Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:9:39

y b •

8% s:1lו סA

docs.google.com/forms

60

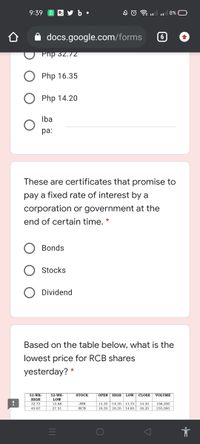

Pnp 32.72

Php 16.35

Php 14.20

Iba

ра:

These are certificates that promise to

pay a fixed rate of interest by a

corporation or government at the

end of certain time. *

Bonds

Stocks

Dividend

Based on the table below, what is the

lowest price for RCB shares

yesterday? *

52-WK-

52-WK-

STOCK

OPEN HIGH LOW

CLOSE

VOLUME

HIGH

LOW

14.20 14.20 13.75

16.35 16.35 14.85

32.72

13.68

JRR

14.20

106,200

16.20 235,000

45.67

27.31

RCB

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the Yield To Maturity of Corporation A’s bond issue?arrow_forwardWhen are corporations likely to call their bonds?arrow_forwardThe following data were taken from the balance sheet accounts of Tamarisk Corporation on December 31, 2024. Current assets Debt investments (trading) Common stock (par value $10) Paid-in capital in excess of par Retained earnings Prepare the required journal entries for the following unrelated items. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Record entries in the order displayed in the problem statement) a b. C No. a. (1) a. (2) b. n $512,000 577,000 471,000 154,000 890,000 A5% stock dividend is (1) declared and (2) distributed at a time when the market price per share is $42. The par value of the common stock is reduced to $2 with a 5-for-1 stock split. A dividend is declared January 5, 2025, and paid January 25, 2025, in bonds held as an investment. The bonds have a book value of…arrow_forward

- A fixed-income security is defined as. A) a debt obligation that pays a fixed rate of return for a one-year period of time. B) common or preferred stock that pays a fixed annual dividend C) a long-term debt obligation that pays scheduled fixed payments. D) long-term debt issued solely by a federal or state government E) any security originally issued as either debt or equity that pays a fixed, pre-se p et paymentarrow_forwardDescribe the three methods used to ensure that funds are available to redeem corporate bonds at maturity.arrow_forwardWhen corporations issue bonds, there are two distinct obligations. What are those obligations? What do the following terms mean in regard to corporations issuing bonds: convertible, callable, and debenture?arrow_forward

- 6. Which of the following is true of secondary securities? a) They include equities, bonds, and other debt claimsb) They are backed by the real assets of corporations issuing them c) They are securities that back primary securitiesd) They are securities issued by FIsarrow_forwardTimes interest earned is A) The number of times the interest on a bond issue is covered by operating profit B) The number of times the dividends are covered by net income C) The number of times the interest on a bond issue is covered by net income D) The number of times the interest on a bond issue is covered by retained earningsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education