Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Because simple interest is used on short-term notes, the time period is often given in days rather

than months or years. We convert this to years by dividing by 360, assuming a 360 day year called a

banker's year.

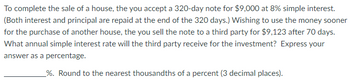

Transcribed Image Text:To complete the sale of a house, the you accept a 320-day note for $9,000 at 8% simple interest.

(Both interest and principal are repaid at the end of the 320 days.) Wishing to use the money sooner

for the purchase of another house, the you sell the note to a third party for $9,123 after 70 days.

What annual simple interest rate will the third party receive for the investment? Express your

answer as a percentage.

_%. Round to the nearest thousandths of a percent (3 decimal places).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- To attend school, Arianna deposits $190 at the end of every month for two and one-half years. What is the accumulated value of the deposits if interest is 4% compounded semi-annually? > The accumulated value is $arrow_forwardYou put $350 per month in an investment plan that pays an APR of 4.5%. How much money will you have after 21 years? Compare this amount to the total deposits made over the time period.arrow_forwardFind the amount due if $400 is borrowed for 14 months at 17% simple interest.Amount = $arrow_forward

- I have $30,000 to put into an account. Explain which account would be better for me to choose. Account A: pays 2% interest, compounded monthly, for 10 years. OR Account B: pays 3% interest, compounded quarterly, for 8 years.arrow_forwardUse PMT = . Round to the nearest dollar. Suppose that you borrow $10,000 for four years at 7% toward the purchase of a car. Find the monthly payments and the total interest for the loan. A.$281; $13,488 B.$239; $1472 C.$624; $19,952 D.$239; $11,472arrow_forwardIn April 2014, you could buy a 10-year U.S. Treasury note (“T-note,” a kind of bond) for $10,000 that pays 2.726% simple interest every year through April 4, 2024. How much total interest would it earn by then?$__________. Give your answer to the nearest whole number.arrow_forward

- The Cooper Foundation contributes $50,000 per year into an annuity fund for building a new zoo. The fund earns 4.5% interest. Find the amount in the fund at the end of 20 years. (Round your final answer to two decimal places.) $arrow_forwardwhat is the FV of the investment. Round to nearest cent. $7,000 for 4 years at 4.75% annual interestarrow_forwardA loan worth $5600 collect simple interest each year for 12 years. At the end of the time, a total of $7605 is paid back. Determine the APR for this loan.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,