ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

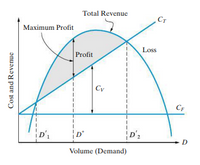

based on the figure below, explain how a profit would possibly occur.

Transcribed Image Text:Total Revenue

CT

Maximum Profit

Los

Profit

Cy

CF

D'1

D'2

D

Volume (Demand)

Cost and Revenue

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The following graph shows the supply of (orange curve) and demand for (blue curve) satellite navigation devices.arrow_forwardAmos McCoy is currently raising corn on his 100-acre farm and earning an accounting profit of $100 per acre. However, if he raised soybeans, he could earned an accounting profit of $200 per acre. Is he currently earning an economic profit?arrow_forwardUSE THE GRAPH TO ANSWER THE FOLLOWING QUESTIONS: (IF REQUIRED, USE THE DISCREET NUMBER OF BARRELS). ANSWERS IN WHOLE NUMBER a. How many barrels of natural-organic oil reflect the lowest minimum average variable cost?b. How much is the price of the natural-organic oil per barrel?c. How much is the fixed cost to produce the natural-organic oil?d. How many barrels of natural-organic oil should the firm produce to maximize its profit?e. At what production level would the marginal cost exceed the average cost?arrow_forward

- Explain what it means in terms of opportunity cost when Economic profits are positive?arrow_forwardFor the pizza seller whose marginal, average variable, and average total cost curves are shown in the graph below, what is the profit-maximizing level of output and how much profit will this producer earn if the price of pizza is $1.50 per slice?Instructions: In the graph below, label all three curves by clicking on the dropdown to select the appropriate label. Instructions: Enter your response as a whole number. If you are entering a negative number, be sure to include a negative sign (−). When the price is $1.50 per slice, the profit-maximizing level of output is slices per day. Instructions: Enter your response rounded to the nearest penny (two decimal places). At the profit-maximizing level of output, the producer's profit is: $ per day.arrow_forwardNews reports from the western United States occasionally report incidents of cattle ranchers slaughtering many newborn calves and burying them in mass graves rather than transporting them to markets. Assuming that this is rational behavior by profit-maximizing "firms," explain what economic factors may influence such behavior. Justify your answer.arrow_forward

- Can you explain the ( Compare the values ) part and how Q = 6.5 is profit maximized?arrow_forwardExplain what it means in terms of opportunity cost when Economic profits are zero?arrow_forwardIn a business where, fixed costs are very high (i.e. the production of a new Music CD, or the research and development of a new cancer drug) and the marginal costs are very low why can't price equal marginal cost?arrow_forward

- Hi, where is P comes from? In the question, it says profit = ei - ci, how does pi*ei makes sense?arrow_forwardEconomists define profit a bit differently than in accounting. In addition to explicit costs, we also subtract out implicit costs—what you could have earned from the next best alternative. For example, suppose that you are making $60,000 as an accountant. You decide to quit your job and open up your own accounting business. You end up making a profit of $50,000. How have you done? Accountants would call this a profit of $50,000 while economists would say that you just lost $10,000 (relative to what you were making before). So, economists define profits as being equal to total revenues minus total costs, where costs include the opportunity cost. Suppose that a firm had sales revenue of $1 million last year. It spent $600,000 on labor, $150,000 on capital, and $200,000 on materials. Calculate the firm’s accounting profit? If the firm’s factory sits on land owned by the firm that it could rent for $30,000 per year, calculate economic profits.arrow_forwardExplain why a company would shut down in the short run.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education