Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

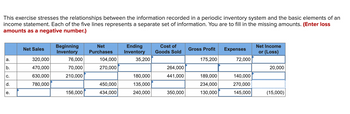

Transcribed Image Text:This exercise stresses the relationships between the information recorded in a periodic inventory system and the basic elements of an

income statement. Each of the five lines represents a separate set of information. You are to fill in the missing amounts. (Enter loss

amounts as a negative number.)

a.

b.

C.

d.

e.

Net Sales

320,000

470,000

630,000

780,000

Beginning

Inventory

76,000

70,000

210,000

156,000

Net

Purchases

104,000

270,000

450,000

434,000

Ending

Inventory

35,200

180,000

135,000

240,000

Cost of

Goods Sold

264,000

441,000

350,000

Gross Profit

175,200

189,000

234,000

130,000

Expenses

72,000

140,000

270,000

145,000

Net Income

or (Loss)

20,000

(15,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Please do not give solution in image format ?arrow_forwardSuppose Perfect Picture Photography Supply's Inventory account showed a balance of $44,700. A physical count showed $43,300 of goods on hand. To adjust the inventory account, Perfect Picture Photography Supply would make which of the following entries? ○ A. Cost of goods sold 1,400 Inventory 1,400 OB. Inventory 1,400 Accounts payable 1,400 ○ C. Accounts payable 1,400 Inventory 1,400 O D. Inventory 1,400 Cost of goods sold 1,400arrow_forwardOn the basis of the following data, determine the value of the inventory at the lower of cost or market. Apply lower of cost or market to each inventory item. Item A B с Total Inventory Quantity 181 82 60 Cost per Unit $10 14 20 Market value per Unit $14 11 22 Cost $1,810 1,148 1,200 Total Market $2,534 902 1,320 LA LCMarrow_forward

- Brief Exercise 6-17 (Algo) Calculate inventory ratios (LO6-7) Use the following information: Net sales $215,000 Cost of goods sold 152,000 Beginning inventory 48,000 Ending inventory 38,000 a. Calculate the inventory turnover ratio.b. Calculate the average days in inventory.c. Calculate the gross profit ratio.arrow_forwardFor all exercises, assume the perpetual inventory system is used unless stated otherwise. Measuring the effect of an inventory errorHot Bread Bakery reported Net sales revenue of $44,000 and cost of goods sold of $33,000. Compute Hot Bread’s correct gross profit if the company made cither of the following independent accounting errors. Show your work. Ending merchandise inventory is overstated by $8,000. Ending merchandise inventory is understated by $8,000.arrow_forwardI need help filling in the blanksarrow_forward

- Fill in the blanks in the following separate income statements a through e. (amounts to be deducted should be indicated by a minus sign) a b c d e Sales $63,000 $43,600 $41,000 ________ $24,500 Cost of goods sold Merchandise inventory (beginning) $7,500 $16,290 $5,200 $7,700 $4,400 Total cost of merchandise purchases $33,000 _______ _______ $33,000 $6,800 Merchandise Inventory (ending) _______ $-2,700 $-8,300 $-7,400 ______ Cost of goods sold $33,450 $17,000 _______ ______ $6,400 Gross profit…arrow_forwardThe following is information for Palmer Company. Year 3 $ 613,825 99,400 Cost of goods sold Ending inventory Year 2 $ 396,650 89,750 Use the above information to compute inventory turnover for Year 3 and Year 2, and its days' sales in inventory at December 31, Year 3 and Year 2. From Year 2 to Year 3, did Palmer improve its (a) inventory turnover and (b) days' sales in inventory? Inventory turnover Days' sales in inventory Year 1 $361,300 94,500 Use the above information to compute inventory turnover for Year 2, and its days' sales in inventory at December 31, Year 2. Numerator / Denominator Ratio Inventory turnover Days' sales in inventory Use the above information to compute inventory turnover for Year 3, and its days' sales in inventory at December 31, Year 3. Numerator 1 Denominator Ratio 0 0 = 0 0arrow_forwardcan you help me solve I am not sure what numbers are suppsed to be put togetherarrow_forward

- Take me to the text a) Fill in the missing numbers in the inventory schedule using the weighted-average cost inventory valuation method. This company uses the perpetual inventory system. Do not enter dollar signs or commas in the input boxes.Round all answers to 2 decimal places. When calculating the unit cost, round to 2 decimal places as well. Inventory Schedule Purchases Sales Balance Transaction Description Quantity Amount Quantity Amount Quantity Amount Opening Balance 0 $ 0 #1 Purchase from AAA Co. 600 $6,600.00 Answer $Answer Answer $Answer #2 Sale to SSS Co. Answer $Answer Answer $Answer 300 $3,300.00 #3 Sale to TTT Co. Answer $Answer 150 $Answer Answer $Answer #4 Purchase from BBB Co. 70 $1,400.00 Answer $Answer Answer $Answer #5 Sale to UUU Co. Answer $Answer 30 $Answer Answer $Answer b) If the FIFO method had been used, what would the value of COGS been for the sale to UUU Co.? COGS = $Answer c) If the specific identification method had…arrow_forwardAs shown below: an accountant has debited the Inventory account for $65,000 and credited the Accounts Payable account for $46,000. Debit Inventory $65,000 Credit Accounts Payable $46,000 Credit ????? $19,000 The entry is not balanced. Which account below could be used to fill in the ????? above to form a realistic transaction? Select one: O a. There is no account that could be used to create a realistic transaction. O b. Sales Revenue. O c. Inventory. O d. Cash at Bank.arrow_forwardSubmit it in excel formarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education