FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

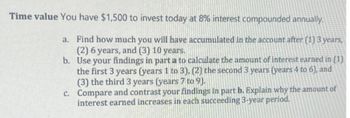

Transcribed Image Text:Time value You have $1,500 to invest today at 8% interest compounded annually.

a. Find how much you will have accumulated in the account after (1) 3 years,

(2) 6 years, and (3) 10 years.

b. Use your findings in part a to calculate the amount of interest earned in (1)

the first 3 years (years 1 to 3), (2) the second 3 years (years 4 to 6), and

(3) the third 3 years (years 7 to 9).

c. Compare and contrast your findings in part b. Explain why the amount of

interest earned increases in each succeeding 3-year period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 3. If you were to deposit $399.27 into an account today that pays 8% interest annually, with a payment of $100 at the end of each year, what would you be left with at the end of 5 years? in excelarrow_forwardSuppose that you invest $5,000 at 6% interest, compound quarterly, for 5 years. use Table 11-1 to calculate the compound interest (in $) on your investment.arrow_forwardFind the accumulated value of an investment of $10,000 for 3 years at an interest rate of 5.5% if the money is a. compounded semiannually; b. compounded quarterly; c. compounded monthly d. compounded continuously. Round answers to the nearest cent. a. What is the accumulated value if the money is compounded semiannually? (Round your answer to the nearest cent.)arrow_forward

- You are investing the following amounts at the end of each of the following three years. How much will this investment be worth at the end of the third year if your investment earns 5.4% compounded annually? Year Amount 1 $2,000 2 $4,000 3 $6,000arrow_forwardTo accumulate $7,500 in 9 years, a deposit of X is to be made today and a second deposit of X is to be made 2 years from now. At an effective annual interest rate of 3%, find the value of the deposit X.arrow_forwardCalculate the amount that must be invested at the end of each year at 9.3% compounded annually in order to accumulate $530,000 after: (Do not round intermediate calculations and round your final answers to 2 decimal places.) a. 25 years. $ b. 30 years. $ In each case, also determine what portion of the $530,000 represents earnings on the annual investments. (Round your intermediate calculations and final answers to 2 decimal places.) a. Earnings portion $ b. Earnings portion $arrow_forward

- Assume today is January 1 and you plan to invest $4,000 today in an account earning interest of 6% compounded semi-annually. You would like to calculate the amount your investment will grow to three years from now.Question: What should be the correct "n" and "i" to use for factor table purposes in order to answer your question?arrow_forwardYou deposit $400 in an account earning 8% coumpound interest for 2 years. Find the future value and the interest earned for each of the following compounding frequencies.arrow_forwardUse the formula for computing future value using compound interest to determine the value of an account at the end of 9 years if a principal amount of $18,000 is deposited in an account at an annual interest rate of 3% and the interest is compounded quarterly. Question content area bottom Part 1 The amount after 9 years will be $enter your response here. (Round to the nearest cent as needed.)arrow_forward

- Which investment will give you the higher future value in 5 years? Investment 1: You deposit $100 every month into an investment savings account that has an interest rate of 2.5% compounded daily. Investment 2: You deposit $300 every three months into an investment savings account that has an interest rate of 2.6% compounded semi-annually.arrow_forwardYou invest $500 in an account that earns $10 interest each year at each year a) at the end of 24months , what is the balance b) at the end of 30months, what is the balance c) at the end of 5years, what is the balance d) find the linear equation that gives the balance after t yearsarrow_forwardAssuming a 5% (0.05) interest rate, $500 invested today in a savings account today will be worth $525 in one year. What will that amount be in 2 and 3 years, and what is the total interest you will earn at the end of three years. Refer to the video in the information page for assistance in calculating simple interest. Year 2: $445.78 Year 3: $335.29 Total Interest: $98.75 Year 2: $551.25 Year 3: $578.81 Total Interest: $78.31 Year 2: $114.49 Year 3: $122.50 Total Interest: $22.50 Year 2: $222.70arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education