Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

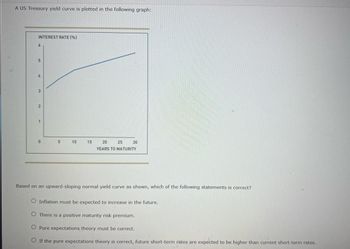

Transcribed Image Text:**A US Treasury Yield Curve Analysis**

The graph above displays a US Treasury yield curve, illustrating the relationship between interest rates (y-axis) and years to maturity (x-axis).

**Graph Details:**

- **Y-Axis:** Displays the interest rate in percentage (%), ranging from 0 to 6.

- **X-Axis:** Shows the years to maturity, extending from 0 to 30 years.

- The curve is upward-sloping, indicating that longer maturity bonds have higher interest rates.

**Question for Analysis:**

Based on the upward-sloping normal yield curve shown, which of the following statements is correct?

- ○ Inflation must be expected to increase in the future.

- ○ There is a positive maturity risk premium.

- ○ Pure expectations theory must be correct.

- ○ If the pure expectations theory is correct, future short-term rates are expected to be higher than current short-term rates.

![### Factors Affecting the Treasury and Corporate Yield Curves

There are three factors that can impact the shape of the Treasury yield curve: the real risk-free rate (\(r^*_{tr}\)), expected inflation (\(IP_{t}\)), and the maturity risk premium (\(MRP_{t}\)). There are five factors that can influence the shape of the corporate yield curve: the real risk-free rate (\(r^*_{tr}\)), expected inflation (\(IP_{t}\)), the maturity risk premium (\(MRP_{t}\)), the default risk premium (\(DRP_{t}\)), and the liquidity premium (\(LP_{t}\)). The yield curve is a reflection of the combined effects of these factors.

#### Yield Curve Shapes

Suppose the real risk-free rate and inflation rate are expected to remain at their current levels throughout the foreseeable future. Consider all factors that affect the yield curve. Then identify which of the following shapes the US Treasury yield curve can take. Check all that apply:

- [ ] Inverted yield curve

- [ ] Downward-sloping yield curve

- [ ] Upward-sloping yield curve

#### True or False Statements

Identify whether each of the following statements is true or false:

| Statements | True | False |

|--------------------------------------------------------------------------------------------------------------------------------------------|------|-------|

| If inflation is expected to decrease in the future and the real rate is expected to remain steady, then the Treasury yield curve is downward sloping. (Assume \(MRP = 0\).) | | |

| All else equal, the yield on new bonds issued by a leveraged firm will be less than the yield on the new bonds issued by an unleveraged firm. | | |

| The yield curve for a BBB-rated corporate bond is expected to be above the US Treasury bond yield curve. | | |

| Yield curves of highly liquid assets will be lower than yield curves of relatively illiquid assets. | | |

#### Graph Explanation

A US Treasury yield curve is plotted in the following graph:

- **Graph Description:** The graph plots interest rates against time to maturity. Typically, the vertical axis represents the interest rate, and the horizontal axis represents the time to maturity. The curve shown would reflect how interest rates vary over different maturities for US Treasury securities.](https://content.bartleby.com/qna-images/question/1449914f-8eca-43bc-87ff-7e50e88e5bf7/ae611fea-9ee5-4e6c-b3ef-fd24a9927fd5/a3tjg7f_thumbnail.jpeg)

Transcribed Image Text:### Factors Affecting the Treasury and Corporate Yield Curves

There are three factors that can impact the shape of the Treasury yield curve: the real risk-free rate (\(r^*_{tr}\)), expected inflation (\(IP_{t}\)), and the maturity risk premium (\(MRP_{t}\)). There are five factors that can influence the shape of the corporate yield curve: the real risk-free rate (\(r^*_{tr}\)), expected inflation (\(IP_{t}\)), the maturity risk premium (\(MRP_{t}\)), the default risk premium (\(DRP_{t}\)), and the liquidity premium (\(LP_{t}\)). The yield curve is a reflection of the combined effects of these factors.

#### Yield Curve Shapes

Suppose the real risk-free rate and inflation rate are expected to remain at their current levels throughout the foreseeable future. Consider all factors that affect the yield curve. Then identify which of the following shapes the US Treasury yield curve can take. Check all that apply:

- [ ] Inverted yield curve

- [ ] Downward-sloping yield curve

- [ ] Upward-sloping yield curve

#### True or False Statements

Identify whether each of the following statements is true or false:

| Statements | True | False |

|--------------------------------------------------------------------------------------------------------------------------------------------|------|-------|

| If inflation is expected to decrease in the future and the real rate is expected to remain steady, then the Treasury yield curve is downward sloping. (Assume \(MRP = 0\).) | | |

| All else equal, the yield on new bonds issued by a leveraged firm will be less than the yield on the new bonds issued by an unleveraged firm. | | |

| The yield curve for a BBB-rated corporate bond is expected to be above the US Treasury bond yield curve. | | |

| Yield curves of highly liquid assets will be lower than yield curves of relatively illiquid assets. | | |

#### Graph Explanation

A US Treasury yield curve is plotted in the following graph:

- **Graph Description:** The graph plots interest rates against time to maturity. Typically, the vertical axis represents the interest rate, and the horizontal axis represents the time to maturity. The curve shown would reflect how interest rates vary over different maturities for US Treasury securities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Explain why current yield changes even though the income from the coupon is constant.arrow_forwardIf we assume that inflation, the real cost of capital and the nominal cost of capital are always positive, which of the following statements is true? Question 3Select one: a. The expected inflation rate will always be greater than the nominal cost of capital. b. The nominal cost of capital will always be greater than the real cost of capital. c. The real cost of capital will always be greater than the nominal cost of capital. d. The expected inflation rate will always be greater than the real cost of capital.arrow_forwardThe beta risk of a share reflects the sensitivity of cash flow, earnings, and the share price to what sort of movements? Select one: a. Industry-wide market movements. b. Capital market movements. c. Economy-wide market movements. d. All of these.arrow_forward

- In the following exercise, separate the investments according to the type of Keynesian demand they are: Transactions (0% to 5%), Precautionary (6% to 9%), and Speculative demand (greater than 10%). Investment in each category has the same risk. So you want to invest in the highest return for the same risk. Take each demand type and choose the highest return and put that amount into the investment. For example, if Bond fund A has a return of 4% and Fund B has a return of 5%, they have the same risk, so you would put $70 into bond fund B. You have the following investments Opportunities ad returns. Fidelity Bonds 11% Fidelity Magellan 9% Putman Bonds one 4% Putman bonds Two 12% Growth Stock One 15% Growth and Income 8% Income Fund 3% Putman Growth…arrow_forwardExplain how to estimate the price per share using the free cashflow valuation model.arrow_forwardDividend policy may be affected by firm level as well as macroeconomic level factors. Select FIVE variables (at least 2 firm-level factors/variables and at least 2 macroeconomic factors/variables) from the list shown below. Explain and discuss the predicted impact of selected factors on dividend policy using relevant theories. i.e. what theories help to predict the positive or negative impact on the dividend payout and why. FIRM-LEVEL FACTOR/VARIABLE Asset growth rate Positive NPV investment opportunities Capital intensity of the production process Free cash flow generated Number of individual shareholders Relative tightness of ownership coalition Size of largest block holder MACROECONOMIC FACTOR/VARIABLE Transaction costs of security issuance Personal tax rates on dividend income Personal tax rates on capital gain Importance of institutional investors Corporate governance power of institutional investors Capital market, relative to intermediated (bank) financingarrow_forward

- Current yield is used to determine Seleccione una: a. A portion of the yield on an investment b. The payout of a bond investment c. The amount of money a bond investor will earn d. The coupon rate of a bond investmentarrow_forwardWhat factors affect current market interest rate? Why does the slope of the yield curve provide an important clue to the direction of future short-term interest rates?Given the forward rate available to the company, discuss the factors that it should consider at the outset when deciding whether to fix the future interest rate. The word-count for this element should be 500-600 words.arrow_forwardWhich statement is false regarding the Capital Asset Pricing Model? A. The beta coefficient of a stock is constant. B. The risk free rate is usually based on the treasury bill yield. C. Market risk premium is the difference between market return and the risk free rate. D. The cost of retained earnings is equal to the cost of new shares issued.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education