FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

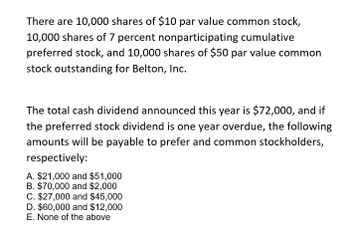

Transcribed Image Text:There are 10,000 shares of $10 par value common stock,

10,000 shares of 7 percent nonparticipating cumulative

preferred stock, and 10,000 shares of $50 par value common

stock outstanding for Belton, Inc.

The total cash dividend announced this year is $72,000, and if

the preferred stock dividend is one year overdue, the following

amounts will be payable to prefer and common stockholders,

respectively:

A. $21,000 and $51,000

B. $70,000 and $2,000

C. $27,000 and $45,000

D. $60,000 and $12,000

E. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Faccone Academy Surplus had 60,000 shares of common stock and 9,000 shares of 20%, $15 par value preferred stock outstanding through December 31, 2024. Income from continuing operations for 2024 was $711,000, and loss on discontinued operations (net of income tax saving) was $36,000. Compute Faccone's earnings per share for 2024, starting with income from continuing operations. Round to the nearest cent. (Enter all EPS amounts to the nearest cent, $X.XX. Use parentheses or a minus sign for amounts reducing the income from continuing operations.) Now, compute Faccone's earnings per share for 2024, starting with income from continuing operations. Earnings per Share of Common Stock (60,000 shares outstanding): Income From Continuing Operations Loss From Discontinued Operations Net Incomearrow_forwardA company had stock outstanding as follows during each of its first 3 years of operations: 4,000 shares of 8%, $100 par, cumulative preferred stock and 44,000 shares of $10 par common stock. The amounts distributed as dividends are presented in the following schedule. Determine the total and per-share dividends for each class of stock for each year by completing the schedule. If necessary, round dividends per share to the nearest cent. If your answer is zero, please enter "0". Year 1 2 3 Dividends $24,000 32,000 38,280 Preferred Total Preferred Per Share $ Common Total Common Per Sharearrow_forwardA company had stock outstanding as follows during each of its first three years of operations: 3,000 shares of 10%, $100 par, cumulative preferred stock and 33,000 shares of $10 par common stock. The amounts distributed as dividends follow. Determine the total and per-share dividends for each class of stock for each year by completing the schedule. Round dividends per share to the nearest cent. If your answer is zero, please enter "0". Preferred Common Year Dividends Total Per Share Total Per Share 1 $22,500 $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 $fill in the blank 4 2 30,000 $fill in the blank 5 $fill in the blank 6 $fill in the blank 7 $fill in the blank 8 3 43,230 $fill in the blank 9 $fill in the blank 10 $fill in the blank 11 $fill in the blank 12arrow_forward

- Master Company has 10,000 preferred shares with 2% cumulative dividends with a par value per share of $ 50 and 25,000 common shares at $ 75 par. The company declares the following cash dividends: Year 1 $ 30,000 Year 2 6,000 Year 3 80,000 Required: Determine the dividends for the preferred and common shares for each year. Present your answer graphically and clearly.arrow_forwardrefer to the photoarrow_forwardThe stockholders' equity of Blue Corporation includes $300,000 of S1 par common stock and $500,000 par of 5% cumulative preferred stock. In its first year of operations, cash dividends of $20,000 were declared. In its second year of operations, cash dividends of $15,000 were declared. Now in its third year, cash dividends of $100,000 are declared. How much of the $100,000 year three dividends will preferred stockholders receive? Multiple Choice $25,000 $15,000 $40,000 $35,000arrow_forward

- Lenore, Inc. declared a cash dividend of $90,000 in 2021 when the following stocks were outstanding: Common stock 30,000 shares, $5 par value $150,000 Preferred stock, 6%, 6,000 shares, $50 par value $300,000 No dividends were declared or paid during the prior two years. Required: Compute the amount of dividends that would be paid to each stockholder group if the preferred stock is noncumulative. Compute the amount of dividends that would be paid to each stockholder group if the preferred stock is cumulative.arrow_forwardStockholders' equity of Ernst Company consists of 80,000 shares of $5 par value, 10% cumulative preferred stock and 280,000 shares of $1 par value common stock. Both classes of stock have been outstanding since the company's inception. Ernst did not declare any dividends in the prior year, but it now declares and pays a $125,000 cash dividend at the current year-end. Determine the amount distributed to each class of stockholders for this two-year-old company. Calculation of preferred dividend: Total cash dividend To preferred shareholders To common shareholders Par Value per Preferred Share Dividend Rate % Dividend per Preferred Share Number of Preferred Shares Preferred Dividend for two yearsarrow_forwardrefer to the photosarrow_forward

- On January 2, Year 1, Torres Corporation issued 25,000 shares of $20 par-value common stock for $25 per share. Which of the following statements is true? Multiple Choice The Common Stock account will increase by $625,000. The Cash account will increase by $500,000. Total stockholders' equity will increase by $500,000. The Paid-in Capital in Excess of Par Value account will increase by $125,000.arrow_forwardA company had stock outstanding as follows during each of its first three years of operations: 1,000 shares of 8%, $100 par, cumulative preferred stock and 43,000 shares of $10 par common stock. The amounts distributed as dividends follow. Determine the total and per-share dividends for each class of stock for each year by completing the schedule. Round dividends per share to the nearest cent. If your answer is zero, please enter "0". Preferred Common Year Dividends Total Per Share Total Per Share 1 $6,000 $ $ $ $ 2 8,000 $ $ $ $ 3 15,680 $ $ $ $arrow_forwardA company had stock outstanding as follows during each of its first three years of operations: 4,000 shares of 9%, $100 par, cumulative preferred stock and 37,000 shares of $10 par common stock. The amounts distributed as dividends follow. Determine the total and per-share dividends for each class of stock for each year by completing the schedule. Round dividends per share to the nearest cent. If your answer is zero, please enter "0". Preferred Common Year Dividends Total Per Share Total Per Share 1 $27,000 $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 $fill in the blank 4 2 36,000 $fill in the blank 5 $fill in the blank 6 $fill in the blank 7 $fill in the blank 8 3 55,880 $fill in the blank 9 $fill in the blank 10 $fill in the blank 11 $fill in the blank 12arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education