Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Can Please Help Me: Finance

60 minutes only the given time. Wish you could help me.

I will give UPVOTE and GOOD FEEDBACK.

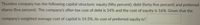

Transcribed Image Text:Thumbss company has the following capital structure: equity (fifty percent); debt (forty five percent) and preferred

shares (five percent). The company's after-tax cost of debt is 14% and the cost of equity is 16%. Given that the

company's weighted average cost of capital is 14.5%, its cost of preferred equity is?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The ABC Company has a cost of equity of 21.2 percent, a pre-tax cost of debt of 5.2 percent, and a tax rate of 30 percent. What is the firm's weighted average cost of capital if the proportion of debt is 65.6%?arrow_forwardKeziah Textiles, Inc. has a cost of equity of 10.8 percent. The company has an aftertax cost of debt of 5.1 percent, and the tax rate is 35 percent. If the company's debt–equity ratio is .80, what is the weighted average cost of capital?arrow_forwardThe Bigelow Company has a cost of equity of 12 percent, a pre-tax cost of debt of 7 percent, and a tax rate of 35 percent. What is the firm’s weighted average cost of capital if the proportion of debt is 37.5% and the proportion of equity is 62.5%?arrow_forward

- Gamma Inc. has a weighted average cost of capital of 18.60%. The firm’s cost of equity is 24.40%, and it’s cost of debt is 15%. The tax rate is 34%. What is Gamma’s debt-to-equity ratio?arrow_forwardB & B Ltd. has a weighted average cost of capital of 10.5%. The company's cost of equity is 15.5%, and its pretax cost of debt is 8.5%. The tax rate is 34%. What is the company's target debt-equity ratio?arrow_forwardCompany A is financed by 20% of debt and the rest of the company is financed by common equity. The company’s before-tax cost of debt is 5%, and its cost of equity is 11%. If the marginal tax rate is 30%, the company’s weighted average cost of capital (WACC) is _____.arrow_forward

- Company X has debt and equity as sources of funds. Company X has market value of debt as $150,000 and book value of debt as $80,000. The company has book value of equity as $100,000 and market value of equity as $125,000. The cost of debt is 8.25% and cost of equity is 9.57%. the tax rate is 38%. What is the Weighted Average Cost of Capital (WACC)? a. 7.59% b. 7.78% c. 7.14% d. 7.68%arrow_forwardGive typing answer with explanation and conclusion Fama's Llamas has a weighted average cost of capital of 11.5 per cent. The company's cost of equity is 16 per cent, and its cost of debt is 8.5 per cent. The tax rate is 35 per cent. What is Fama's debt–equity ratio?arrow_forwardFama's Llamas has a weighted average cost of capital of 11 percent. The company's cost of equity is 15 percent, and its pretax cost of debt is 7.5 percent. The tax rate is 32 percent. What is the company's target debt-equity ratio? a) 0.678 b) 0.7119 c) 0.7051 d) 1.1429 e) 0.6441arrow_forward

- Blask Technology has the following capital structure: Debt: 35% Preferred Stock: 15 Common Equity: 50 The after-tax cost of debt is 6.5%; the cost of preferred stock is 10% and the cost of common equity is 13.5%. Compute the company's weighted average cost of capital.arrow_forwardCompany A has a debt to equity ratio to one. Its cost of equity is 20% and its cost of debt is 10%. Assuming a tax rate of 50%. Company A's weighted average cost of capital is? (write the process of calculation.)arrow_forwardTake It All Away has a cost of equity of 11.14 percent, a pretax cost of debt of 5.34 percent, and a tax rate of 21 percent. The company's capital structure consists of 66 percent debt on a book value basis, but debt is 32 percent of the company's value on a market value basis. What is the company's WACC?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education