ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Please see attachment and type out the correct answer ASAP with proper explanation of all the sub question given.will give you thumbs up only for the correct answer. Thank you

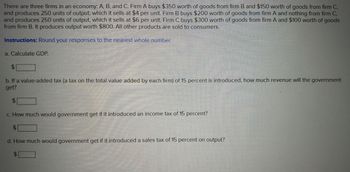

Transcribed Image Text:There are three firms in an economy: A, B, and C. Firm A buys $350 worth of goods from firm B and $150 worth of goods from firm C,

and produces 250 units of output, which it sells at $4 per unit. Firm B buys $200 worth of goods from firm A and nothing from firm C,

and produces 250 units of output, which it sells at $6 per unit. Firm C buys $300 worth of goods from firm A and $100 worth of goods

from firm B. It produces output worth $800. All other products are sold to consumers.

Instructions: Round your responses to the nearest whole number.

a. Calculate GDP.

b. If a value-added tax (a tax on the total value added by each firm) of 15 percent is introduced, how much revenue will the government

get?

$

c. How much would government get if it introduced an income tax of 15 percent?

d. How much would government get if it introduced a sales tax of 15 percent on output?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- riginal price 3. Five years ago, Mary opened a savings account for a condo on the beach that earns 2.6% simple interest each year. She started the account with $550 and has not touched the account since. How much money is in the account now?arrow_forwardAnswer quick please. Do not need full workarrow_forwardWhat equal amount (Q) must be deposited at the beginning of each year for the next 5 year s in a saving account with 10% interest in order to get a future sum of $1000 at the end of year 6. Please provide me a cash flow diagram and calculate.arrow_forward

- You are in the market to buy a used car. Your monthly budget allows for a $300 per month car payment and you want to finance for 4 years. The current APR for a used car is 3%. a) Calculate the amount of loan you can afford. b) Complete the table below. Year 0 After 1 month After 2 months After 6 months After 1 year Loan Balance Interest Paidarrow_forwardjust subparts i and ii. spreadsheet attached tooarrow_forwardSubject - advanced math Frank's loan pay off is to be made in two installments: $2500 in a year, and $3500 in 3 ½year. After talking to his loan officer, it was decided that he could pay both installments in 20months. How much would he pay if his loan is processed at 7 ¼ simple interest. Draw a timelineto illustrate your solution.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education