Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

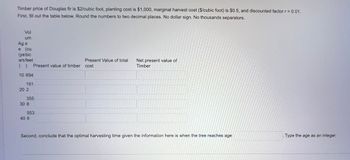

Transcribed Image Text:Timber price of Douglas fir is $2/cubic foot, planting cost is $1,000, marginal harvest cost ($/cubic foot) is $0.5, and discounted factor r = 0.01.

First, fill out the table below. Round the numbers to two decimal places. No dollar sign. No thousands separators.

Vol

um

Age

e (cu

(ye bic

ars feet

) ) Present value of timber cost

10 694

191

20 2

355

30 8

553

40 6

Present Value of total

Net present value of

Timber

Second, conclude that the optimal harvesting time given the information here is when the tree reaches age

Type the age as an integer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Calculate the Contribution Margin Ratio: Sales 2,000,000 Rent 500,000. Depreciation 200,000. Variable COGS 60,000 Fixed COGS 35,000.arrow_forwardA firm sell a single product for $6. Its variable cost per unit is $4 and fixed costs are $50. Ignoring income taxes, the amount of sales revenue needed for $20 profit is Select one: a. $210. b. $150. c. $35. d. $25.arrow_forwardMatch the descriptions 1 through 5 with labels a through e on the CVP chart. Dollars $25,000 $20,000 $15,000 $10,000 $5,000 $0 1. Break-even point 2. Total sales line 3. Loss area 4. Profit area 5. Total costs line (b) 200 400 600 (c) (d) (a) (e) 800 1,000 1,200 1,400 1,600 1,800 2,000 2,200 2,400 Units produced and soldarrow_forward

- Strong Key Pte. Ltd, manufactures a key for houses with the selling price $7/per unit. Each key has variable cost per unit $4.- Fixed Cost $60.000/per year. Interest expense for obligation is $15.000,- per year and divided for preferred stock every year is $7.500. Annual sales for this year are 40.000 units. Tax is 30%. a. Calculate and make a graph BEP Strong Key Pte.Ltd. b. Calculate EBIT and Earning Available for Common Stockholders. c. Calculate DOL, DFL, and DTL. d. If Strong Key can add sales in units 20.000 units and become 60.000 units, what is the new EBIT?arrow_forwardIf this year Eloise Ltd. had sales of $750,000, fixed costs of $150,000, and variable costs of $350,000, what is the margin of safety in dollars?(round numbers within the calculations to 2 decimal places and choose the closest whole number) $400,000 $466,981 $450,000 $425,650arrow_forwardrange of production is 500 units to 1,500 units): Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant Mc Graw Hill 'Z² ± 080 2 A Sales Variable expenses Contribution margin Z Fixed expenses Net operating income Contribution margin per unit 2 Required: What is the contribution margin per unit? (Round your answer to 2 decimal places.) F2 ((1:1) @ W S F3 # 3 X Alt / £ E D F4 $ 4 $ C ¢ $ R 23,900 13,300 10,600 7,632 2,968 F F5 OIO % 5 V F6 粥 ¤ T G л 6 B F7 ? Y H F8 & 7 N Jy L § F12 ) 0 14 Alt Car Scr Lk Arrêtdef P - PrtSc/Imprecr. SysRq/Syst. 目 1½/2 2 + 11 ? Pause Break/Interr. 1 | | ^ = 3/4 A } >> \ o « Insert ]] < Delete/Suppr. V. A V 1 ▷arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education