FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:j. Received a cheque of RM200 for dividend

from Mayabank

k. Sold goods on credit to Chong Enterprise of

RM800

1. A debtor Chong Enterprise paid the debt by

cheque

m. Paid salaries RM4,000 by cash

n. Received goods by Chong Enterprise a

debtor due to damage worth of RM50

o. Received loan of RM4,000 from Bank

Combo

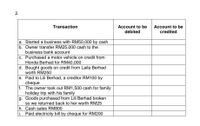

Transcribed Image Text:2.

Transaction

Account to be

Account to be

debited

credited

a. Started a business with RM50,000 by cash

b. Owner transfer RM25,000 cash to the

business bank account

c. Purchased a motor vehicle on credit from

Honda Berhad for RM40,000

d. Bought goods on credit from Laila Berhad

worth RM250

e. Paid to Lili Berhad, a creditor RM100 by

cheque

f. The owner took out RM1,500 cash for family

holiday trip with his family

g. Goods purchased from Lili Berhad broken

so we returned back to her worth RM25

h. Cash sales RM800

Paid electricity bill by cheque for RM200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QUESTION TWO Enter the following transactions in the accounts of R.Sampa,balance off the accounts and extract the Trial Balance: 2022 Nov 1 Started in business with K15,000 in the bank. 3 Bought goods on credit from: J Small K290; F Brown K1,200; T Rae K610; R Charles K530. 5 Cash sales K610. == 6 Paid rent by cheque K175. 7 Paid business rates by cheque K130. 11 Sold goods on credit to: T Potts K85; J Field K48; T Gray K1,640. == == 17 Paid wages by cash K290. 18 We returned goods to: J Small K18; R Charles K27 19 Bought goods on credit from: R Charles K110; T Rae K320; F Jack K165. == == 20 Goods were returned to us by: J Field K6; T Potts K14. 21 Bought van on credit from Turnkey Motors K4,950. 23 We paid the following by cheque: J Small K272; F Brown K1,200; T Rae K500. == == 25 Bought another van, paying by cheque immediately K6,200. 26 Received a loan of K750 cash from B. Bennet. 28 Received cheques from: T Potts K71; J Field K42. 30 Proprietor brings a further K900 into the…arrow_forwardAccount for the following transactions using T accounts: Sell goods for 90,000£ on credit Receive a cash payment of 50,000£ from the credit customer The business grants a discount of 5,000£ to the credit customer for early repayment Buy a car for 25,000 in cash Pay wages for 8,000£ Open a bank loan for 5,000£, receive the proceeds in cash Identify each transaction by its number. For each account, indicate what type of account this is (i.e. Current Assets, Non-current liabilities, etc.).arrow_forwardTravel Planners, Incorporated borrowed $5,000 from First State Bank and signed a promissory note. What entry should Travel Planners record when the note is repaid?arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education