Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Don't used Ai and hand raiting

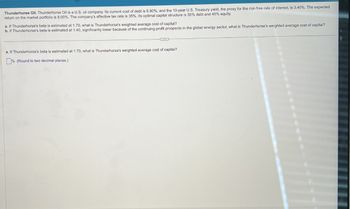

Transcribed Image Text:Thunderhorse Oil. Thunderhorse Oil is a U.S. oil company. Its current cost of debt is 6.80%, and the 10-year U.S. Treasury yield, the proxy for the risk-free rate of interest, is 3.40%. The expected

return on the market portfolio is 8.00%. The company's effective tax rate is 35%. Its optimal capital structure is 55% debt and 45% equity.

a. If Thunderhorse's beta is estimated at 1.70, what is Thunderhorse's weighted average cost of capital?

b. If Thunderhorse's beta is estimated at 1.40, significantly lower because of the continuing profit prospects in the global energy sector, what is Thunderhorse's weighted average cost of capital?

a. If Thunderhorse's beta is estimated at 1.70, what is Thunderhorse's weighted average cost of capital?

% (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Thunderhorse Oil. Thunderhorse Oil is a U.S. oil company. Its current cost of debt is 7.20%, and the 10-year U.S. Treasury yield, the proxy for the risk-free rate of interest, is 3.10%. The expected return on the market portfolio is 8.30%. The company's effective tax rate is 38%. Its optimal capital structure is 70% debt and 30% equity. a. If Thunderhorse's beta is estimated at 1.30, what is Thunderhorse's weighted average cost of capital? b. If Thunderhorse's beta is estimated at 1.00, significantly lower because of the continuing profit prospects in the global energy sector, what is Thunderhorse's weighted average cost of capital? a. If Thunderhorse's beta is estimated at 1.30, what is Thunderhorse's weighted average cost of capital? % (Round to two decimal places.)arrow_forwardThunderhorse Oil. Thunderhorse Oil is a U.S. oil company. Its current cost of debt is 6.70%, and the 10-year U.S. Treasury yield, the proxy for the risk-free rate of interest, is 3.30%. The expected return on the market portfolio is 8.60%. The company's effective tax rate is 39%. Its optimal capital structure is 40% debt and 60% equity. a. If Thunderhorse's beta is estimated at 1.70, what is Thunderhorse's weighted average cost of capital? b. If Thunderhorse's beta is estimated at 1.30, significantly lower because of the continuing profit prospects in the global energy sector, what is Thunderhorse's weighted average cost of capital?arrow_forwardThunderhorse Oil. Thunderhorse Oil is a U.S. oil company. Its current cost of debt is 7.4%, and the 10-year U.S. Treasury yield, the proxy for the risk-free rate of interest, is 3.9%. The expected return on the market portfolio is 8.1%. The company's effective tax rate is 38%. Its optimal capital structure is 55% debt and 45% equity. a. If Thunderhorse's beta is estimated at 1.6, what is Thunderhorse's weighted average cost of capital? b. If Thunderhorse's beta is estimated at 1.1 , significantly lower because of the continuing profit prospects in the global energy sector, what is Thunderhorse's weighted average cost of capital?arrow_forward

- The chapter demonstrated that a firm borrowing in a foreign currency could potentially end up paying a very different effective rate of interest than what it expected. Using the same baseline values of a debt principal of SF1.5 million, a one year period, an initial spot rate of SF1.5000/$, a 5.000% cost of debt, and a 34% tax rate, what is the effective cost of debt for one year for a U.S. dollar-based company if the exchange rate at the end of the period was: a. SF1.5000/$ b. SF1.4400/$ c. SF1.3860/$ d. SF1.6240/%arrow_forwardThe State of Connecticut can currently borrow money in 10 years at 0.65% - the same yield as the US Government. Is the market saying that the State of Connecticut is as good of a counterparty risk as the Federal Government? What is the right way to evaluate this relationship? Do the calculation assuming a 20% tax bracket..arrow_forwardA company requires a 26% internal rate of return (before taxes) in U.S. dollars on project investments in foreign countries. Solve, a. If the currency of Country A is projected to average an 8% annual devaluation relative to the dollar, what rate of return (in terms of the currency there) would be required for a project? b. If the dollar is projected to devaluate 6% annually relative to the currency of Country B, what rate of return (in terms of the currency there) would be required for a project?arrow_forward

- Based in the U.S., Your firm faces a 25% chance of a potential loss of $20 million next year. If yourfirm implements new policies, it can reduce the chance of this loss by 10%, but these new policieshave an upfront cost of $300,000. Suppose the beta of the loss is 0, and the risk-free interest rate5%.ISa) If the firm is uninsured, what is the NPV of implementing the new policies?b) If the firm is fully insured, what is the NPV of implementing the new policies?c) Given your answer to question b), what is the actuarially fair cost of full insurance?d) What is the minimum-size deductible that would leave your firm with an incentive toimplement the new policies?e) What is the actuarially fair price of an insurance policy with the deductible in question darrow_forwardA firm wants to fund a $7 million project by raising both short-term and long-term debt. Because short-term debt is less risky, its cost is 5%. The long-term debt (bond) must pay 5.5% annual coupons. If the firm raises $5 million in short-term debt and the remainder in long-term debt, what is this project's WACC? Assume the tax rate = 26%. a. 5.14% b. 3.81% c. 3.89% d. 5.25% e. 1.34%arrow_forwardBBA Ltd has just issued $10 million in debt (at par or face value). The firm will pay interest only on this debt. BBA’s marginal tax rate is expected to be 30% for the foreseeable future. a) Suppose BBA pays interest of 6% per year on its debt. What is its annual interest tax shield? b) What is the present value of the interest tax shield, assuming the tax shield’s risk is the same as that of the loan? c) Suppose instead that the interest rate on the debt is 5%. What is the present value of the interest tax shield in this case? Ten years have passed since BBA issued $10 million in perpetual interest-only debt with a 6% annual coupon. Tax rates have remained the same at 30% but interest rates have dropped so BBA’s current cost of debt capital is 4%. d) What is BBA’s annual interest tax shield now? e) What is the present value of the interest tax shield now?arrow_forward

- A U.S. company can borrow 10,000 pounds in Great Britain for 6% interest, paying back 10,600 pounds in one year. Alternatively, the U.S. company can borrow an equivalent amount of U.S dollars in the United States and pay 13% interest. Assuming capital markets are efficient, estimate the expected inflation rate in the United States if inflation in Great Britain is expected to be zero. Select one: a. 7% b. 6.6% C. 6.2% d. 5.4%arrow_forwardTransPacific Inc. is an import-export company specializing in products from Asia and the West Coast. It can borrow in the debt market at 9%. Its cost of equity with 40% DN ratio is 13%. Its corporate tax rate is 20%. If the M&M world of taxes holds true, what is the WACC for TransPacific Inc. with a 40% DIV financing? A. 9.44% B. 8.00% C. 10.68% D. 7.80%arrow_forwardClifford Chance is a large U.K. firm with the before tax cost of debt of 10%. The risk-free rate of interest on 10-year Treasury bonds is 4%. The expected return on the market portfolio is 8%. After effective taxes, Clifford Chance’s effective tax rate is 20%. Its optimal capital structure is 70% debt and 30% equity. If Clifford Chance’s beta is estimated at 1.5, what is its weighted average cost of capital? (4 marks) This firm has collected 50,000 GBP from U.K. stock and bond markets by using the weighted average cost of capital calculated in step (a). It has invested this fund on a 3-year project in U.K. and earned the cash flows of 10,000, 15,000, and 20,000 for the first, second, and third years of the project, respectively. Calculate Net Present Value of the project and provide a decision whether this project is acceptable for investment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education