FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

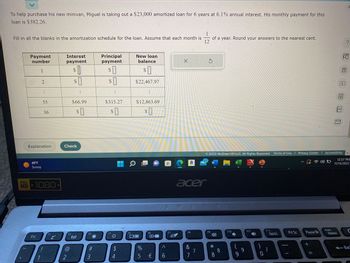

Transcribed Image Text:To help purchase his new minivan, Miguel is taking out a $23,000 amortized loan for 6 years at 6.1% annual interest. His monthly payment for this

loan is $382.26.

1

Fill in all the blanks in the amortization schedule for the loan. Assume that each month is of a year. Round your answers to the nearest cent.

12

FULL

HD

Payment

number

1

49°F

Sunny

2

Esc

⠀

Explanation

1

35

36

1080

F1

Z²

Interest

payment

2

$

F2

0

SO

$

Check

$66.99

$0

((1))

:

F3

#3

Principal

payment

$0

$0

$315.27

$0

F4

$

4

F5

New loan

balance

$1

$22,467.97

:

$12,863.69

$0

F6

%

5 €

▬▬

^

6

I

X

F7

a

S WL F

acer

F8

&

27

7

7

3

W

2022 McGraw Hill LLC. All Rights Reserved. Terms of Use | Privacy Center | Accessibility

F9

D

*

8

8

F10

X

9

9

PDF/

W& Est

F11

F12

NumLk

Prt Sc

Pause Br

+

//

181

Aa

Insert

Delete

La

E

12:57 PM

11/15/2022

Back

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- How much should Timothy's dad invest into a savings account today, to be able to pay for Timothy's rent for the next six years if rent is $850 payable at the beginning of each month? The savings account earns 3.50% compounded monthly. Round to the nearest centarrow_forwardLin took a loan of $10000 from Vancity credit union, the interest rate is 12% compounded monthly. Lin plans to pay off his loan in 10 years. What is the amount of interest in the 3rd payment? 111.25 $90.11 $99.13 $89.11arrow_forwardThe problem describes a debt to be amortized. (Round your answers to the nearest cent.)A man buys a house for $330,000. He makes a $150,000 down payment and amortizes the rest of the purchase price with semiannual payments over the next 10 years. The interest rate on the debt is 12%, compounded semiannually. (a) Find the size of each payment.$ (b) Find the total amount paid for the purchase.$ (c) Find the total interest paid over the life of the loan.arrow_forward

- The problem describes a debt to be amortized. (Round your answers to the nearest cent.) A man buys a house for $350,000. He makes a $150,000 down payment and amortizes the rest of the purchase price with semiannual payments over the next 5 years. The interest rate on the debt is 10%, compounded semiannually. (a) Find the size of each payment. $ (b) Find the total amount paid for the purchase. $ (c) Find the total interest paid over the life of the loan. $arrow_forward1) you open `on an Account to SAVE for downpayment house. The Account has an APR of 1.2% initial compounded quarterly. You plan to make an and quarterly deposits of $450." for 5 years. contributions? ^) After 5 years, what is the total of your What is the total interest earned? B) How much will $ i 7 year 7 2 years! 5 years $ you il D) If you $150,000 condo, want to make. conde, how of $450 would you e) suppose you if c) What would happen if you used a bank that offered APR of 1.15% Compounded daily? (still contributing have had more in the $450 quarterly) Would account after 5 YEARS # have in the Account after: you 甘 7 jist downpayment of 10% on a many, quarterly contributions have to make into the 1st Account? CD (5 years out 7% APR. Monthly) at were given A worth $5000, you combine the CD with the Account will you have enough for the 10% down payment in 5 years?arrow_forwardPlease show full steps along with concept.arrow_forward

- Ben Brown bought a home for \$225.000 . He put down 20\% The mortgage is at 6 1 2 \% 30 years . Using the formula or calculator , his monthly payment isarrow_forward5) George wants to purchase a new house that costs $185, 500. The terms of the sale are 10% down payment and the rest to be paid off at a 5.75% interest rate compounded monthly for 30 years. paying $974.28 for his monthly payment b.) how much will george pay in interest for the life of the loanarrow_forwardMario is buying a new car for $18,500. Compare the two loan offers by finding the monthly payments for each and calculating the total amount paid for each. Loan Options Down Payment Monthly Payment Total 5% down payment, 4.5% APR for 5 years 10% down payment, 3.5% APR for 4 yearsarrow_forward

- Noor is buying a home with a $200,000 mortgage using a 5.5 percent, 30-year loan. How much of the first month's payment will go toward the principal if the payment per $1000 on this loan is $5.6779? O a. $917 O b. $219 O c. $0 O d. $538arrow_forwardApril borrows $20000 at an interest rate of 7% to purchase a new automobile. At what rate (in dollars per year) must she pay back the loan, if the loan must be paid off in 5 years? (Use decimal notation. Give your answer to two decimal places.) withdrawal rate: $ per yeararrow_forwardThe problem describes a debt to be amortized. (Round your answers to the nearest cent.)A man buys a house for $330,000. He makes a $150,000 down payment and amortizes the rest of the purchase price with semiannual payments over the next 9 years. The interest rate on the debt is 10%, compounded semiannually. (a) Find the size of each payment.$ (b) Find the total amount paid for the purchase.$ (c) Find the total interest paid over the life of the loan.$arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education