Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

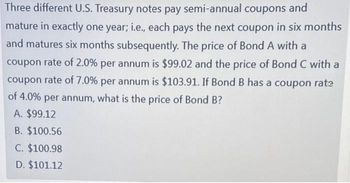

Transcribed Image Text:Three different U.S. Treasury notes pay semi-annual coupons and

mature in exactly one year; i.e., each pays the next coupon in six months

and matures six months subsequently. The price of Bond A with a

coupon rate of 2.0% per annum is $99.02 and the price of Bond C with a

coupon rate of 7.0% per annum is $103.91. If Bond B has a coupon rate

of 4.0% per annum, what is the price of Bond B?

A. $99.12

B. $100.56

C. $100.98

D. $101.12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Treasury securities that mature in 6 years currently have an interest rate of 7.00 percent. Inflation is expected to be 5 percent in each of the next three years and 6 percent each year thereafter. The maturity risk premium is estimated to be 0.10% × (t-1), where t is equal to the maturity of the bond (i.e., the maturity risk premium of a one-year bond is zero). The real risk-free rate is assumed to be constant over time. What is the real risk-free rate of interest?arrow_forwardSuppose the redemption value of a 5-year bond is $105. It pays semiannual coupons of $3 each. The annual yield rate is 8% convertible semiannually. Calculate the interest earned on this bond for the first half year. Round the answer to the nearest tenth dollar.arrow_forwardIn May 2000, the U.S. Treasury issued 30-year bonds with a coupon rate of 6.25%, paid semi-annually. A bond with a face value of $1,000 pays $31.25 (1,000 × 0.0625 / 2) every six months for the next 30 years; in May 2030, the bond also repays the principal amount, $1,000. 1. What is the value of the bond if, immediately after issue in May 2000, the 30-year interest rate increases to 7.5%? 2. What is the value of the bond if, immediately after issue in May 2000, the 30-year interest rate decreases to 5.0%? 3. On a graph in Excel, show how the value of the bond changes as the interest rate changes (plot the value as a function of the interest rate). At what interest rate is the value of the bond equal to its face value of $1,000?arrow_forward

- Treasury notes and bonds. Use the information in the following table: . What is the price in dollars of the February 2001 Treasury note with semiannual payment if its par value is $100,000? What is the current yield of this note? Treasury note is a U.S. government bond with a maturity of between two and ten years. Par value is the principal amount to be repaid at the maturity of the bond. Current yield is the annual bond coupon payment divided by the current price.arrow_forwardBonds often pay a coupon twice a year. For the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. Using the values of cash flows and number of periods, the valuation model is adjusted accordingly. Assume that a $1,000,000 par value, semiannual coupon US Treasury note with two years to maturity has a coupon rate of 4%. The yield to maturity. (YTM) of the bond is 8.80%. Using this information and ignoring the other costs involved, calculate the value of the Treasury note: O $776,642.92 O $913,697.55 O$1,096,437,06 Based on your calculations and understanding of semiannual coupon bonds, complete the following statement. The T-pote described in this problem is selling at aarrow_forwardAn annual payment bond has a 10% required rate of return.Interest rates are expected to decrease 71 basis points.If the bond's duration is 12 years.what is the percentage change in bond's price?(write the answer in percentage and round it to two decimals)arrow_forward

- A BBB-rated corporate bond has a yield to maturity of 13.2%. A U.S. Treasury security has a yield to maturity of 11.8%. These yields are quoted as APRS with semiannual compounding. Both bonds pay semi-annual coupons at a rate of 12.7% and have 5 years to maturity. a. What is the price (expressed as a percentage of the face value) of the Treasury bond? b. What is the price (expressed as a percentage of the face value) of the BBB-rated corporate bond? c. What is the credit spread on the BBB bonds?arrow_forwardThe Wall Street Journal reports that the rate on 3-year Treasury securities is 7.10 percent, and the 6-year Treasury rate is 7.35 percent. From discussions with your broker, you have determined that expected inflation premium is 2.60 percent next year, 2.85 percent in Year 2, and 3.05 percent in Year 3 and beyond. Further, you expect that real interest rates will be 3.55 percent annually for the foreseeable future. What is the maturity risk premium on the 6-year Treasury security?arrow_forwardBonds often pay a coupon twice a year. For the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. Using the values of cash flows and number of periods, the valuation model is adjusted accordingly. Assume that a $1,000,000 par value, semiannual coupon US Treasury note with three years to maturity has a coupon rate of 6%. The yield to maturity (YTM) of the bond is 9.90%. Using this information and ignoring the other costs involved, calculate the value of the Treasury note: $567,545.29 $765,735.71 $900,865.54 $1,081,038.65 Based on your calculations and understanding of semiannual coupon bonds, complete the following statement: Assuming that interest rates remain constant, the T-note’s price is expected to ( Increase, Decrease).arrow_forward

- The interest rate on one-year Treasury bonds is 0.8 percent, the rate on two-year T-bonds is 0.9 percent, and the rate on three-year T-bonds is 1.0 percent. Using the expectations theory, compute the expected one-year interest rate in the second year (Year 2 only). Round your answer to one decimal place. % Using the expectations theory, compute the expected one-year interest rate in the third year (Year 3 only). Round your answer to one decimal place. %arrow_forwardPlease Explain Step by Step Thank you! A bond pays $12,000 per year for the next 10 years. The bond costs $108,000 now. Inflation is expected to be 6 percent over the next 10 years. Answer parts (a) and (b). a. What is the current dollar internal rate of return? Use linear interpolation with x1=1.95% and x2=2.00% to find your answer. The current dollar internal rate of return is enter your response here percent. (Type an integer or decimal rounded to two decimal places as needed.) b. What is the real internal rate of return? The real internal rate of return is enter your response here percent. (Type an integer or decimal rounded to two decimal places as needed.)arrow_forwardSuppose a bank enters a repurchase agreement in which it agrees to buy Treasury securities from a correspondent bank at a price of $31,950,000, with the promise to buy them back at a price of $32,000,000. a. Calculate the yield on the repo if it has a 5-day maturity. b. Calculate the yield on the repo if it has a 15-day maturity. (For all requirements, use 360 days in a year. Do not round intermediate calculations. Round your percentage answers to 5 decimal places. (e.g., 32.16161)) a. b. X Answer is complete but not entirely correct. Yield on the repo Yield on the repo 1.02857 % 0.34286 %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education