Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Hello, I am having a hard time with the

Transcribed Image Text:These financial statement items are for Ivanhoe Company at year-end, July 31, 2022.

Salaries and wages payable

$ 3,900

Salaries and wages expense

59,300

Supplies expense

16,900

Equipment

16,580

Accounts payable

3,500

Service revenue

67,900

Rent revenue

9,800

Notes payable (due in 2025)

3,000

Common stock

16,000

Cash

35,620

Accounts receivable

11,000

Accumulated depreciation-equipment

7,900

Dividends

4,000

Depreciation expense

4,000

Retained earnings (beginning of the year)

35,400

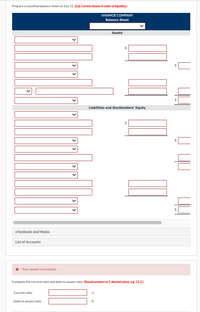

Transcribed Image Text:Prepare a classified balance sheet at July 31. (List Current Assets in order of liquidity.)

IVANHOE COMPANY

Balance Sheet

Assets

$

$

$

Liabilities and Stockholders' Equity

$

$

eTextbook and Media

List of Accounts

X Your answer is incorrect.

Compute the current ratio and debt to assets ratio. (Round answers to 1 decimal place, e.g. 15.2.)

Current ratio

:1

Debt to assets ratio

%

Expert Solution

arrow_forward

Introduction

The balance sheet is the most important financial report that represents a financial position of a business entity. It shows what resources are owned by the business (i.e., assets) and also what it owes to outsiders and owners (I.e., liabilities and stockholders' equity.

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Most of the users of financial statements are concerned about what will happen in the future. Explain the statement with an example?arrow_forwardMost long-term liabilities are really just: Debt. Expense. Income. Equity. please give me correct answer and explain whyarrow_forwardHow do excessive inventories affect the following financial statements; Income Statement, Balance Sheet, and Cash Flow Statement. Is it positive or negative, be specific.arrow_forward

- Is it possible to have “record net income” for a quarter and negative cash flows at the same time? Be specific in your response as to how you would, or would not, be able to see this in the financial statements.arrow_forwardLimitations of the balance sheet include the following, except Group of answer choices It is the basis for calculating many financial ratios Assets and liabilities are generally reported at historical cost Judgment and estimates are used in some cases The omission of items that have financial valuearrow_forwardGive any two limitations of the analysis of financial statements.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education