FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Please look at the questions on the first picture and answer them on secound picture.

thanks for your time

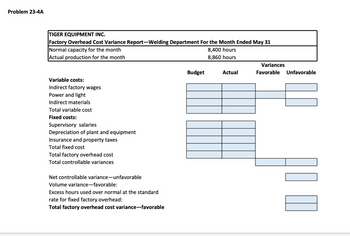

Transcribed Image Text:Problem 23-4A

TIGER EQUIPMENT INC.

Factory Overhead Cost Variance Report-Welding Department For the Month Ended May 31

Normal capacity for the month

8,400 hours

Actual production for the month

8,860 hours

Variable costs:

Indirect factory wages

Power and light

Indirect materials

Total variable cost

Fixed costs:

Supervisory salaries

Depreciation of plant and equipment

Insurance and property taxes

Total fixed cost

Total factory overhead cost

Total controllable variances

Net controllable variance-unfavorable

Volume variance-favorable:

Excess hours used over normal at the standard

rate for fixed factory overhead:

Total factory overhead cost variance-favorable

Budget

Actual

Variances

Favorable Unfavorable

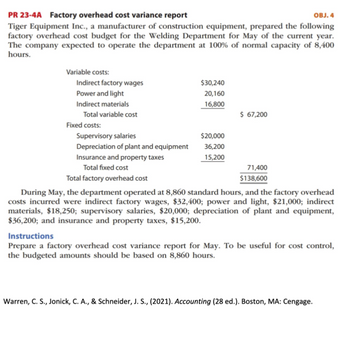

Transcribed Image Text:PR 23-4A Factory overhead cost variance report

OBJ. 4

Tiger Equipment Inc., a manufacturer of construction equipment, prepared the following

factory overhead cost budget for the Welding Department for May of the current year.

The company expected to operate the department at 100% of normal capacity of 8,400

hours.

Variable costs:

Indirect factory wages

Power and light

Indirect materials

Total variable cost

Fixed costs:

Supervisory salaries

Depreciation of plant and equipment

Insurance and property taxes

Total fixed cost

Total factory overhead cost

$30,240

20,160

16,800

$20,000

36,200

15,200

$ 67,200

71,400

$138,600

During May, the department operated at 8,860 standard hours, and the factory overhead

costs incurred were indirect factory wages, $32,400; power and light, $21,000; indirect

materials, $18,250; supervisory salaries, $20,000; depreciation of plant and equipment,

$36,200; and insurance and property taxes, $15,200.

Instructions

Prepare a factory overhead cost variance report for May. To be useful for cost control,

the budgeted amounts should be based on 8,860 hours.

Warren, C. S., Jonick, C. A., & Schneider, J. S., (2021). Accounting (28 ed.). Boston, MA: Cengage.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- Please watch the following video, then answer the prompt below: https://youtu.be/nfkqCv3Rd_g: copy and paste it to view After watching, answer the question below: Describe the Time Value of Money.arrow_forwardPlease help on parts 4 and 5. Please also show work on how to do.arrow_forwardHello i have attached two pictures. They are both used together to answer the question. The first picture is the information to use too answer the question. The second attachment is the for the answer. I hope it is understandable and whoever answer this can please explain how they got the answers. I need the help. I have marked a yellow x on what i have done already. I DO NOT NEED HELP WITH WHAT IS CROSSED IN YELLOW (PARTS 1-3) I NEED PARTS 4-6. THIS IS IS IS THE ANSWER TO PARTS 1-3 Analysis and Calculation: 1) Gold Medal Athletic Co., Sales Budget: For the month ended March: Product Sales Volume Sale Price per unit Sales, $ Batting helmet 1,200 units $40 $ 48,000 Football helmet 6,500 units $160 $1,040,000 Total revenue from sales $ 1,088,000 2) Production Budget: Batting Football Helmet Helmet Expected units to be sold 1,200 6,500 Add: desired Ending inventory 50 220 Total 1,250 6,720 Less: Beginning estimated inventory 40 240 Total…arrow_forward

- Any help is appreciated, here is the question. https://drive.google.com/file/d/0B-AOAJtLKPhfOEJhR0RWRWtmT3BGVVljQUZaRko0Zkh2NDRr/view?usp=sharingarrow_forwardHow do you get a report into PDF format? Select an answer: You need to email the report and then convert it to PDF. Click on the Export button and Click on Export as PDF. You cannot export reports into PDF. You have to print the report and then scan it as a PDF.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education