FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please help me

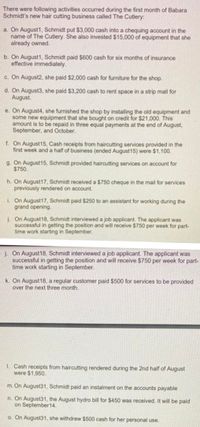

Transcribed Image Text:There were following activities occurred during the first month of Babara

Schmidt's new hair cutting business called The Cutlery:

a. On August1, Schmidt put $3,000 cash into a chequing account in the

name of The Cutlery. She also invested $15,000 of equipment that she

already owned.

b. On August1, Schmidt paid $600 cash for six months of insurance

effective immediately.

c. On August2, she paid $2,000 cash for furniture for the shop.

d. On August3, she paid $3,200 cash to rent space in a strip mall for

August.

e. On August4, she furnished the shop by installing the old equipment and

some new equipment that she bought on credit for $21,000. This

amount is to be repaid in three equal payments at the end of August,

September, and October.

f. On August15, Cash receipts from haircutting services provided in the

first week and a half of business (ended August15) were $1,100.

g. On August15, Schmidt provided haircutting services on account for

$750.

h. On August17, Schmidt received a $750 cheque in the mail for services

previously rendered on account.

i. On August17, Schmidt paid $250 to an assistant for working during the

grand opening.

J. On August18, Schmidt interviewed a job applicant. The applicant was

successful in getting the position and will receive $750 per week for part-

time work starting in September.

j. On August18, Schmidt interviewed a job applicant. The applicant was

successful in getting the position and will receive $750 per week for part-

time work starting in September.

k. On August18, a regular customer paid $500 for services to be provided

over the next three month.

1. Cash receipts from haircutting rendered during the 2nd half of August

were $1,950.

m. On August31, Schmidt paid an instalment on the accounts payable

n. On August31, the August hydro bill for $450 was received. It will be paid

on September14.

o. On August31, she withdrew $500 cash for her personal use.

Transcribed Image Text:Prepare trial balance

Prepare balance sheet and income statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education