Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

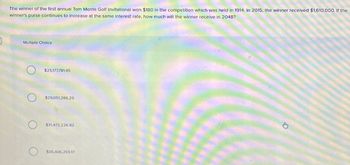

Transcribed Image Text:The winner of the first annual Tom Morris Golf Invitational won $180 in the competition which was held in 1914. In 2015, the winner received $1,610,000. If the

winner's purse continues to increase at the same interest rate, how much will the winner receive in 2048?

Multiple Choice

O

$25,177,781.45

$29,051,286.29

$31,472,226.82

$35,406,255.17

J

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please do the following questions with full workingarrow_forwardJake won $350,000 in the lottery! He will receive $35,000 each year at the beginning of each of the discounted rate of 5%, what is the present value of the lottery winnings? $0.00 ANSWER Number of Years Number of Periods/Year Number of Periods Annual Interest Rate Interest Rate/Period Payment Future Value Type (0=END; 1=BEG) Present Valuearrow_forwardAssume you won a worldwide lottery that pays $1.55 million in year 0, $5 million in year 1, and $200,000 in years 5 through 100. Assuming that 100 years is as “long” as infinity, calculate the perpetual equivalent annual worth for years 1 through infinity at an interest rate of 10% per year. (Enter your answer in dollars and not in millions.) The perpetual equivalent annual worth for years 1 through infinity is $ .arrow_forward

- Winners of the Dream a Dream Lotto draw are given the choice of receiving the winning amount divided equally over 22 years or as a lump sum cash option amount. The cash option amount is determined by discounting the winning amount at 9 percent interest compounded quarterly over 22 years. This week the lottery is worth $18 million to a single winner.arrow_forwardQ7. On September 1, 2014, a university received a grant of $100,000 from Tajinder. The money is invested at 8% compounded quarterly. The grant is to be used to pay out semi-annual scholarships for 20 years. What is the size of each scholarship if the first one is awarded on September 1, 2016?arrow_forwardOn January 1, you win $5,000,000 in the state lottery. The $5,000,000 prize will be paid in equal installments of $500,000 over 10 years. The payments will be made on December 31 of each year, beginning on December 31 of the current year. If the current interest rate is 6%, determine the present value of your winnings. Use Table 3. Round to the nearest whole dollar.arrow_forward

- How much must be deposited today into the following account in order to have a $135,000 college fund in 11 years? Assume no additional deposits are made. An account with quarterly compounding and an APR of 7.32% $ should be deposited today. (Do not round until the final answer. Then round to the nearest cent as needed.) Enter your answer in the answer box. Type here to search 0 哥 同arrow_forwardPlease don't provide solution in image format thankuarrow_forwardOn January 1 you win $50,000,000 in the state lottery. The $50,000,000 prize will be paid in equal installments of $6,250,000 over eight years. The payments will be made on December 31 of each year, beginning on December 31 of this year. If the current interest rate is 12%, determine the present value of your winnings. Use the present value tables in Exhibit 7. Round to the nearest whole dollar. Will the present value of your winnings using an interest rate of 12% be more than the present value of your winnings using an interest rate of 5%?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education