FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

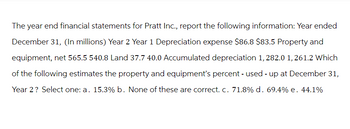

Transcribed Image Text:The year end financial statements for Pratt Inc., report the following information: Year ended

December 31, (In millions) Year 2 Year 1 Depreciation expense $86.8 $83.5 Property and

equipment, net 565.5 540.8 Land 37.7 40.0 Accumulated depreciation 1, 282.0 1, 261.2 Which

of the following estimates the property and equipment's percent - used - up at December 31,

Year 2? Select one: a. 15.3% b. None of these are correct. c. 71.8% d. 69.4% e. 44.1%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The income statement disclosed the following items for the year: Depreciation expense $57,000 Gain on disposal of equipment 24,000 Net income 542,000 The changes in the current asset and liability accounts for the year are as follows: Increase(Decrease) Accounts receivable $9,800 Inventory (5,550) Prepaid insurance (1,000) Accounts payable (3,700) Income taxes payable 1,440 Dividends payable 2,200 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.arrow_forward1. Determine the annual depreciation expense for each of the estimated 5 years of use, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year by (a) the straight-line method and (b) the double-declining-balance method. a. Straight-line method Additional Instruction Accumulated Depreciation, Year Depreciation Expense End of Year Book Value, End of Year 1 2 3 4 5 b. Double-declining-balance method Accumulated Depreciation, Year Depreciation Expense End of Year Book Value, End of Year 1 2 3 4 5 New lithographic equipment, acquired at a cost of $859,200 on March 1 at the beginning of a fiscal year, has an estimated useful life of 5 years and an estimated residual value of $96,660. The manager requested…arrow_forwardThe following are financial data taken from the annual report of Foundotos Company: Year 2 $134,448 51,981 37,154 57,504 Net sales Gross property, plant and equipment Accumulated depreciation Intangible assets (net) A. Calculate the following ratios for Year 1 and Year 2: 1. Fixed asset turnover 2. Accumulated depreciation divided-by-gross fixed assets B. What do the trends in these ratios reveal about Foundotos? Year 1 $130,060 47,744 34,180 36,276arrow_forward

- Accrued Expenses: Entity D acquired a piece of land on April 1, 20x1. The purchase price was reduced by a credit for the real property taxes accrued during the year. Entity D records real property taxes at each month-end by adjusting the prepaid tax or tax payable account as appropriate On May 1, 20x1 Entity D paid the first of two equal installments of P72,000 for real property taxes. Requirement: What is the entry to record the payment on May 1?arrow_forwardPlease help me with show all calculation thankuarrow_forwardSunland Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $1,944,000 on March 1, $1,224,000 on June 1, and $3,072,650 on December 31. Compute Sunland's weighted-average accumulated expenditures for interest capitalization purposes. Weighted-average accumulated expenditures $arrow_forward

- The draft financial statements of Enjoy Ltd for the year ended 31 December 20X6 are given below. The following additional information is also provided: (i) Plant with an original cost of $800 and accumulated depreciation of $600 was sold for $200. (ii) Interest expense was $350 of which $140 was paid during the period. $130 relating to interest expense of the prior period was also paid during the period. (iii) Investment income included $250 of interest that was received during the period and $250 of interest still to be received. The $250 of interest still to be received is included within other receivables. (iv) Investment income also included $300 of dividend that was received. Statement of Profit and Loss for the year ended 31 December 20X6: Sales 44,870 Cost of sales 31,000 Gross Profit…arrow_forwardProvide the 2020 adjusting journal entry (both accounts and amounts) that Newell Brands made to record amortization on its finite-lived Intangible Assets. Assume that Newell Brands makes one adjusting journal entry for amortization expense at the end of each fiscal year as part of its adjusting entriesarrow_forwardAssume the following general ledger account balances for Xenon Inc. for December 31, 2019 Accumulated Depreciation 50,000 Building 70,000 Depreciation Expense 20,000 Equipment 53,000 Land 90,000 Unused Supplies 3,000 What is the carrying amount of the company’s plant and equipment section of thebalance sheet at December 31, 2019?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education