EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

What is the firm's total liabilities?

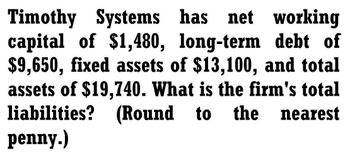

Transcribed Image Text:Timothy Systems has net working

capital of $1,480, long-term debt of

$9,650, fixed assets of $13,100, and total

assets of $19,740. What is the firm's total

liabilities? (Round to the nearest

penny.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Scare Train, Inc. has the following balance sheet statement items: current liabilities of $779,470; net fixed and other assets of $1,329,896; total assets of $3,237,746; and long-term debt of $621,991. What is the amount of the firm's net working capital?arrow_forwardCalculate the market Value.arrow_forwardI need Solutionarrow_forward

- Sunny firm has the following balance sheet statement items: total current liabilities of RM805,000; total assets of RM2,655,000; fixed and other assets of RM1,770,000; and long-term debt of RM200,000. What is the amount of the firm's total current assets?arrow_forwardWhat is the common size percentage for the net fixed assets?arrow_forwardA firm has total assets of $638,727, current assets of $203,015, current liabilities of $122,008, and total debt of $348,092. What is the debt-equity ratio? Can you provide the forumla?arrow_forward

- You find the following financial information about a company: net working capital = $7, 809; total assets $11,942; and long-term debt Multiple Choice $9, 115 $4, 507 $10, 339 $6, 129 $4, 133 = = = $1, 287; fixed assets $4,589. What is the company's total equity?arrow_forwardWhat is the value of the total assets?arrow_forwardA firm's current ratio is 1.7, and its quick ratio is 1.0. If its current liabilities are $11,500, what are its inventories?arrow_forward

- Thickburger's net fixed assets = $200,000, total assets = $400,000, inventory =$50,000 and current liabilities = $100,000. All assets are classified as beingeither "current assets" or "fixed assets". What is the firm's current ratio?b. What is Thickburger's quick ratio?arrow_forwardYou calculate that a firm has a total asset turnover of 0.12 and a profit margin of 0.92. If the firm reports that its ROE for the same time period is equal to 0.26, what must be the firms debt-to-equity ratio? Answer as a decimal (not percentage) to two decimal places.arrow_forwardAndyco, Inc., has the following balance sheet, WACC calculation? 1 and an equity market-to-book ratio of 1.7. Assuming the market value of debt equals its book value, what weights should it use for its The weight of debt for the WACC calculation is %. (Round to two decimal places.) The weight of equity for the WACC calculation is%. (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Liabilities & Equity Assets $1,020 Print Debt Equity Done $410 $610 — Xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning