit 6 of the desks acquired on August 2 because they were of the incorrect size and style. Aug 8 - Renwick & Co. returned the office desks to its inventory. Aug 9 - Renwick & Co. received payment by cheque from Shams Ltd. for 30 office desks. Aug 27 - Renwick & Co. received payment in cash from Shams Ltd. in full settlement for the remaining office desks acquired on August 2. Renwick & Co. uses the net method to record sales and cash discounts and the perpetual inventory system. You may copy and paste from this list: Accounts receivable Discount Interest income Bad debt expense Bank Cash Cost of Goods Sold COGS REQUIRED: Interest receivable Inventory Notes receivable Par Premium Sales discounts Sales discounts forfeited Sales returns…arrow_forwardWhich of the following does not accurately describe a requirement that a company must fulfill when adopting IFRS for the first time? 14 Multiple Choicearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education