Concept explainers

Allison Corporation acquired 90 percent of Bretton on January 1, 2016. Of Bretton’s total acquisition-date fair value, $60,000 was allocated to undervalued equipment (with a 10-year remaining life) and $80,000 was attributed to franchises (to be written off over a 20-year period).

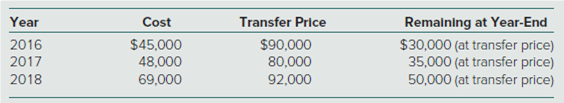

Since the takeover, Bretton has transferred inventory to its parent as follows:

On January 1, 2017, Allison sold Bretton a building for $50,000 that had originally cost $70,000 but had only a $30,000 book value at the date of transfer. The building is estimated to have a five-year remaining life (straight-line

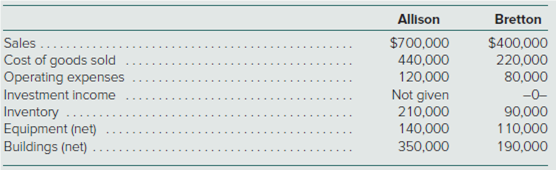

Selected figures from the December 31, 2018,

Determine consolidated totals for each of these account balances.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

- Allison Corporation acquired 90 percent of Bretton on January 1, 2022. Of Bretton's total acquisition-date fair value, $65,100 was allocated to undervalued equipment (with a 10-year remaining life) and $86,800 was attributed to franchises (to be written off over a 20-year period). Since the takeover, Bretton has transferred inventory to its parent as follows: Remaining at Year- Year Cost Transfer Price End (at transfer 2022 2023 $50,100 53,100 75,375 price) $33,400 2024 $100,200 88,500 100,500 39,165 51,700 On January 1, 2023, Allison sold Bretton a building for $67,000 that had originally cost $93,800 but had only a $40,200 book value at the date of transfer. The building is estimated to have a five-year remaining life (straight-line depreciation is used with no salvage value). Selected figures from the December 31, 2024, trial balance of these two companies are as follows: Sales Allison $729,750 Bretton $417,000 Cost of Goods Sold 458,700 229,350 Operating Expenses 125,100 83,400…arrow_forwardThe DeBlois Family Co. acquired 40% of Orange Beach Co. with a $500,000 payment on January 1, 2023. The equivalent net book value (40% share) of Orange Beach on the date of acquisition was $425,000. $50,000 of the excess payment was attributable to equipment with a 10-year remaining life. The remainder of the excess payment was not attributable to any identifiable item. Orange Beach Co. Reported net income of $40,000 in 2023. No dividends were paid out. On January 1, 2024, DeBlois Family Co. Acquired an additional 50% ownership share in Orange Beach Co. With a cash payment of $700,000. The fair value of the noncontrolling interest was determined to be $140,000 on the date of acquisition. The total fair value of Orange Beach's identifiable assets and liabilities on January 1, 2024, was $1,000,000. The trading value of stock shares remained the same as acquisition date prices for several months after January 1, 2024. What amount should be reported as consolidated goodwill on January 1,…arrow_forwardOn January 1, 2022, P Company purchased 64,000 shares of the 80,000 outstanding shares of S Company at a price of P1,200,000, with an excess of P30,000 over the book value of S Company's net assets. P13,000 of the excess is attributed to an undervalued equipment with a remaining useful life of eight years from the date of acquisition and the rest of the amount is attributed to goodwill. For the year 2022, P Company reported a net income of P750,000 and paid dividends of P180,000, while S Company reported a net income of P240,000 and paid dividends to P Company amounting to P39,000. The retained earnings of P Company at the end of 2022 per books is P1,025,000. P Company uses the cost method to account for its investment in S Company and elected to measure non-controlling interest at fair value on date of acquisition. How much is the consolidated net income attributable to controlling interests?arrow_forward

- On January 2, 2014, Prunce Company acquired 90% of the outstanding common stock of Sun Company for $180,700 cash. Just before the acquisition, the balance sheets of the two companies were as follows: Prunce Sun Cash $282,130 $ 59,040 Accounts receivable (net) 142,020 24,810 Inventory 118,670 53,230 Plant and equipment (net) 395,640 92,960 Land 62,550 29,220 Total asset $1,001,010 $259,260 Accounts payable $106,440 $ 50,420 Mortgage payable 67,320 37,660 Common stock, $2 par value 421,400 76,960 Other contributed capital 217,440 21,970 Retained earnings 188,410 72,250 Total equities $1,001,010 $259,260 The fair values of Sun Company’s assets and liabilities are equal to their book values with the exception of land. (a) Your answer is correct. Prepare a journal entry to record the purchase of Sun Company’s common stock.…arrow_forwardIn examining the feasibility of an enterprise of egg laying hens (chickens), you discover that while the chickens can live successfully on pasture, if you give them a feed of barley, sunflower seeds and maize, you will increase the egg production per unit of time. a) Since your goal is to maximize the profitability of the enterprise, what do you have to consider? b)On a per hen-basis what things would you need to consider to make the determination? c) Why would the price at which you sell the eggs matter? Because you need to get the gross margin per egg produced of both production schemes.arrow_forwardGiant acquired all of Small’s common stock on January 1, 2017, in exchange for cash of $770,000. On that day, Small reported common stock of $170,000 and retained earnings of $400,000. At the acquisition date, $32,500 of the fair-value price was attributed to undervalued land while $95,500 was assigned to undervalued equipment having a 10-year remaining life. The $72,000 unallocated portion of the acquisition-date excess fair value over book value was viewed as goodwill. Over the next few years, Giant applied the equity method to the recording of this investment. The following are individual financial statements for the year ending December 31, 2021. On that date, Small owes Giant $11,900. Small declared and paid dividends in the same period. Credits are indicated by parentheses. Giant Small Revenues $ (1,183,550 ) $ (462,500 ) Cost of goods sold 583,000 98,500 Depreciation expense 187,000 148,000 Equity in income of Small (206,450 ) 0…arrow_forward

- On January 1, 2017, Palka, Inc., acquired 70 percent of the outstanding shares of Sellinger Company for $1,666,000 in cash. The price paid was proportionate to Sellinger’s total fair value, although at the acquisition date, Sellinger had a total book value of $2,070,000. All assets acquired and liabilities assumed had fair values equal to book values except for a patent (six-year remaining life) that was undervalued on Sellinger’s accounting records by $300,000. On January 1, 2018, Palka acquired an additional 25 percent common stock equity interest in Sellinger Company for $656,250 in cash. On its internal records, Palka uses the equity method to account for its shares of Sellinger. During the two years following the acquisition, Sellinger reported the following net income and dividends: 2017 2018 $525,000 $701,000 Net…arrow_forwardPerke Corporation purchased 80% of the stock of Superstition Company for $1,970,000 on January 1, 2012. On this date, the fair value of the assets and liabilities of Superstition Company was equal to their book value except for the inventory and equipment accounts. The inventory had a fair value of $725,000 and a book value of $600,000. Sixty percent of Superstition Company's inventory was sold in 2012; the remainder was sold in 2013. The equipment had a book value of $900,000 and a fair value of $1,075,000. The remaining useful life of the equipment is seven years. The balances in Superstition Company's capital stock and retained earnings accounts on the date of acquisition were $1,200,000 and $600,000, respectively. Perke uses the complete equity method to account for its investment in Superstition. The following financial data are from Superstition Company's records. Net income: (2012) $750,000; (2013) $900,000 Dividends declared: (2012) $150,000; (2013) $225,000 Required: c.…arrow_forwardHouse Corporation has been operating profitably since its creation in 1960. At the beginning of 2016, House acquired a 70 percent ownership in Wilson Company. At the acquisition date, House prepared the following fair-value allocation schedule: Consideration transferred for 70% interest in Wilson $ 707,000 Fair value of the 30% noncontrolling interest 303,000 Wilson business fair value $ 1,010,000 Wilson book value 790,000 Excess fair value over book value $ 220,000 Assignments to adjust Wilson’s assets to fair value: To buildings (20-year remaining life) $ 60,000 To equipment (4-year remaining life) (20,000 ) To franchises (10-year remaining life) 40,000 80,000 To goodwill (indefinite life) $ 140,000 House regularly buys inventory from Wilson at a markup of 25 percent more than cost. House's purchases during 2016 and 2017 and related ending inventory…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education