ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

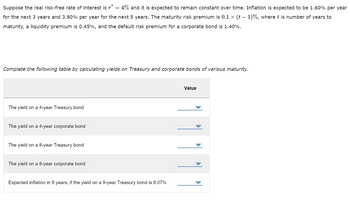

Transcribed Image Text:Suppose the real risk-free rate of interest is r* = 4% and it is expected to remain constant over time. Inflation is expected to be 1.60% per year

for the next 3 years and 3.90% per year for the next 5 years. The maturity risk premium is 0.1 × (t − 1)%, where t is number of years to

maturity, a liquidity premium is 0.45%, and the default risk premium for a corporate bond is 1.40%.

Complete the following table by calculating yields on Treasury and corporate bonds of various maturity.

The yield on a 4-year Treasury bond

The yield on a 4-year corporate bond

The yield on a 8-year Treasury bond

The yield on a 8-year corporate bond

Expected inflation in 9 years, if the yield on a 9-year Treasury bond is 8.07%

Value

▶

Transcribed Image Text:If the yield on a 5-year Treasury bond is 7.38% and the yield on a 6-year Treasury bond is 7.83%, the expected inflation in 6 years is

(Hint: Do not round intermediate calculations.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 19 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 5. Funding the nest egg shortfall Determining Retirement Shortfall Yuan and Alex have 40 years to retirement. They are taking a personal finance course and have calculated their projected retirement income and investment needs. Based on their calculations and taking into account their Social Security and pension incomes, they have a projected shortfall of $6,750.00 per year. Use the following tables to answer the questions about future value interest factors. Interest Factors-Future Value Interest Factors-Future Value of an Annuity Periods 3.00% 5.00% 6.00% 8.00% 9.00% 5.600 1.810 2.090 3.386 4.290 2.653 3.210 4.661 6.848 8.620 2.420 4.322 5.740 10.062 13.260 20.410 2.810 5.516 7.690 14.785 20 25 30 35 40 3.260 7.040 10 280 21 724 31 410 = The impact of the inflation factor Continuing their worksheet, they consult a friend, economics professor Dr. Wu, who believes that they can expect the average annual inflation rate to be 5%, possibly 6% tops. Complete the following table by…arrow_forwardQuestion 7 15.0% 14.0% 13.0% 12.0% 11.0% .10.0% 9.0% 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% Inflation Rate (n) down to 0 decreases to 5.04 1,000 2,000 10.04 3,000 4,000 5,000 Consider the graph above. It is also in the files folder under the name Short Run and the Long Run. The graph pertains to a hypothetical country. The central bank in this country (also called the Fed) follows an inflation targeting policy. The current target inflation rate in 8 percent (I know, it is too high. We will deal with this problem later after appointing a new chairperson for the Fed). The natural rate of unemployment is 5 percent and Okun's alpha is 8. 7000.00 LRAS Suppose that consumer confidence in the economy declines and as a result AD decreases by 3,000 units. This reduction in demand causes the inflation rate to slow 7.00 percent in the short run. In the short run, the real GDP percent. AD Real GDP (Y) SRAS 6,000 7,000 8,000 9,000 10,000 3 11,000 12,000 13,000 14,000 15,000 16.000 17,000…arrow_forwardWhy do the selling prices of depreciable assets increase with the general inflation rate?arrow_forward

- 14.46. Well-managed companies set aside money to pay for emergencies that inevitably arise in the course of doing business. A commercial solid-waste recycling and disposal company in Mexico City puts 0.10% of its income after-tax income into such an account. (a) How much will the company have after 7 years if after-tax income averages $16.4 million per year and inflation and market interest rates are 4% per year and 9% per year, respectively? (b) What will be the buying power of that amount in today's dollars if the inflation rate is 4% per year?arrow_forwardIf inflation has been running at 2.2% per year and a washing machine costs $460 today, what would it hace cost three years ago? What is the interest rate per period? i=arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education