FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:**Special Order**

Total cost data follow for Glendale Manufacturing Company, which has a normal capacity per period of 8,000 units of product that sell for $60 each. For the foreseeable future, regular sales volume should continue to equal normal capacity.

| Cost Item | Amount ($) |

|------------------------------------|------------|

| Direct material | 100,000 |

| Direct labor | 61,600 |

| Variable manufacturing overhead | 46,000 |

| Fixed manufacturing overhead (Note 1) | 38,400 |

| Selling expense (Note 2) | 35,200 |

| Administrative expense (fixed) | 15,000 |

| **Total** | **296,200**|

**Notes:**

1. Beyond normal capacity, fixed overhead costs increase $1,800 for each 500 units or fraction thereof until a maximum capacity of 10,000 units is reached.

2. Selling expenses consist of a 6% sales commission and shipping costs of 80 cents per unit. Glendale pays only three-fourths of the regular sales commission on sales totaling 501 to 1,000 units and only two-thirds the regular commission on sales totaling 1,000 units or more.

Glendale's sales manager has received a special order for 1,200 units from a large discount chain at a price of $36 each, F.O.B. factory. The controller's office has furnished the following additional cost data related to the special order:

1. Changes in the product's design will reduce direct material costs by $1.50 per unit.

2. Special processing will add 20% to the per-unit direct labor costs.

3. Variable overhead will continue at the same proportion of direct labor costs.

4. Other costs should not be affected.

---

This information is designed to illustrate cost behaviors and decision-making processes in manufacturing settings. The provided data and notes give insight into how special orders impact cost structures and profitability. By understanding these nuances, students can better grasp the complexities of managerial accounting and operational planning.

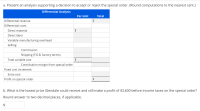

Transcribed Image Text:### Differential Analysis for Special Order Decision

**a. Present an analysis supporting a decision to accept or reject the special order.**

*(Round computations to the nearest cent.)*

| Differential Analysis | Per Unit | Total |

|--------------------------------------------|----------|-------|

| **Differential revenue** | | $ |

| | | |

| **Differential costs** | | |

| Direct material | $ | |

| Direct labor | | |

| Variable manufacturing overhead | | |

| **Selling:** | | |

| Commission | | |

| Shipping (F.O.B. factory terms) | | |

| **Total variable cost** | $ | |

| | | |

| Contribution margin from special order | $ | |

| | | |

| **Fixed cost increment:** | | |

| Extra cost | | |

| | | |

| **Profit on special order** | | $ |

**Explanation of Table:**

- **Differential revenue:** This is the additional revenue that would be generated if the special order is accepted.

- **Differential costs:** These are the additional costs incurred due to the special order. This includes direct material, direct labor, variable manufacturing overhead, and selling costs (e.g., commission and shipping under F.O.B. factory terms).

- **Total variable cost:** The sum of all differential costs per unit.

- **Contribution margin from special order:** This is the difference between the differential revenue and the total variable cost.

- **Fixed cost increment:** Any fixed costs that will increase as a result of accepting the special order.

- **Profit on special order:** The resultant profit after accounting for all additional revenue and costs associated with the special order.

**b. What is the lowest price Glendale could receive and still make a profit of $3,600 before income taxes on the special order?**

*Round answer to two decimal places, if applicable.*

$ _______________

---

This example illustrates how to conduct a differential analysis to determine the feasibility of accepting a special order. Filling in the actual figures will help in making an informed decision.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume the following information for a company that produced 10,000 units and sold 9,000 units during its first year of operations: Per Unit Per Year Selling price $ 200 Direct materials $ 69 Direct labor $ 50 Variable manufacturing overhead $ 12 Sales commission $ 8 Fixed manufacturing overhead $ 300,000 Using variable costing, what is the company's contribution margin? Multiple Choice • $549,000 • $423,000 • $351,000 • $621,000arrow_forwardThe following information relates to XYZ manufacturing for the first quarter of 2021: Fixed Cost MVR 50,000 Total Cost MVR 80,000 Total Revenues MVR 120,000 Number of units produced and sold during the period is 10000 units. Calculate: a) Break-even point in units b) Margin of safety in units and valuearrow_forwardSales price per unit. 51.00 Fixed costs (per month): Selling, general, and administrative (SG&A) 900,000 Manufacturing overhead 1,800,000 Variable costs (per unit): Direct labor 8.00 Direct materials 13.00 Manufacturing overhead 9.00 4.00 SG&A Number of units produced per month. 300,000 units Required: Compute the amounts for each of the following assuming that both production levels are within the relevant range. (Do not round intermediate calculations. Round your answers to 2 decimal places.) 300,000 units 400,000 units a. Prime cost per unit. b. Contribution margin per unit. C. Gross margin per unit. d. Conversion cost per unit. e. Variable cost per unit. f. Full absorption cost per unit. g. Variable production cost per unit. h. Full cost per unit. $arrow_forward

- Required information [The following information applies to the questions displayed below] Hudson Company reports the following contribution margin income statement. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (9,700 units at $280 each) Variable costs (9,700 units at $210 each) Contribution margin Fixed costs Income 1. Amount of sales 2. Margin of safety 1. Assume Hudson has a target income of $163,000. What amount of sales (in dollars) is needed to produce this target income? 2. If Hudson achieves its target income, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.) $ 2,716,000 2,037,000 679,000 441,000 $ 238,000 %arrow_forwardSales (17,500 units) $1,750,000 Production costs (23,000 units): Direct materials $851,000 Direct labor 409,400 Variable factory overhead 204,700 Fixed factory overhead 135,700 1,600,800 Selling and administrative expenses: Variable selling and administrative expenses $248,100 Fixed selling and administrative expenses 96,000 344,100 If required, round interim per-unit calculations to the nearest cent. *** I only need assistance with the ones that are blank. Could you also leave the steps on how to solve it, please? a. Prepare an income statement according to the absorption costing concept. Shawnee Motors Inc. Absorption Costing Income Statement For the Month Ended August 31 Sales $1750000 Cost of goods sold Gross profit $ Selling and administrative expenses 344100 Income from operations $ b. Prepare an income statement according to the variable costing concept. Shawnee Motors Inc.…arrow_forwardRequired information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (11,600 units at $225 each) Variable costs (11,600 units at $180 each) Contribution margin Fixed costs Income $ 2,610,000 2,088,000 522,000 315,000 $ 207,000 1. Assume Hudson has a target income of $150,000. What amount of sales (in dollars) is needed to produce this target income? 2. If Hudson achieves its target income, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.)arrow_forward

- Maxim Manufacturing operations for 2022 are as follows: Per unit: $ Sales price 50 Direct material cost 18 Direct wages 4 Variable production overhead 3 Per month: Fixed production overhead 99 000 Fixed selling expenses 14 000 Fixed administration expenses 26 000 Variable selling expenses is 10% of sales value. Normal capacity was 11 000 units per month. October 2022 November 2022 Units Units Sales 10 000…arrow_forwardSwisher, Incorporated reports the following annual cost data for its single product: Normal production level 30,000 units Direct materials $6.40 per unit Direct labor $3.93 per unit Variable overhead $5.80 per unit Fixed overhead $150,000 in total This product is normally sold for $48 per unit. If Swisher increases its production to 50,000 units, while sales remain at the current 30,000 unit level, by how much would the company's income increase or decrease under variable costing? $60,000 decrease. b. $90,000 decrease. c.There is no change in gross margin. d. $90,000 increase. e. $60,000 increase.arrow_forwardIsaac Company has estimated the following costs for this year for 240,000 units: Manufacturing Selling & Administrative Variable $150,000 $65,000 Fixed 350,000 135,000 Total $200,000 $500,000 Calculate the manufacturing cost markup needed to obtain a target profit of $100,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education