Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

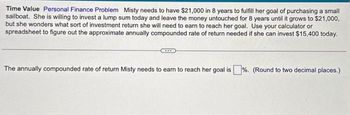

Transcribed Image Text:**Time Value - Personal Finance Problem**

Misty needs to have $21,000 in 8 years to fulfill her goal of purchasing a small sailboat. She is willing to invest a lump sum today and leave the money untouched for 8 years until it grows to $21,000, but she wonders what sort of investment return she will need to earn to reach her goal. Use your calculator or spreadsheet to figure out the approximate annually compounded rate of return needed if she can invest $15,400 today.

The annually compounded rate of return Misty needs to earn to reach her goal is _____%. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Time Value Personal Finance Problem Misty needs to have $16,000 in 8 years to fulfill her goal of purchasing a small sailboat. She is willing to invest a lump sum today and leave the money untouched for 8 years until it grows to $16,000 , but she wonders what sort of investment return she will need to earn to reach her goal. Use your calculator or spreadsheet to figure out the approximate annually compounded rate of retum needed if she can invest $11,500 today. The annually compounded rate of return Misty needs to earn to reach her goal is \%. (Round to two decimal piaces.)arrow_forward(Click on the into a spreadsheet.) Annuity B C Premium paid today $24.098.32 $22,274.30 $31,240.13 $30,150.95 Annual benefit $3,200 $4100 $4,000 $4,200 Life (years) 20 10 15arrow_forwardFuture value with periodic rates. Denise has her heart set on being a millionaire. She decides that at the end of every year, she will put away $4,800 into her "I want to be a millionaire account" at her local bank. She expects to earn 6.5% annually on her account. a. How many years must Denise faithfully put away her money to succeed at becoming a millionaire? b. If Denise switches to a monthly savings plan and puts one-twelfth of the $4,800 away each month ($400), how much will she have in 43 years at the 6.5% APR? c. Why is the future value under the monthly savings plan more than the $1,000,000 goal?arrow_forward

- Time to accumulate a given sum Personal Finance Problem Manuel Rios wishes to determine how long it will take an initial deposit of $7,000 to double. a. If Manuel earns 8% annual interest on the deposit, how long will it take for him to double his money? b. How long will it take if he earns only 5% annual interest? c. How long will it take if he can earn 10% annual interest? d. Reviewing your findings in parts a, b, and c, indicate what relationship exists between the interest rate and the amount of time it will take Manuel to double his money. a. If Manuel earns 8% annual interest, the amount of time to double his money is years. (Round to two decimal places.) Carrow_forwardSuppose Rachel and Nadia buy a house and have to take out a loan for $191000. If they qualify for an APR of 4.25% and choose a 30 year mortgage, we can find their monthly payment by using the PMT formula. If Rachel and Nadia decide to pay $1500 per month, we can use goal seek to see how many years it will take to pay off the loan. Use the PMT function and goal seek (as needed) to answer the following questions about Rachel and Nadia's mortgage. a. What is their monthly payment on the 30 year loan? $ b. If they qualify for the same APR on a 15 year loan, what will the new monthly payment be? $ c. If Rachel and Nadia have monthly payments of $1500 each month, how long will it take for them to pay off their loan? years d. If they want to have monthly payments of $650 and still pay the loan off in 30 years, what interest rate would they have to qualify for? %arrow_forwardWITH SOLUTION PLS Suppose you make an annual contribution of P8,698 each year to a college fund for a niece. He is 6 years now, and you will start next year and make the last deposit when he is 18. The fund is a money market account earning 5.29% per year. What will it be worth immediately after the last deposit?arrow_forward

- Margaret has an investment opportunity where she can receive cashflows as follows 1. $1,000 end of years 1 & 2 2. $1,100 end of years 3 & 4 3. $1,200 end of years 5 to perpetuity 4. $1,400 end of years 8 to perpetuity If you require a return of 8%, how much should you be willing to pay for this investment today? A. $36, 700 B. $59, 750 C. $24, 702 D. $25, 584 E. $27, 353 F. $58, 750arrow_forwardUse a financial calculator or computer software program to answer the following questions: a) Melanie is trying to save money for retirement and has a future goal of $750,000 at the end of 20 years. Determine the present value of her goal using a discount rate of 12%. b) How would the present value change if the $750,000 is to be received at the end of 15 years instead? Explain the impact and show your work?arrow_forwardFuture value. Jack and Jill are saving for a rainy day and decide to put $40 away in their local bank every year for the next 20 years. The local Up-the-Hill Bank will pay them 6% on their account. a. If Jack and Jill put the money in the account faithfully at the end of every year, how much will they have in it at the end of 20 years? b. Unfortunately, Jack had an accident in which he sustained head injuries after only 10 years of savings. The medical bill has come to $400. Is there enough in the rainy-day fund to cover it? a. If Jack and Jill put the money in the account faithfully at the end of every year, how much will they have in it at the end of 20 years? $nothing (Round to the nearest cent.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education