MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

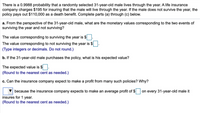

Transcribed Image Text:There is a 0.9988 probability that a randomly selected 31-year-old male lives through the year. A life insurance

company charges $195 for insuring that the male will live through the year. If the male does not survive the year, the

policy pays out $110,000 as a death benefit. Complete parts (a) through (c) below.

a. From the perspective of the 31-year-old male, what are the monetary values corresponding to the two events of

surviving the year and not surviving?

The value corresponding to surviving the year is $

The value corresponding to not surviving the year is $

(Type integers or decimals. Do not round.)

b. If the 31-year-old male purchases the policy, what is his expected value?

The expected value is $

(Round to the nearest cent as needed.)

c. Can the insurance company expect to make a profit from many such policies? Why?

because the insurance company expects to make an average profit of $

on every 31-year-old male it

insures for 1 year.

(Round to the nearest cent as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Similar questions

- Pro forma income statement, in won (millions) sales (1,000,000 @ 5,000 won/set)............. 5,000 costs..............................................................(4,000) labor-skilled....................................(1,700) raw materials: imported (duty-free)......................(1,000) local.................................................(500) overhead..........................................(300) interest.............................................(500) profit (before tax) 10%........................1,000 if the won devalues, from w484/$ to w580/$, recompute the statement assuming domestic sales remain the samearrow_forwardDr. Stephanie Andrews (3) Value 30000 27500 25000 22500 20000 17500 15000 12500 10000 7500 5000 2500 0 0 Value of a 2013 Chevy Impala Over Time 1 2 3 Years Since Purchase a. Estimate the value of the car at Year 3. 4 c. How much does the car depreciate each year? act A rental car company purchased a new Chevy Impala for $27,385. The company determined this asset should be depreciated for five years using the straight-line depreciation method. At the end of five years, the car will be worth $9,405. y (³) 5 b. Did you use interpolation or extrapolation to estimate the value in part a? Explain. 6 d. Write an algebraic model to find the value of the car given the years since purchase. the car at Year 3. 2arrow_forwardplz and Asap thanksarrow_forward

- K There is a 0.9986 probability that a randomly selected 32-year-old male lives through the year. A life insurance company charges $189 for insuring that the male will live through the year. If the male does not survive the year, the policy pays out $100,000 as a death benefit. Complete parts (a) through (c) below. a. From the perspective of the 32-year-old male, what are the monetary values corresponding to the two events of surviving the year and not surviving? The value corresponding to surviving the year is $ The value corresponding to not surviving the year is $ (Type integers or decimals. Do not round.)arrow_forwardWhen it is sunny, Joe's ice cream truck generates a profit of $547 per day, when it is not sunny, the profit is $250 per day, and when the truck is not out there selling ice cream, Joe loses $120 per day. Suppose 8% of a year Joe's truck is on vacation, and 86% of a year the truck is selling ice cream on sunny days, what is the expected daily profit the truck generates over a year? Enter answer as a decimal rounded to TWO digits after the decimal point.arrow_forwardInsurance A 65-year-old woman takes out a $100,000 term life insurance policy. The company charges an an-nual premium of $520. Estimate the company’s expected profit on such policies if mortality tables indicate thatonly 2.6% of women age 65 die within a year.arrow_forward

- A paper included analysis of data from a national sample of 1,000 Americans. One question on the survey is given below. "You owe $3,000 on your credit card. You pay a minimum payment of $30 each month. At an Annual Percentage Rate of 12% (or 1% per month), how many years would it take to eliminate your credit card debt if you made no additional charges?" Answer options for this question were: (a) less than 5 years; (b) between 5 and 10 years; (c) between 10 and 15 years; (d) never-you will continue to be in debt; (e) don't know; and (f) prefer not to answer. A USE SALT (a) Only 355 of the 1,000 respondents chose the correct answer of "never." Assume that the sample is representative of adult Americans. Is there convincing evidence that the proportion of adult Americans who can answer this question correctly is less than 0.40 (40%)? Use the five-step process for hypothesis testing (HMC3) described in this section and a = 0.05 to test the appropriate hypotheses. (Hint: See Example…arrow_forwardThere is a 0.9991 probability that a randomly selected 33-year-old male lives through the year. A life insurance company charges $166 for insuring that the male will live through the year. If the male does not survive the year, the policy pays out $100,000 as a death benefit. Complete parts (a) through (c) below. a. From the perspective of the 33-year-old male, what are the monetary values corresponding to the two events of surviving the year and not surviving? The value corresponding to surviving the year is $ The value corresponding to not surviving the year is $ (Type integers or decimals. Do not round.) b. If the 33-year-old male purchases the policy, what is his expected value? The expected value is $ (Round to the nearest cent as needed.) c. Can the insurance company expect to make a profit from many such policies? Why? because the insurance company expects to make an average profit of $ on every 33-year-old male it insures for 1 year. (Round to the nearest cent as needed.)arrow_forwardRound to the nearest centarrow_forward

- There is a 0.9986 probability that a randomly selected 27-year-old male lives through the year. A life insurance company charges $157 for insuring that the male will live through the year. If the male does not survive the year, the policy pays out $80,000 as a death benefit. Complete parts (a) through (c) below. a. From the perspective of the 27-year-old male, what are the monetary values corresponding to the two events of surviving the year and not surviving? The value corresponding to surviving the year is $nothing. The value corresponding to not surviving the year is $nothing. (Type integers or decimals. Do not round.) b. If the 27-year-old male purchases the policy, what is his expected value? The expected value is $nothing. (Round to the nearest cent as needed.) c. Can the insurance company expect to make a profit from many such policies? Why? because the insurance company expects to make an average profit of $nothing on every 27-year-old male it…arrow_forwardThere is a 0.9987 probability that a randomly selected 32-year-old male lives through the year. A life insurance company charges $197 for insuring that the male will live through the year. If the male does not survive the year, the policy pays out $100,000 as a death benefit Complete parts (a) through (c) below. a. From the perspective of the 32-year-old male, what are the monetary values corresponding to the two events of surviving the year and not surviving? The value corresponding to surviving the year is S The value corresponding to not surviving the year is $ (Type integers or decimals. Do not round.)arrow_forwardJay and Charles, two equally talented athletes, expect to compete in the upcoming Swimming match in the 200-meter freestyle. Each of them is trying to decide how many hours to train each week for the first race. We will use the Tullock model to describe their behavior. For each athlete, winning is worth 120 hours per week, so we measure the prize as 120 hours. The cost of an hour of effort is, of course, an hour. Suppose that Jay plans to train 10 hours per week, and Charles plans to train 20 hours per week. Question 1 What is the probability that Jay wins the race? O 1/4 O 1/3 1/2 O 2/3arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman