Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

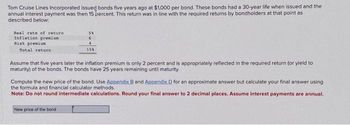

Transcribed Image Text:Tom Cruise Lines Incorporated issued bonds five years ago at $1,000 per bond. These bonds had a 30-year life when issued and the

annual interest payment was then 15 percent. This return was in line with the required returns by bondholders at that point as

described below:

Real rate of return

Inflation premium

Risk premium

Total return

58

6

4

158

Assume that five years later the inflation premium is only 2 percent and is appropriately reflected in the required return (or yield to

maturity) of the bonds. The bonds have 25 years remaining until maturity.

Compute the new price of the bond. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using

the formula and financial calculator methods.

Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. Assume interest payments are annual.

New price of the bond t

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- I would like to understand how to solve this in Excel. Hardware Inc. bonds are selling in the market for $960.45. These bonds carry a 9 percent coupon paid semiannually, and have 15 years remaining to maturity. What is the capital gain yield assuming that the interest rates will remain constant over the year?arrow_forwardFind the Macaulay duration and the modified duration of a 15-year, 7.5% corporate bond priced to yield 5.5%. According to the modified duration of this bond, how much of a price change would this bond incur if market yields rose to 6.5%? Using annual compounding, calculate the price of this bond in one year if rates do rise to 6.5%. How does this price change compare to that predicted by the modified duration? Explain the difference.arrow_forwardA company's 5-year bonds are yielding 8% per year. Treasury bonds with the same maturity are yielding 4.2% per year, and the real risk-free rate (r*) is 2.15%. The average inflation premium is 1.65%, and the maturity risk premium is estimated to be 0.1 × (t - 1)%, where t = number of years to maturity. If the liquidity premium is 0.4%, what is the default risk premium on the corporate bonds? Round your answer to two decimal places.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education