ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

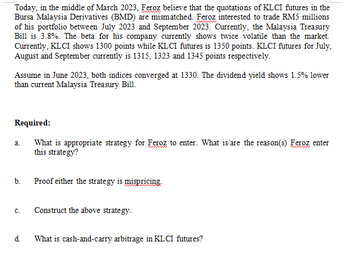

Transcribed Image Text:Today, in the middle of March 2023, Feroz believe that the quotations of KLCI futures in the

Bursa Malaysia Derivatives (BMD) are mismatched. Feroz interested to trade RM5 millions

of his portfolio between July 2023 and September 2023. Currently, the Malaysia Treasury

Bill is 3.8%. The beta for his company currently shows twice volatile than the market.

Currently, KL CI shows 1300 points while KL CI futures is 1350 points. KLCI futures for July,

August and September currently is 1315, 1323 and 1345 points respectively.

Assume in June 2023, both indices converged at 1330. The dividend yield shows 1.5% lower

than current Malaysia Treasury Bill.

Required:

What is appropriate strategy for Feroz to enter. What is/are the reason(s) Feroz enter

this strategy?

a.

b.

C.

d.

Proof either the strategy is mispricing.

Construct the above strategy.

What is cash-and-carry arbitrage in KL CI futures?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3) Unlike most money market securities, commercial paper A) in general, has a time to maturity that is longer than a year. B) is not generally traded in a secondary market. C) is not popular with most money market investors because of the high default risk. D) all of the above.arrow_forwardCurrently a three-month Treasury bill has a yield of 5% while the yield on a ten-year Treasury bond is 4.7%. What is the risk premium of an A-rated ten-year corporate bond with a yield of 5.5%? 0.5% 5.5% 0.8% 1.17%arrow_forwardQuestion 3 (6.5 points): Hedge October 15th: A producer plans to sell wheat in early July; currently, July wheat futures are trading at 680'6. The expected basis is $0.60 under. July 1 • Does the producer have a long or short cash position? Does the producer have a long or short futures position? To hedge: The producer will per bushel. What is the expected cash price? (buy/sell) July wheat futures at 680'6 ⚫ The producer must (buy/sell) wheat locally in the cash market at 562'2 per bushel. To offset their future position, they must. 599'4 per bushel. • What is the actual basis? • (buy/sell) July futures at 。 Was the basis stronger, weaker, or the same as expected? What is the realized price for the producer? Method 1: 。 Method 2: 。 The hedge resulted in a realized price ofarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education