FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

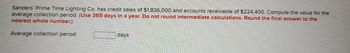

Transcribed Image Text:Sanders' Prime Time Lighting Co. has credit sales of $1,836,000 and accounts receivable of $224,400. Compute the value for the

average collection period. (Use 365 days in a year. Do not round intermediate calculations. Round the final answer to the

nearest whole number.)

Average collection period

days

Transcribed Image Text:Sanders' Prime Time Lighting Co. has credit sales of $1,836,000 and accounts receivable of $224,400. Compute the value for the

average collection period. (Use 365 days in a year. Do not round intermediate calculations. Round the final answer to the

nearest whole number.)

Average collection period

days

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Shannon's currently boasts a customer base of 1,750 customers that frequent the brewhouse on average twice per month and spend $30 per visit. Shannon 's current variable cost of goods sold is 50% of sales. The customer base is growing at the rate of 3% per month with a customer retention rate of 0.73%, based on data collected from its website and an analysis of credit card receipts. It's current cost of capital for borrowing and investing is about 12% per year. What is Shannon's approximate CLV for its average customer? Compute your answer to the nearest penny.arrow_forwardSoler Inc. wishes to speed up collection of its receivables. Soler currently offers credit terms of net 30. It is considering changing to terms of 2/10 net 20. The collection period is expected to be reduced from 40 to 25 days. The percentage of customers paying within the discount period is expected to be 60 percent. Bad debt losses average 6 percent of sales and are expected to decrease to 5 percent under the proposed policy. The inventory level is expected to increase by $300,000. Annual billings are $50 million. The variable cost ratio is 75 percent. The pretax return on funds made available by this change in policy is 6 percent. Assuming the change in terms is made; determine the net effect on Soler’s pretax profits.arrow_forwardDodge Ball Bearings had sales of 16,000 units at $50 per unit last year. The marketing manager projects a 35 percent increase in unit volume sales this year with a 10 percent price decrease (due to a price reduction by a competitor). Returned merchandise will represent 9 percent of total sales. What is your net dollar sales projection for this year? Net salesarrow_forward

- The Milton Company currently purchases an average of $18,000 per day in raw materials on credit terms of "net 25." The company expects sales to increase substantially next year and anticipates that its raw material purchases will increase to an average of $22,000 per day. Milton feels that it may need to finance part of this sales expansion by stretching accounts payable. Round your answers to the nearest dollar. Assuming that Milton currently waits until the end of the credit period to pay its raw material suppliers, what is its current level of trade credit? $ If Milton stretches its accounts payable an extra 5 days beyond the due date next year, how much additional short-term funds (that is, trade credit) will be generated? $arrow_forwardS Global Services is considering a promotional campaign that will increase annual credit sales by $450,000. The company will require investments in accounts receivable, inventory, and plant and equipment. The turnover for each is as follows: Accounts receivable Inventory Plant and equipment 2 6 1 All $450,000 of the sales will be collectible. However, collection costs will be 6 percent of sales, and production and selling costs will be 71 percent of sales. The cost to carry inventory will be 4 percent of inventory. Depreciation expense on plant and equipment will be 5 percent of plant and equipment. The tax rate is 30 percent. Accounts receivable Inventory a. Compute the investments in accounts receivable, inventory, and plant and equipment based on the turnover ratios. Add the three together. Plant and equipment Total Investment times times time b. Compute the accounts receivable collection costs and production and selling costs and add the two figures together. Collection cost…arrow_forwardPeanut Inc. is evaluating whether to change its credit terms from 2/10 net 30 to 3/10 net 30. At present, 50% of Peanut's sales are paid at day 10. Regardless of the credit terms, half of the customers who do not take the discount are expected to pay on day 30 whereas the remainder will pay 15 days late (no bad debts exist). But as a result of the higher cash discount offered with the new terms, sales are expected to increase from 757,000 to 801,000 per year. Peanut's variable cost ratio is 75% and its cost of funds is 8.7%. All production costs are paid on the day of the sale. Should the change be made?arrow_forward

- The Boyd Corporation has annual credit sales of $2.8 million. Current expenses for the collection department are $38,000, bad debt losses are 1.6%, and the days sales outstanding is 30 days. The firm is considering easing its collection efforts such that collection expenses will be reduced to $23,000 per year. The change is expected to increase bad - debt losses to 2.6% and to increase the days sales outstanding to 45 days. In addition, sales are expected to increase to $2,825,000 per year. Suppose that the opportunity cost of funds is 18%, the variable cost ratio is 65%, and taxes are 40%. Assuming a 365-day year, calculate the cost of carrying receivables under the current policy and the new policy. Enter your answers as positive values. Do not round intermediate calculations. Round your answers to the nearest dollar.arrow_forwardCurrently, OET Corporation sells 350,000 units of widgets a month at a price of $21 a unit. The company currently has a net 30 credit policy. Mr. Ent, the company's financial manager, is evaluating a new credit policy of net 60 for the company. The marketing manager thinks that sales would increase by 10,000 units per month if the company were to switch to the new credit policy. The APR for OET is 13% compounded monthly, and its variable cost per widget is $12. Ignore taxes. Tomorrow, Mr. Ent will be making a presentation on the new proposed credit policy to the CEO of OET. He will be expected to provide answers to the following questions. The net present value of the proposed credit policy switch is O a. $837,692.31 O b. $437,295.90 O $783.926.13 O d. $592,032.32 O. e. $639,284.55arrow_forwardLast year, the sales of OSP Inc. Amounted to R5 million and its most recent statement of financial position revealed trade receivables of R822 000. All sales were on 30 days’ credit to customers. In order to encourage customers to pay in time, the management accountant of OSR Inc has proposed introducing an early settlement discount of 1% for payment within 30 days, while increasing its normal credit period to 45 days. It is expected that, on average, 60% of customers will take the discount and pay within 30 days. 30% of the customers will pay after 45 days, and the rest of the customers will not change their current paying behaviour, OSP Inc. Is charge interest of 12% per annum on its overdraft facility Required: Determine the net benefit (cost) of the proposed changes in trade receivables policy A. Net cost of approximately R7 000 B. Net benefit of approximately R 13000 C. Net cost of approximately R 13 000 D. Net benefit of approximately R 7 000arrow_forward

- Warren Motor Company sells $30 million of its products to wholesalers on terms of "net 30." Currently, the firm's average collection period is 48 days. In an effort to speed up the collection of receivables, Warren is considering offering a cash discount of 2 percent if customers pay their bills within 10 days. The firm expects 50 percent of it's customers to take the discount and it's average collection period to decline to 30 days. The firm's required pretax return (i.e. opportunity cost) on receivables investment is 16 percent. Determine the cost of the cash discounts to Warren. a. $300,000 b. $ 60,000 c. $ 40,000 d. $48,000arrow_forwardGlobal Services is considering a promotional campaign that will increase annual credit sales by $650,000. The company will require investments in accounts receivable, inventory, and plant and equipment. The turnover for each is as follows: Accounts receivable Inventory Plant and equipment 2 times 4 times 2 times All $650,000 of the sales will be collectible. However, collection costs will be 6 percent of sales, and production and selling costs will be 76 percent of sales. The cost to carry inventory will be 4 percent of inventory. Depreciation expense on plant and equipment will be 10 percent of plant and equipment. The tax rate is 35 percent. a. Compute the investments in accounts receivable, inventory, and plant and equipment based on the turnover ratios. Add the three together. Accounts receivable Inventory Plant and equipment Total Investmentarrow_forwardDodge Ball Bearings had sales of 14,000 units at $70 per unit last year. The marketing manager projects a 15 percent increase in unit volume sales this year with a 10 percent price decrease (due to a price reduction by a competitor). Returned merchandise will represent 10 percent of total sales. What is your net dollar sales projection for this year? Net salesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education