Concept explainers

Through the payment of $14,890,000 in cash, Drexel Company acquires voting control over Young Company. This price is paid for 70% of the subsidiary;s 150,000 outstanding common shares ($40 par value) as well as all 30,000 shares of 6 percent, cumulative, $100 par value preferred stock. Of the total payment, $3.2 million is attributed to the fully partifipating preferred stock with the remainder paid for the common. This acquisition is carried out on January 1, 2021, when Young reports

During 2021, Young reports net income of $910,000 while the Clarion $410,000 in cash dividends. Drexel used the initial value metod to account for both these investments.

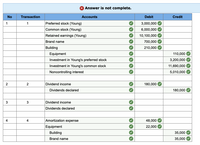

Prepare appropriate entires for 2021. I can not figure out the 3rd entry. Please see attached document for the entires.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- On January 1, 2021 ABC purchased 80% of the outstanding shares of DEF at a cost of $960,000. On that date, DEF had $600,000 worth of outstanding shares and $60,000 worth of accumulated profits. For 2021, ABC had income of $336,000 from its own operations and paid dividends of $180,000. For 2021, DEF reported income of $64,000 and paid dividends of $36,000. All of the assets and liabilities of DEF have book values equal to their market value. On January 1, 2021, ABC sold equipment to DEF for $120,000. The book value of the equipment on that was $144,000. The loss of $24,000 is reflected in the net income of indicated above. The equipment is expected to have a useful life of five years from the date of the sale. In the December 31, 2021 consolidated statement of financial position, the non- controlling interest in net assets of Subsidiary should be presented at O 284,400 O 240,000 O 245,600 O 255,600arrow_forwardOn January 1, 2015, Wells Corporation acquires 8,000 shares of Towne Company stock and 18,000 shares of Sara Company stock for $176,000 and $240,000, respectively. Each investment is acquired at a price equal to the subsidiary’s book value, resulting in no excesses. Towne Company and Sara Company have the following stockholders’ equities immediately prior toWells’s purchases: Towne Company Sara CompanyCommon stock ($5 par). . . . . . . . . . . . . . . . $ 50,000Common stock ($10 par). . . . . . . . . . . . . . $300,000Paid-in capital in excess of par . . . . . . . . . 100,000Retained earnings . . . . . . . . . . . . . . . . . . . . . 70,000 100,000Total stockholder’s equity. . . . . . . . . . . . . . $220,000 $400,000Additional information is as follows:a. Net income for Towne Company and Sara Company for 2015 and 2016 follows (income is assumed to be earned evenly…arrow_forwardPeal Corporation Issued 4,000 shares of Its $10 par value stock with a market value of $85,000 to acquire 85 percent of the common stock of Seed Company on August 31, 20X3. Seed's fair value was determined to be $100,000 on that date. Peal had previously purchased 15 percent of Seed's common stock for $9,000 on January 31, 20X1, and had carried this Investment at fair value on Its balance. Peal reported this Investment at $15,000 on Its balance sheet at August 31, 20X3, Immediately prior to acquiring the remaining 85 percent of Seed's shares. On August 31, 20X3, Peal also paid appraisal fees of $3,500 and stock Issue costs of $2,000 Incurred in completing the acquisition of the additional shares. Required: Prepare the Journal entries to be recorded by Peal in completing the acquisition of the additional shares of Seed. Note: If no entry is required for a transaction/event, select "No Journal entry required" In the first account field. No A B C Event 1 2 3 Acquisition Expense Cash…arrow_forward

- Sykora Company owns 80% of Walton Company. Information reported by Sykora and Walton as of the current year end follows. Assume Walton issues 60,000 additional shares of previously authorized but unissued common stock solely to outside investors (none to Sykora) for $14 cash per share. Indicate the financial statement effects of this stock issuance on Sykora using the financial statement effects template. I need help figuring out Noncash assets and Contributed Capital. Please don't provide solution in an image based answers thanksarrow_forwardMunabhaiarrow_forwardReden Corporation purchased 40 percent of Montgomery Company’s common stock on January 1, 20X9, at underlying book value of $262,400. Montgomery’s balance sheet contained the following stockholders’ equity balances: Preferred Stock ($4 par value, 42,000 shares issued and outstanding) $ 168,000 Common Stock ($1 par value, 145,000 shares issued and outstanding) 145,000 Additional Paid-In Capital 189,000 Retained Earnings 322,000 Total Stockholders’ Equity $ 824,000 Montgomery’s preferred stock is cumulative and pays a 5 percent annual dividend. Montgomery reported net income of $95,000 for 20X9 and paid total dividends of $46,000. Required: Give the journal entries recorded by Reden Corporation for 20X9 related to its investment in Montgomery Company common stock. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education