Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

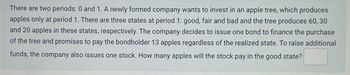

Transcribed Image Text:There are two periods: 0 and 1. A newly formed company wants to invest in an apple tree, which produces

apples only at period 1. There are three states at period 1: good, fair and bad and the tree produces 60, 30

and 20 apples in these states, respectively. The company decides to issue one bond to finance the purchase

of the tree and promises to pay the bondholder 13 apples regardless of the realized state. To raise additional

funds, the company also issues one stock. How many apples will the stock pay in the good state?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- An investor is considering purchasing a Microsoft bond. The bond has a $1,000 face value, coupon rate of 7.5% and matures in 5 years. The bond is currently quoted at 93%.a) If the investor decides to buy the bond today, how much will she pay, in dollars? b) If the investor has a discount rate of 4.0%, what is the most she should be willing to pay for the bond today?arrow_forward28. Suppose an investor has the opportunity to buy thefollowing contract (a stock call option) on March 1.The contract allows him to buy 100 shares of ABCstock at the end of March, April, or May at a guaranteed price of $50 per share. He can exercise thisoption at most once. For example, if he purchases the stock at the end of March, he cannot purchasemore in April or May at the guaranteed price. If theinvestor buys the contract, he is hoping that the stockprice will go up. The reasoning is that if he buys thecontract, the price goes up to $51, and he buys thestock (that is, he exercises his option) for $50, he canthen sell the stock for $51 and make a profit of $1per share. Of course, if the stock price goes down, hedoesn’t have to exercise his option; he can just throwthe contract away.Assume that the stock price change each monthis normally distributed with mean 0 and standarddeviation 2. The investor uses the following strategy. At the end of March, he exercises the optiononly if…arrow_forwardSapling Independent is a small bank located in Hong Kong. Sapling Independent is interested in increasing the number of mortgages it writes, but it is constrained by how many deposits it has. It has decided to borrow 12,000,000 euros from a large German bank for one year. The German bank is going to charge Sapling Independent an interest rate of 2.5%per year. The German bank insists on being repaid in euros. After Sapling Independent borrows the money, it is going to have to convert the money into Hong Kong dollars at an exchange rate of 11.5 HK dollars/euro.11.5 HK dollars/euro. Then, Sapling Independent is going to lend all the money at an interest rate of 7.0% per year. At the end of one year, all the money that Sapling Independent lent will be repaid, plus interest. Finally, at the end of one year, Sapling Independent is going to have to repay its loan to the German bank in euros. At the end of the year, the exchange rate is 10.0 HK dollars/euro.10.0 HK dollars/euro. What is…arrow_forward

- Write the factors of the three scenariosa) Finding annuities given present value;b) Finding annuities given future value;c) Finding present value given annuities.arrow_forwardRunHeavy Corporation (RHC) is a corporation that manages a local band. It had the following activities during its first month. RHC was formed with an investment of $11,900 cash, paid in by the leader of the band on January 3 in exchange for common stock. On January 4, RHC purchased music equipment by paying $2,300 cash and signing an $9,600 promissory note payable in three years. On January 5, RHC booked the band for six concert events, at a price of $2,800 each, but no cash was collected yet. Of the six events, four were completed between January 10 and 20. On January 22, cash was collected for three of the four events. The other two bookings were for February concerts, but on January 24, RHC collected half of the $2,800 fee for one of them. On January 27, RHC paid $3,440 cash for the band’s travel-related costs. On January 28, RHC paid its band members a total of $2,490 cash for salaries and wages for the first three events. As of January 31, the band members hadn’t yet been paid…arrow_forwardBrenda's bank offers car financing for 3,4,or 5 years. If Brenda chooses 5 year financing, how many monthly payments will she have?arrow_forward

- A rent-to-own agreement allows the renter to either return the merchandise after a specified period of time or apply the monthly payments toward purchasing the item(s) (or clearly, the renter could default on the agreement). A rent-to-own company reports that nationally 60% of the agreements result in the merchandise being returned, 27% of the agreements result in the merchandise being purchased, and the remaining agreements are defaulted on (consumer does not make required payments specified in the contract). At a local rent-to-own company, a sample of 229 agreements finds that 110 result in the merchandise being returned, 74 agreements result in the merchandise being purchased and the remaining agreements are defaulted upon. When testing (at the 5% level of significance) whether the proportions of the local company are different than the proportions nationally, what is the test statistic (please round your answer to 3 decimal places)arrow_forwardSharp Outfits is trying to decide whether to ship some customer orders now via UPS or wait until after the threat of another UPS strike is over. If Sharp Outfits decides to ship the requested merchandise now andthe UPS strike takes place, the company will incur $60,000 in delay and shipping costs. If Sharp Outfits decides to ship the customer orders via UPS and no strike occurs, the company will incur $4000 in ship-ping costs. If Sharp Outfits decides to postpone shipping its customer orders via UPS, the company will incur $10,000 in delay costs regardless of whether UPS goes on strike. Let p represent the probabilitythat UPS will go on strike and impact Sharp Outfits’s shipments.a. For which values of p, if any, does Sharp Outfits minimize its expected total cost by choosing to postpone shipping its customer orders via UPS? b. Suppose now that, at a cost of $1000, Sharp Outfits can purchase information regarding the likelihood of a UPS strike in the near future. Based on similar…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,