Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

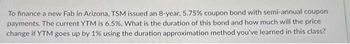

Transcribed Image Text:To finance a new Fab in Arizona, TSM issued an 8-year, 5.75% coupon bond with semi-annual coupon

payments. The current YTM is 6.5%. What is the duration of this bond and how much will the price

change if YTM goes up by 1% using the duration approximation method you've learned in this class?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- I need assistance with the following: Suppose you have bough the above zero-coupon bond, with value and duration equal to your obligation. Now suppose the rates immediately increase to 9%. What happens to your net position? How much is the tuition obligation? How much is the zero-coupon bond? How much is the net position?arrow_forwardproblems should be solved by using a financial calculator or MS excel spreadsheet. Accordingly, you must show the values of all relevant time valu of money variables Findlay company recently issued bonds with a 20-year maturity, a 7.5% semiannual coupon, and a par value of $1,000. The going interest rate (kd, rd) is 6.0%, based on semiannual compounding. What is the bond's price?arrow_forwardSuppose that you bought a 14% Drexler bond with time to maturity of 9 years for $1,379.75 (semiannual coupons, interest rate=8%). After another ½ year, you sold the bond. Assuming that the required rate of return remained at 8%, what would the selling price be? What is the rate of return from this investment? If the interest rate dropped by 25 basis points, what would the selling price be? What would the rate of return from this investment be?arrow_forward

- As a bond analyst at Morgan Stanley Investment Banking, you are performing an analysis on bond yield. You have the following data for a bond issued by Intel Corp. The bond has 7% coupon and 20-year maturity. The bond sells for $1,150 and is callable in 10 years at a call price of $1,250. The bond has a face value of $1000 and makes semiannual coupon payments.a. What is the annual Yield to Call? (sample answer: 12.45%)b. What is the annual Yield to Maturity? (sample answer: 12.45%) Give typing answer with explanation and conclusionarrow_forwardA risk-free 3-year annual coupon bond has a 5% coupon rate, a face value of $1,000, and trades for $950. The 1-year spot interest rate is 5%. The 2-year spot interest rate is 5.25%. The 3-year spot interest rate is 5.5%. What is your trading strategy? Please show your cash flowsarrow_forwardArco Industries has a bond outstanding with 15 years to maturity, an 8.25% nominal coupon, semiannual payments, and a $1,000 par value. The bond has a 7.20% yield to maturity, but it can be called in 6 years at a price of $1,045. What is the bond's yield to call? Hint: Calculate the bond's price based on the YTM, and then use that price to find the YTC. Your answer should be between 4.08 and 10.64, rounded to 2 decimal places, with no special characters.arrow_forward

- YOUR BANK is thinking to issue a regular coupon bond (debenture) with the following particulars: Maturity = 3 years, Coupon rate = 9%, Face value = $1,500, Coupon payments are annual and paid at the end of a year. In the fixed-income securities market, the yield curve for the bond similar to the one issued by YOUR BANK is flat and it is 7.500% per annum continuously compounded. As per you, what should be the issue (offer) price per bond of YOUR BANK in US dollars?arrow_forwardWhat is the price of a bond with the following information? It is 1.5 years until expiration. The coupon rate is 7 percent and coupon payments are made once per year. The market rate of return is 5.9 percent. The bond has a face value of 2000 SEK. Tips Draw a time axis so that you do not make any mistakes with the discounting. Don't look at the cash flows as an annuity, but as two separate cash flows. There is always a coupon payment when the bond matures, how long is it then until the next coupon payment? (Answers are rounded to integers) a) 265 b) 2100 c) 1971 d) 1990 e) 2216arrow_forwardA bond has a coupon rate of 5.2%, and 6.5 years until maturity. If the YTM is 6.2%, what is the price of this bond? TIP: Write the price as a percentage of the bonds par value. All bonds in this class make two coupon payments per year, and have a face value of $1,000. You don't need to write in the "%" sign.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education