FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

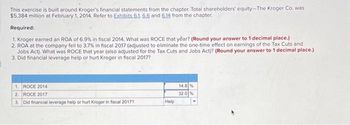

Transcribed Image Text:This exercise is built around Kroger's financial statements from the chapter. Total shareholders' equity-The Kroger Co. was

$5,384 million at February 1, 2014. Refer to Exhibits.61. 6.6 and 6.14 from the chapter.

Required:

1. Kroger earned an ROA of 6.9% in fiscal 2014. What was ROCE that year? (Round your answer to 1 decimal place.)

2. ROA at the company fell to 3.7% in fiscal 2017 (adjusted to eliminate the one-time effect on earnings of the Tax Cuts and

Jobs Act). What was ROCE that year (also adjusted for the Tax Cuts and Jobs Act)? (Round your answer to 1 decimal place.)

3. Did financial leverage help or hurt Kroger in fiscal 2017?

1. ROCE 2014

2. ROCE 2017

3. Did financial leverage help or hurt Kroger in fiscal 2017?

Help

14.8 %

32.0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Compute the missing amounts on the company’s financial statements. (Hint: What’s the difference between the acid-test ratio and the current ratio?)13. Total liabilities14. Common stock capital15. Total stockholders' equityarrow_forwardThis exercise is built around Kroger’s financial statements from the chapter. Total shareholders' equity—The Kroger Co. was $5,384 million at February 1, 2014. Refer to Exhibits 6.1, 6.6 and 6.14 from the chapter. Required: Kroger earned an ROA of 6.9% in fiscal 2014. What was ROCE that year? (Round your answer to 1 decimal place.) ROA at the company fell to 3.7% in fiscal 2017 (adjusted to eliminate the one-time effect on earnings of the Tax Cuts and Jobs Act). What was ROCE that year (also adjusted for the Tax Cuts and Jobs Act)? (Round your answer to 1 decimal place.) Did financial leverage help or hurt Kroger in fiscal 2017? 1. ROCE 2014 % 2. ROCE 2017 % 3. Did financial leverage help or hurt Kroger in fiscal 2017? Help or Hurtarrow_forwardPlease help me. Thankyou.arrow_forward

- I'm stuck on how to solve the last 3arrow_forwardThe following are extracts from Beer’s ledger for the year ended December 31, 2017$'000Profit for the year 421Dividend (98)323During the year the following important events took place:1) Properties were revalued by $105,000 increase.2) $200,000 equity shares of $1 were issued during the year at a 25c premiumThe opening equity balance were as follows:Issued capital 400Share premium 50Other components of equity 165Retained earnings 310925 Required:In accordance with IAS 1, prepare the statement of changes in equity for the year-ended 31December 2017.Show all workingsarrow_forwardkai.4 On December 31,2020 , the total assets of Allen, Inc. were $91,000, and liabilities were $48,000. Allen, Inc. began business January 1,2016 , and had an average net income of $16,000 per year. Total dividends paid for the five-year period were $63,850. Instructions: Compute Allen, Inc.'s owners' equity balance as of December 31, 2020 and the amount of its original investment.arrow_forward

- At the beginning of 2010, a corporation had assets of $270,000 and liabilities of $160,000. During 2010, assets increased by $25,000 and liabilities increased by $5,000. What was stockholders-equity on December 31, 2010? A. $140,000 B. $130,000 C. $190,000 D. $80,000arrow_forwardA company's financial statements include the following selected data ($ in millions): Sales, $22,600; Net income, $900; Beginning stockholders' equity, $3,540; Ending stockholders' equity, $4,200.Calculate the return on equity. (Round your answer to 1 decimal place.) Return on equity: _________%arrow_forwardPlease answer to the below questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education