ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

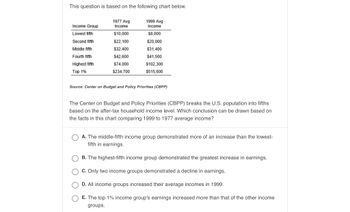

Transcribed Image Text:This question is based on the following chart below.

1999 Avg

1977 Avg

Income

Income Group

Income

Lowest fifth

$10,000

$8,000

Second fifth

$22,100

$20,000

Middle fifth

$32,400

$31,400

Fourth fifth

$42,600

$41,500

$74,000

$102,300

Highest fifth

Top 1%

$234,700

$515,600

Source: Center on Budget and Policy Priorities (CBPP)

The Center on Budget and Policy Priorities (CBPP) breaks the U.S. population into fifths

based on the after-tax household income level. Which conclusion can be drawn based on

the facts in this chart comparing 1999 to 1977 average income?

A. The middle-fifth income group demonstrated more of an increase than the lowest-

fifth in earnings.

B. The highest-fifth income group demonstrated the greatest increase in earnings.

C. Only two income groups demonstrated a decline in earnings.

D. All income groups increased their average incomes in 1999.

E. The top 1% income group's earnings increased more than that of the other income

groups.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- In a hypothetical economy, Clancy earns $37,000, Eileen earns $74,000, and Hubert earns $111,000 in annual income. The following table shows the annual taxable income and tax liability for these three single individuals. For example, Clancy, who earns $37,000, owes $9,250 in taxes. Use the tax liability figures provided to complete the following table by computing the average tax rate for Clancy, Eileen, and Hubert with an annual income of $37,000, $74,000, and $111,000, respectively. Taxable Income Tax Liability Average Tax Rate Taxable Income (Dollars) (Dollars) (Percent) Clancy 37,000 9,250 Eileen 74,000 11,100 Hubert 111,000 11,100 The income tax system for this country isarrow_forward38arrow_forward1. Income inequality and the poverty rate The following table summarizes the income distribution for the town of Perkopia, which has a population of 10,000 people. Every individual within an income group earns the same income, and the total annual income in the economy is $500,000,000. Suppose that in 2007, the poverty line is set at an annual income of $42,350 for an individual. Year Lowest Quintile Second Quintile 2001 2007 2013 2019 3.0 3.4 3.8 5.0 Share of Total Income in Perkopia (Percent) 8.6 9.4 9.7 11.0 The data in the table suggest that there was Middle Quintile Fourth Quintile 14.0 14.6 15.2 15.5 21.9 22.4 22.9 25.0 Highest Quintile 52.5 50.2 48.4 43.5 income inequality from 2001 to 2019. MacBook Pro Complete the following table to help you determine the poverty rate in Perkopia in 2007. To do this, begin by determining the total income of all individuals in each quintile using the fact that total annual income in the economy is $500,000,000. Next, determine the income of an…arrow_forward

- When Ann's income increased from $100,000 to $120,000, her income tax payment increased from $22,000 to $30,000. Ann's average tax rate is and her marginal tax rate is A. 25 percent; 25 percent B. 40 percent; 25 percent C. 40 percent; 40 percent D. 25 percent; 40 percentarrow_forwardTable H-1. Income Limits for Each Fifth and Top 5 Percent of All Households: 1967 to 2021 Current Dollars 2021 Year Number (thousands) Lowest Upper limit of each fifth (dollars) Second Third 89,744 Fourth 149,131 Lower limit of top 5 percent (dollars) 131,202 28,007 55,000 Question 04b: Which of the following statements are true? a) The upper limit on income of the lowest 20% of households in the United States is $28,007 meaning the range of the lowest quintile is from zero to $28,007. 286,304 b) The income range of the middle (third) quintile of households is from $55,001 to $89,744. c) The top 20% of households had income of at least $149,132. d) All of the above are true statements for the almost 130 million households in 2021.arrow_forwardAssume that the government proposes a negative income tax that calculates taxes owed using the following formula: taxes owed = 0.25 Income $20,000. If a family earns an income of $60,000, how does this tax scheme affect them? they receive a subsidy of $5000 they pay $15,000 in taxes they pay $20,000 in taxes they receive an income subsidy of $15,000.arrow_forward

- 5arrow_forwardMACROECONOMICS Progressive Tax Based on your yearly income above, calculate the amount of tax each income bracket would pay under a progressive tax plan. Each row up to the total income amount should be filled in. For an example of a completed chart, go to Page 4 of Lesson 05.03: Sharing with Uncle Sam. Calculate the tax for $95,000. For example, $10,000x40%-%$4,000 in tax. Show your work!! Proposed Regressive Plan Calculate the tax for S25,000. For example, $10,000x40%=$4,000 in tax. Show your work!! 10% on income up to $25,000 20% on income between S25,000 and S34,000 25% on income between S34,000 and S44,000 30% on income between $44,000 and S80,000 40% on taxable income over S80,000 TOTAL TAX PAID (sum of all rows):arrow_forwardBriefly explain the purpose served by payroll taxes and how they are collected. Describe any comment that economists point out with regard to payroll taxes.arrow_forward

- 4. Study Questions and Problems #4 Federal income tax is an example of a tax that follows the principle. According to this principle, an individual with a higher afford to pay more in taxes. Therefore, regardless of who reaps the benefits from the taxes, individuals with higher incomes proportion of their income in taxes. income should contribute aarrow_forward7. Study Questions and Problems #7 Suppose Sean has a total taxable income of $30,000, and he must pay $3,000 in taxes for clothing purchased this year. Yvette has a total taxable income of $65,000. The average tax rate for Sean is %. Based on Yvette's taxable income and the average tax rate you found for Sean in the prior question, calculate the minimum amount of tax Yvette must pay to achieve each tax structure listed in the following table. Type of Tax Structure Regressive Progressive Proportional Tax Needed to Achieve Tax Structure (Dollars)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education